10.8% is low, almost everywhere in SV is higher since 2011 even though historically is 6-8% p.a… Since 2011 is about 12-15% p.a.

Weekly reminder that you own two houses in Cupertino?

13.5%  since 2011

since 2011  expect to gradually slow down to 8% asymptotically.

expect to gradually slow down to 8% asymptotically.

8% is actually quite high, doubling in 9 years. Is it the long term trend? That a 2M crap shack in Cupertino will be worth 4M in 2027 ?

Long term trend is 6-8% p.a. Have been so since post-war. Apple, Facebook and Google had (will be) building their HQs here, so 6-8% p.a. is sustainable (till those guys… black swan)

Are you expecting Austin to have higher appreciation rate than SV going forward? How much are you targeting?

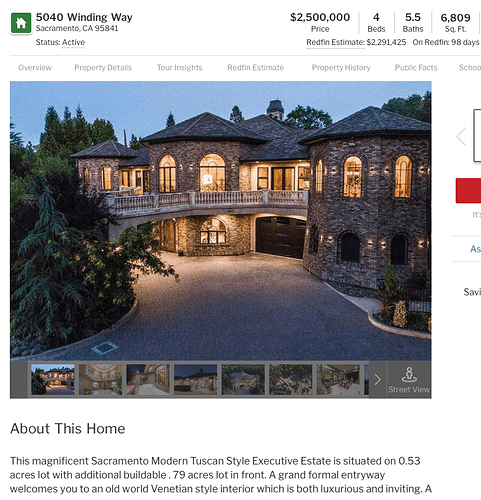

Yeah. “Location, location, location” is real. That Sacramento mention will depreciate in value while your Cupertino houses will shoot for the sky.

Very good question which I don’t have an answer because I didn’t do my DD.

So far 8-10%, less than ![]() 13.5%. Ignoring those I bought at bargain price e.g. from a divorced couple.

13.5%. Ignoring those I bought at bargain price e.g. from a divorced couple.

Another one I bookmarked in the past. I think I passed on this one because of the house number. It was also too expensive at the time for Outer Sunset:

What’s a realistic price for this one? Can you hear the traffic on Lincoln?

I don’t think the noise is too bad unless you are facing Lincoln. The real killer is locating less than half a block from the train tracks, which doesn’t apply to this one. $1.5ish is my guess, but it may go for lower given the slowdown…

A lot of good listings at very attractive price. Need to watch how long it will stay a buyers market