So sick of hearing people bashing millennials. None of the people in my circle have credit card debt. Why can’t we talk more about the good examples like Zuckerberg and less about these bad influences. It’s no use comparing against trashy people. You are more responsible than someone drowning in student loans and credit card debt, so what?

Because old people are going thru their manopause moments…

Now that they are getting married and having kids, they are moving to the suburbs. Turns out they aren’t that different than previously generations. They’re just time delayed.

But the Journal notes other, more affordable, metropolitan areas are also gaining millennials, including cities like Austin, Columbus, Ohio, Los Angeles, San Diego and Seattle.

Wise ![]() choice. Probably went to Austin’s suburb like 78613, 78681 and 78660.

choice. Probably went to Austin’s suburb like 78613, 78681 and 78660.

http://www.noradarealestate.com/blog/austin-real-estate-market/

Good year for Austin, congratulations sensei

Now is a good time to buy? Yes!

Since @manch loves the Gini coefficient he should leave California. It’s one of the highest for any state.

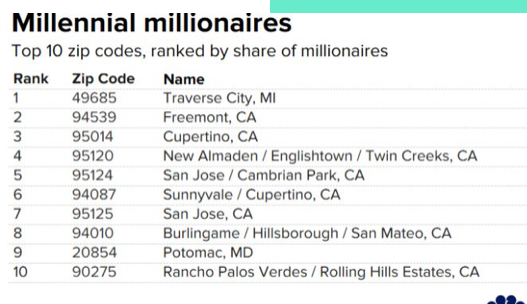

Fremont has the highest number of millennial millionaires ![]() All working in FB?

All working in FB?

Millennials living in Fremont? Something must be wrong with those people. ![]()

They clearly don’t care about nightlife so maybe that’s why they are millionaires ![]() .

.

I’m confused how Traverse City is #1. It’s a tourist town known for its cherry festival. I don’t get what jobs are they to have enough income to accumulate $1M of net worth.

Here’s the actual report.

Traverse City has experienced an urban renaissance in the last 10 years, with a dynamic food scene, microbreweries, wineries and walkable downtown with music, arts and festivals to attract younger generations of affluent homebuyers.

“The younger affluent like that they can get a fabulous home on, near or overlooking vineyards, fresh water or beaches for a fraction of the cost of larger metropolitan areas,” explains Shawn Schmidt Smith, associate broker/owner for Traverse City-based Coldwell Banker Schmidt. “We have a full-service airport, making it easy to commute. We have strong schools. We’ve also become a foodie destination and a vibrant cultural community.”

*Smith also says an increased desire among affluent millennials to have a worklife balance has accounted for Traverse City’s growing popularity. “In northwest *

Michigan, locals are constantly slipping in and out of play/recreation mode throughout the week,” she notes. “It’s a small town where you’re never more than 10 minutes from a body of water, which makes it easy to get outside — whether it’s SUPing, boating, mountain biking or hiking. We’re a four-season town with amazing recreational opportunities year-round. On a Tuesday when you’re done with work, you can be on the bay SUPing or in a river fly-fishing within 20 minutes.”

Smith also notes that most of the younger affluent buyers purchasing properties in Traverse City typically have some sort of connection to the area. “They vacationed here as kids or they grew up here, moved away and when they were ready to settle down, Traverse City became a natural fit.”

Like their Silicon Valley counterparts, affluent Traverse City millennials view real estate as an important step on their journey toward wealth. “They understand that this region can be a very good long-term play,” says Smith. “We see a lot of

millennials deciding that this is a place that they can call home for the rest of their lives. It’s not uncommon that their parents, grandparents and siblings also end up

making Traverse City their home base.”

I still don’t get where they actually work though. It makes it sound like they commute by airport. Maybe they can work remote.

Pretty good idea! But no need to leave the state entirely, it’s a big state. I didn’t want to move out of the bay area at the the time I did but it was one of the best decisions I ever made. Air quality is better, quality of life much improved, water much cleaner, people friendlier. I would never want to live in ba but there are some decent pockets for sure and lots of good people. One problem with big city folks is that some value money and material goods too much. Lots of rich people are miserable, ask any divorce attorney. What good is all the money in the world without excellent health and a feeling of satisfaction, good interpersonal relationships, etc? Money is a great tool, we all need it but many millionaires will tell you they are not rich, it’s never enough. I haven’t worked for years because investing in Inland empire hi desert has been good to us and prefer other philanthropic pursuits, my wife continues to work; when she gets stressed I remind her we don’t need the money but she gets some satisfaction from it and likes having extra dough to send back to her folks in their country.

Marquis – I’m intrigued by your story. Where do you live? What is “Inland empire hi desert” ?

I had to look up Traverse City on the map. Is this what people call “UP” ? Maybe these are finance millennials from Chicago?

The UP is further north across the Mackinaw bridge. The bridge connects the lower and upper peninsulas.

I think the bigger issue is terrible gross margins. These aren’t tech companies. Hardware should have 30-50% gross margin and SaaS should have 70-90% gross margins. A lot of these statues are in the teens which is industrial or raw materials gross margin levels. They’ll never generate profits on the level of AAPL, MSFT, GOOG, or FB.

.

More than 86,000 of these individuals wound up settling in Texas, making it the top landing place for people departing California, the Census found.

@manch Future is going to Texas ![]()

California has a top individual income tax rate of 13.3% — the highest in the country, according to the Tax Foundation.

The Lone Star state doesn’t tax individual income, making it a welcome change for high-earners based in California.

0% vs 13.3% more than enough to compensate for higher property tax rate in Texas. In fact, absolute property tax dollar is less than Cali because the Texas house is 1/8 of the price. Wrap your head around, is like 13.3% annualized return of an investment, more than the historical 7-11% annualized return of S&P.