It should not go down, that creates inversion !

No downpayment? Guess is for easy comparison.

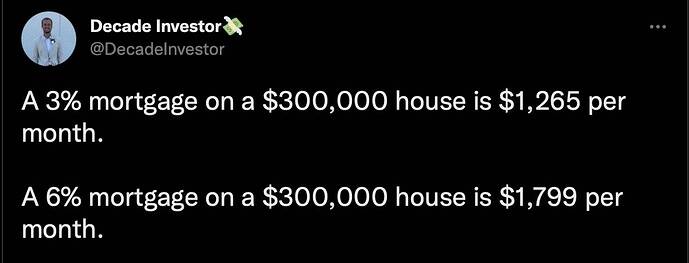

Sound scary but at 6%, shouldn’t the same $300,000 house would have declined to $211,000. A decline of 30%.

Current mortgage rate is 5%, so same $300k house should decline to $235,500. A decline of 21.5%.

Looking from another perspective, normal downpayment is 20%.

At 3%, 20% downpayment ($60k), monthly mortgage = $1012.

At 5%, downpayment remains as $60k, monthly mortgage remains as $1012, house price = $248k. A decline of 17.3%.

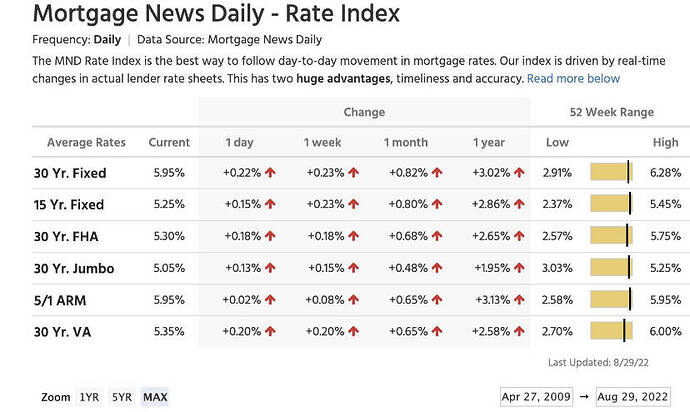

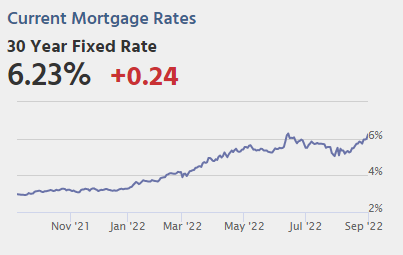

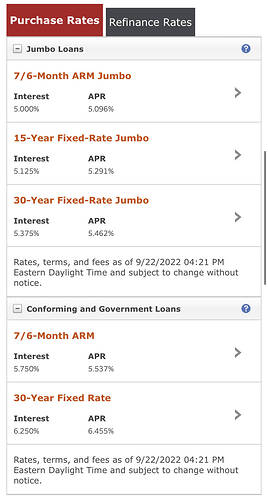

It was only a few weeks back when it looked like rates were heading back to the 4s. Nope. It’s heading to the 6s instead.

![]()

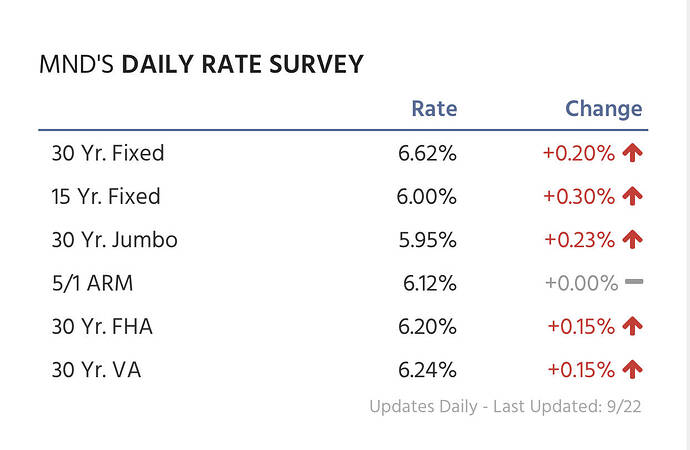

Yes, 7’s are on their way. ARM loans won’t provide relief as lenders qualify them at Index, Plus Margin which is approaching 6 percent.

Thanks for reading

Remember that these averages are a 1-2 week look back to where rates were, not where they are now. As well, the rate info includes anywhere from .50 to .875 in fees to get the rate. Add .125 to .250 in rate to equal a zero point, zero cost loan.

Thanks for reading,

I think we flatten out here for awhile. Based on the historical spread, the mortgage rates are already pricing in future hikes. Mortgage rates should only increase if future expectations change.

I still can’t quite wrap my head around how come jumbo rate is lower than conforming.

Near perfect FICO wealthy guys borrow Jumbo ![]() Remember debt doesn’t pay tax?

Remember debt doesn’t pay tax?

I know the credit profile may be better for jumbo. But don’t we have guaranteed buyers Fannie and Freddie for conforming loans? So even with these big buyers conforming rates are still higher? That’s the part that puzzles me.

Freddie/Fannie buy the mortgages then create and auction the MBS. Mortgage rates are set by what’s happening at the mortgage auctions. That’s why mortgage rates have been moving ahead of fed moves. Buyers at auction price in the upcoming rate increases when determining what price they are willing to pay.

Jumbo loan underwriting is much tighter than Conforming Conventional Agency products so the value in these loans are partly due to their relative safety resulting in lower costs/rates. The sources of funds for portfolio loans - balance sheet cash - also has a lower expense than Agency loans. These are some of the reasons why Non-Agency Jumbo pricing is better than Agency conforming.

The better pricing out of all products are the Government Insured loans - FHA and VA. FHA however has UFPMI and MMI, and VA is specific to Veterans - a smaller buyer pool. If Agency is 6, Non-Agency is 5.50, and Government Insurance is a 4.75% rate but with MMI the cost is closer to 5.25 percent.

6.70%

.

Suma suma