Just updating whatever I know:

There are more than 100+ companies (not 30+) trying to develop vaccines, but handful few companies working out mRNA (Messenger RNA) method which has so far given success against virus. ** Messenger RNA is a new innovative technology.**

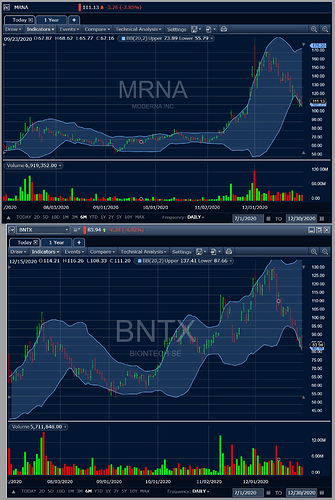

Of these, two are MRNA (US-94.1%), BNTX (Germany-95%) and third one is AZN (70% success, not completed 3rd level testing).

Since demand is there, MRNA is charging high $37 with discount only to USA (as US government sponsored loans IIRC). Almost full year capacity (500M) orders booked, esp US is priority. Euro will approve it jan 6th.

BNTX charges $19 but shares profit with PFE, full year capacity (1.3Bln) orders booked, USA, UK and Euro also approved.

Both are highly reliable vaccines, naturally US, UK and Euro do not like to compromise on quality/standards. Drugs are always expensive by the amount of research and patent for 20 years. For example allergic drug epi-pen costs $650-$700 per shot.

Third one from AZN, UK and India placed huge orders as they are cheaper $4/dose, but not proven to the MRNA & BNTX level. A long way to complete - may be six months.

Fourth, few days before China Sinovac said 91% success and brazil said Sinovac is 50%-70% only (conflicting results)

Everyone is rushing their claims only to get various countries orders.

In six months, when the trailing team, such as AZN and Sinovac or other complete their third level test with almost 30000 people, these two companies BNTX & MRNA would have experience with 25 million people experience and they would have released new versions to meet 99% quality standards.

In short, BNTX & MRNA is at Usain Bolt level, started already and for others it is not easy to catch these two companies with full year order book position. This is the benefit of leadership.

If they finish the one year Dec 31, 2021, these two would have made few billions in profit which will make them financially stable position and fund other 20+ projects in their side. They will continue to grow with their own technology.

This is ultimate lift off by Covid vaccine innovation !

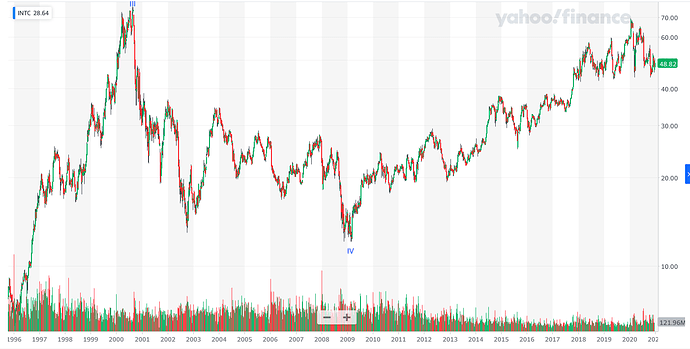

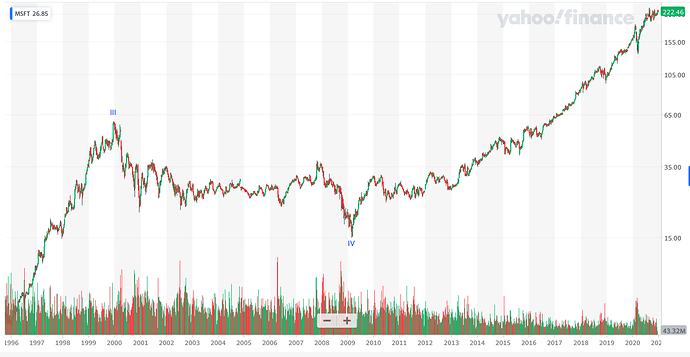

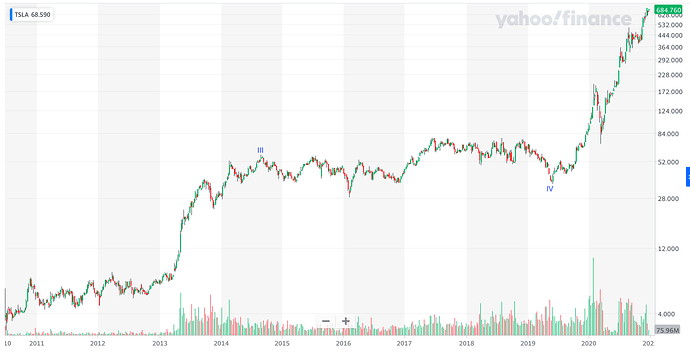

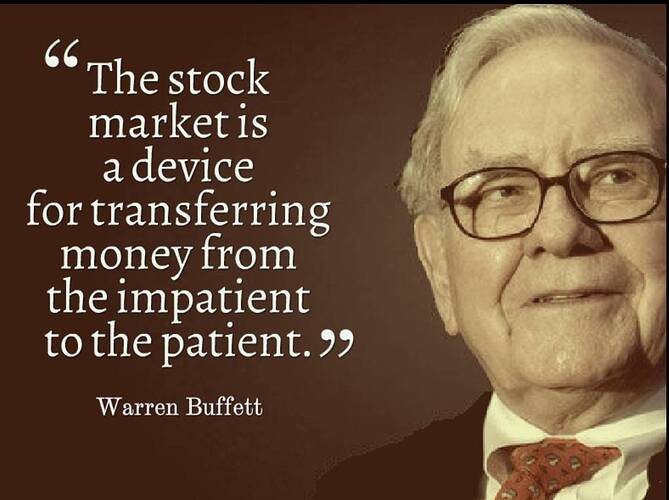

This is exactly going like TSLA, people were pessimistic/scared when stocks dropped from $350 to $180 and then banks picked it to massive level now.

I do not know whether these will go like TSLA, but I expect minimum 2x (with current price) by end of 2021. BNTX Forward P/E is 5.46 and MRNA forward P/E is 10.84.