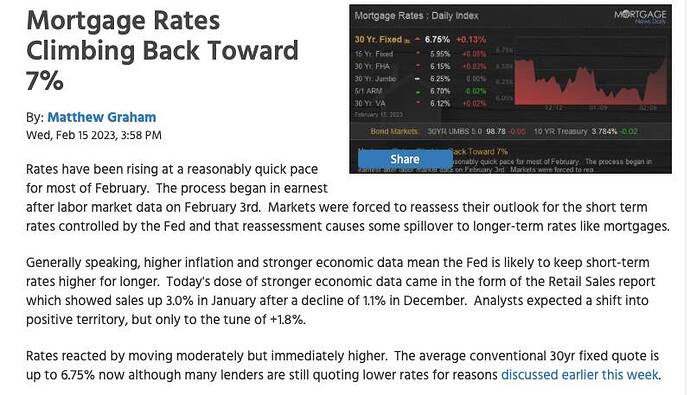

This makes me wonder if we’ll see creative new products. Where people do down payment, then a lease option to buy the house later. That way the seller gets some cash now (down payment), and the buyer can have a smaller payment. The buyer can get their own mortgage later when rates are lower.

Where are you buying?

Cashing out my Antioch place. Can’t have that much money tied up.

Too broke right now! My stocks might be margin called soon at this rate. Need money!

Stay away from margin permanently !

I think there’s a reasonable way to use it.

Margin is a tool. use it irresponsibly and you will get hurt. If I do that, then it serves me right.

Didn’t you buy this last year? Did you put 20% down?

That one was in San Leandro. Antioch only few months ago. I bought with cash (+margin ![]() )

)

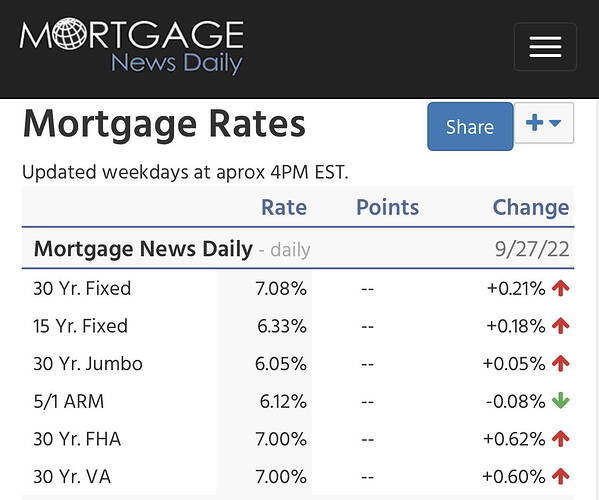

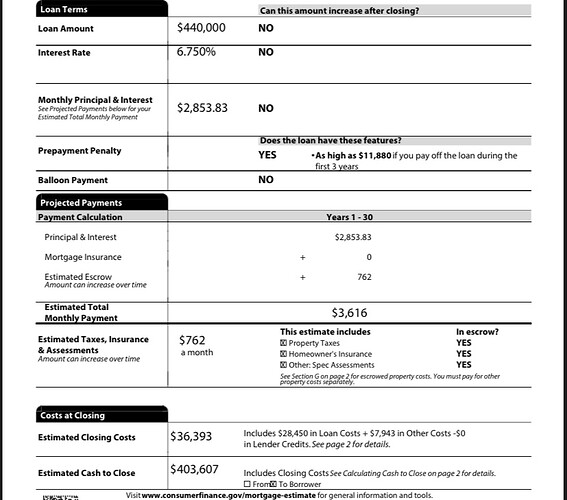

That 6.75 Closing Disclosure made me think of a strategy to consider.

- IF you qualify, put only enough down to be $100 over Standard Conforming.

- Work directly with a Bank using their portfolio Jumbo loans. That 6.75 rate would have been 5.x.

- Post closing, put the remaining cash you have down on your loan balance.

- Call the bank to re-cast your loan. The recast process takes about 30 days to complete and will get for you the payment you had been seeking all along.

Remember that Jumbo, non-Agency lending has different Debt to Income Ratio tolerances and post closing cash reserves. If your ratios and reserves are able to do what’s suggested above, you will be rewarded with significantly better loan terms.

Thanks for reading.