Most of our current shareholders understand we’re not managing our P&L to the month or the quarter. Creating the future of human interaction—the metaverse—is not a short-term endeavor.

With enough computer power and bandwidth, parts of Roblox’s human coexperience platform will look and feel more realistic than ever before and therefore more immersive and even more useful to even more people. Creators who want photorealism will get that, while those who still want a cartoon world will have that option. You’ll be able to attend a concert with 50,000 people and see and hear almost exactly what you would at a live venue. Avatars will become more sophisticated, letting people be whomever they want to be online.

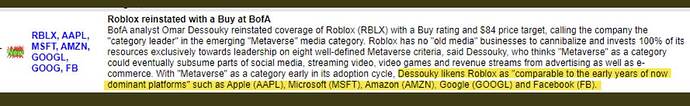

Plough more $ into the sinking ship RBLX.

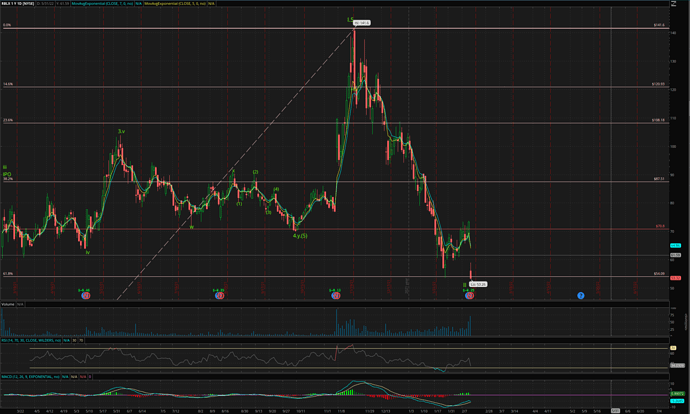

RBLX is obviously in wave II (23.6% to 99% retracement, currently at 61.8% ![]() ) and below IPO

) and below IPO ![]() Potential bullish divergence, tbd after few more days of trading. In the chart, I label $53.17 as wave II, could be wave II.A (so counter-trend up wave II.B, then another down wave II.C)… If wave II.B retraces wave II.A by more than 61.8%, then $53.17 is wave II. Monitor

Potential bullish divergence, tbd after few more days of trading. In the chart, I label $53.17 as wave II, could be wave II.A (so counter-trend up wave II.B, then another down wave II.C)… If wave II.B retraces wave II.A by more than 61.8%, then $53.17 is wave II. Monitor ![]() Btw, wave II can last a few months to a few years… hopefully not a few years.

Btw, wave II can last a few months to a few years… hopefully not a few years.

Technically, all the metaverse stocks (except AAPL MSFT NVDA) are weak. Don’t be too surprised, some of them would disappear or get acquired or wave II last a few years. HODL. Diamond hands.

So far, U is in a better shape than RBLX.

One of those rare stocks that is still trading above May low ![]() EW picture is better than many stocks. Is in wave III.2 until proven otherwise, most of the growth stocks are in wave II (don’t know when they will be completed, hopefully not at zero).

EW picture is better than many stocks. Is in wave III.2 until proven otherwise, most of the growth stocks are in wave II (don’t know when they will be completed, hopefully not at zero).

No new insights. Just what articles will say when things turn bad.

/the-metaverse-makes-no-sense-and-here-s-why?

Nobody is getting it right. RBLX is the best so far but its monetization scheme is not great. What do all these means?

Wait for AAPL

As Roblox’s engagement and monetization rates decelerate, its losses continue to widen. Its net loss widened from $71 million in 2019 to $253 million in 2020, then widened to a whopping $492 million in 2021.

Those losses were mainly caused by Roblox’s developer exchange fees (the cash it pays creators for trading their Robux back to real-world currencies), cloud infrastructure costs, safety-related expenses for children, R&D expenses for new features, and high stock-based compensation expenses (18% of its revenue in 2021) to fund its salaries.

18% of revenue for SBC ![]()

Roblox’s decelerating bookings growth, sluggish monetization rates, widening losses, rising leverage, and ongoing dilution make it a tough stock to recommend as rising interest rates rattle the market.

Need to improve on monetization.

I believe investors would be better off sticking with Unity, which is a more balanced play on the gaming and metaverse markets, than taking a chance on Roblox’s murky vision for the future.

Evidenced in the EW picture that investors prefer U over RBLX.

The cost of building the metaverse is very expensive, need to find better monetization to fund the expenses.

Cathie Wood in the CNBC interview also said Roblox Corp. – down 9% Friday – is one of the best ways to play the metaverse.

RBLX is the closest to ideal metaverse but where is the money? No point having the best of breed, best delight to customers, best this, best that, when don’t have the monetization scheme to make money. This is a business!

“Omniverse or the Metaverse is going to be a new economy that is larger than our current economy.”

Hope so. Bleeding deeply because of COIN RBLX U MTTR.

The Metaverse is particularly challenging for investors as the opportunity is enormous yet getting the timing right and also choosing which companies will participate in the futuristic yet burgeoning virtual economy will not be easy.

Agree. Started scaling into NVDA and NET.

The portal to the Metaverse is Pixar’s Universal Scene Description. USD is hailed as one of the most important tools for building the Metaverse as it allows for a persistent experience to where the Metaverse is more connective and has consistency. Metaverse experts tend to reference the internet as a baseline for how the Metaverse will become widely adopted. In this Web 3.0 reference, Pixar’s USD functions like the connective HTML of 3D worlds.

Didn’t know this. I see why DIS is of interest to many. Need to find out more about this USD.

Apple, Autodesk, and many other companies are also using the framework to create a persistent experience for developers and creators. For example, the iPhone’s LiDAR scanner allows you to scan objects in USD. The scanned images are saved in a USDZ compressed file to be used across other platforms.

![]()

Autonomous driving is one of the more compelling use cases for the Metaverse given the number of times autonomous vehicle systems were deployed on the roads and yet were pulled from the market due to accidents.

Cool! No need for training in real physical environment.

It’s understandable if investors are skeptical of the Metaverse as the technology is essentially in the early adopter stage.

I know. Getting in early should yield high return ![]()

![]()

Can someone explain the math of how the metaverse economy will be bigger than the regular economy? Maybe this is the real end game of crypto. It’s possible to create more money than is actually in circulation as long as everyone doesn’t try to convert crypto to real money at the same time. That’s how this will actually fail.

Virtual > fiat > physical money

Not good enough. Need better monetization approach.