This is a disaster. Home prices in Bay Area and the US will surely start dropping now

.

You have been saying this for years ![]()

Price chart of a SFH in CU. Do you think the eventual correction would be worse (in % term) than in 2018-2019 (almost 20% decline from previous ATH) ?

Take note that even if one bought at the high in 2018, still sitting on pretty good return.

Aren’t home prices up 20% yr/yr? According to what people repeat all the time prices should be lower, since rates are up.

It takes time, but home prices will start to go lower as high interest rates persist

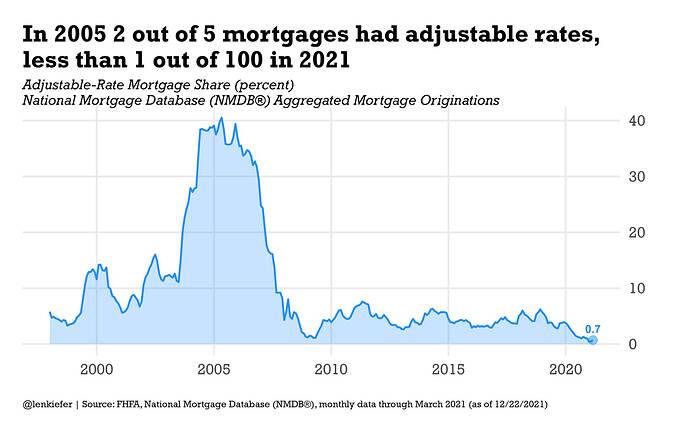

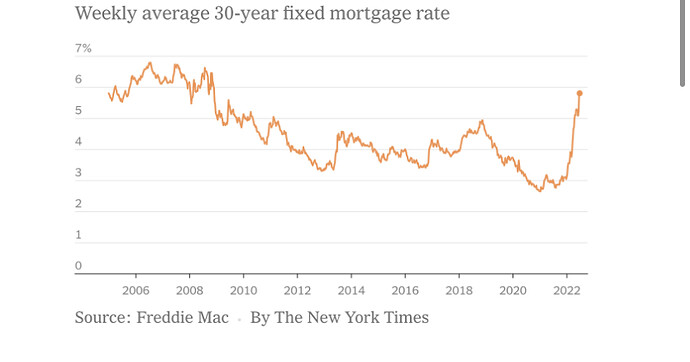

I had a client contact me for a Non-Owner, Cash Out, Condo Refinance. Given all of those Loan Level Price Adjustments (LLPA’s) the best available terms were in the low 7’s. Spicy, to say the least! Agency (FNMA/FHLMC) investors just do not want this type of loan so the prices are redonkulous right now. ARM prices are also rising since these loans are influenced more by actions the Fed does than an other mortgage product.

When I told my Realtor contacts in January 2022 that we’d hit the 7’s I could watch the blood drain from their faces. Not sure what the reaction will be when I tell them that we might even see an 8 handle in rates depending on the product.

Thanks for reading.

Many articles claimed that consumers expect mortgage rate would eventually rise to 8+%. However, given that Fed is unlikely to push Fed rate higher than 4%, mortgage rate should top at 6.5%. Ofc, if Fed insists on pushing rate higher despite signals indicating economy is weakening, mortgage rate could go to that level.

Hmmm, you just consider FED rate. In the past FED was flooding with QE, now they are unwinding with QT. They are not only stop flooding market with cash, but reducing balance sheet almost 2T.

This means all mortgages going forward must get cash from external third party funding which will come from market.

When it comes to market, it is just Supply and demand, and 10-year note rate available at that time as mortgage is almost linked(follows) 10-year rate. The rates can be volatile to 8% or 9%. It is hard to predict at this time.

TechCrunch: Redfin and Compass lay off a combined 900+ employees as mortgage interest rates continue to climb.

This is what Fed wants, kill the wealth feeling/ effect.

The pricing models for cash out refinancing are blowing up, at least for conforming conventional loans. My guess - and that’s all it is - is that Agency investors feel home price reductions are on their way and the underlying security of the loan (the home value, not your ability to repay…) is at a growing risk position.

Agency cash out is in the 6’s with significant fees (2-3 points) Non-Agency (AKA Bank Portfolio) is still in the 5’s today. If your considering a refi, better get it done soon. Using Redfin, if you type “San Francisco” in the search bar, today (6/15/22) there are 1,450 homes for sale. Now, if you ask how many have had price reductions in the last 7 days - it’s 96 of those 1,450 homes - so about 6.6%.Sure, they may be minor price reductions, but perception IS reality. Run that same scenario next week. If that percentage is trending towards 9%, you can see where this is ultimately headed…

Thanks for reading.

Highest Mortgage Rates Since 2008 Housing Crisis Cool Sales

As the Federal Reserve tries to fight high inflation, costly mortgage rates have begun to price people out of the housing market.