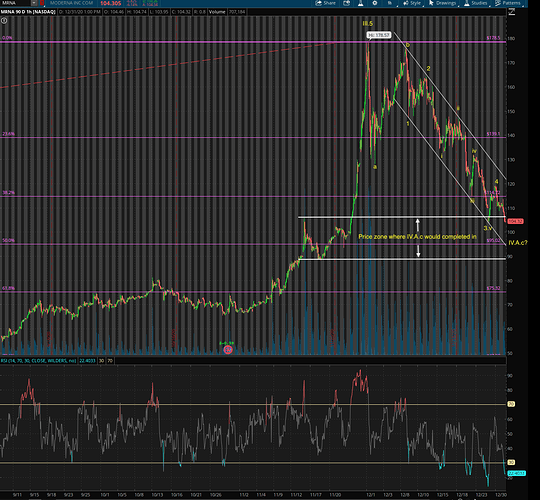

More than 24 hrs ago I posted a Primary (multi-month) to Cycle Degree (multi-year) EW picture. Below is the intermediate degree (multi-week) EW picture,

No letting down, keep on adding shares including today.

Let me see my destiny where it leaves me by dec 2021

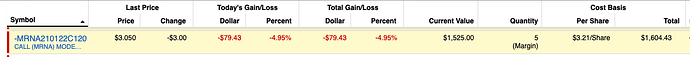

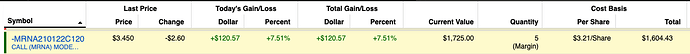

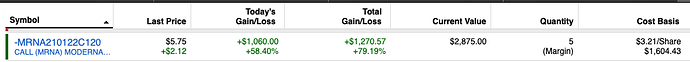

Look like wave A is close to be completed, spent $1600 of this year winnings to make a lotto bet, long 5 calls, so far is RED,

I have also reserved some cash for mRNA $100 !

Stocks no options

I bought some MRNA

You seem to did quite a bit of homework on biotech. I watched and read Cathie Wood interview. She mentioned AI, robotics, energy storage, genome, and blockchain. Other than genome, the other fours are pretty obvious, we in tech industry knew. As for genome, I was thinking it is still not mature yet, guess I am wrong. Now that she mentions it, I am itchy to put some money into some of these genome stocks. Is MRNA a genome stock? She recommends NTVA  Decided to put a tiny amount in it on Monday since it is in corrective mode - not idea when it will bottom, didn’t do any EWA.

Decided to put a tiny amount in it on Monday since it is in corrective mode - not idea when it will bottom, didn’t do any EWA.

Genome is a big subject involving genes. Messenger RNA is a subsect of genes which is a new technology. For investing, you only need to know what is this company doing and how is going to be its future. Just read the company ( BNTX and MRNA) investors press releases, rest you will know about this.

zeapelido link is enough for you

I just scanned CRSP, and they are doing research on 1) cancer cells 2) Diabetes with new DNA modification technology which is similar to MRNA & BNTX on Covid-19 (RNA technology).

They (CRSP) has 3 products which has success (Oct 2020 they claimed) that made appx 200% increase in share price which is also getting corrected year-end now. They have tie-up with vertex pharma (similar to PFE & BNTX) for commercialization of their CTX110.

ARK investments has the highest stake holder with 11.97% ($1.4B), next comes Capital International Investors 10.47%($1.2B).

Looks like they do not sufficient order book - as of date - expecting eps 1.32 (loss) next two quarters (Refinitiv). However, company is at 10B mcap. If they succeed in making cancer and diabetes drug, they have major world potential.

You please do some research on fundamentals. Even this is getting corrected, you can review some EWT and possibly take some position when you are comfortable.

Since it is similar stock, I stay with BNTX & MRNA, but review later on CRSP.

Since you have fidelity, you just compare BNTX vs CRSP and see the difference with “Earnings” & “Insiders”.

CRSP has a few competitors, EDIT NVTA BEAM. Cathie owns all fours.

ARK is top holder (>10%) of CRSP, EDIT and NVTA, but small stake in BEAM (ARKG has 0.88%). Being 10% holder, they are insiders as per SEC. They will be inside management as directors and may have better knowledge on those companies (Like WB in WFC or BAC…etc).

The best time for all such companies are just after start of 3rd trial of drug and before completion. The growth depends on marketing potential - too hard to account.

It is better to buy ARKG or ARKK so that they take care of balancing the portfolio.

Why you need to do research? See here, you need ensure growth.

Based on some reading, CRSP is the hottest of the fours.

Anyhoo, I have decided get rid of some of my cloud stocks to buy the top five of ARKG

CRSP

NVTA

TWST

PACB

IOVA

Just a puny amount as foothold while reading up more.

Compared to all these 5 top stocks, MRNA and BNTX are way better stock than these five stocks.

If I assume 5% ROI every year, current price of MRNA and BNTX matches. However, market projected 10%-15% ROI for these stocks, i.e., both these stocks are way undervalued (suppressed) with current drops.

Among the 5, CRSP is better as they declared first success last oct 2020 (no FDA approval yet), but BNTX and MRNA got approval, got one full year (more to come) booked orders.

I will leave the decision to you.

At present, I have more MRNA than the planned purchase of those five combined  I need to expand my horizons

I need to expand my horizons  I need to buy them so I will have the incentive to read more. I am also seriously considering start DCA into ARKG

I need to buy them so I will have the incentive to read more. I am also seriously considering start DCA into ARKG  I think Genomics stocks are still in first innings, the other four platforms she mentioned have already run up quite a lot. The probability of 10x over a few years is hard.

I think Genomics stocks are still in first innings, the other four platforms she mentioned have already run up quite a lot. The probability of 10x over a few years is hard.

This is the stock for investment, but you are playing like short term options. Even if you gain short term 79%, it is not so much great gain, but missing the boat.

If you want to know, I have appx half million with it, combined MRNA and BNTX, but not interested in small magic gains !

What is their market potential? => The whole world economy is standstill with covid-19 for which these two companies have to fix it. If they are not fixing, whole world economy will be in correction mode !

I can not catch WQJ as TSLA is a bigger bet, but I do not want to miss this chance like TSLA again.

Whether the forum members buy or play with options, no gain to me.

Think this way: If BNTX or MRNA is worth nothing, why do governments placed 15 billion orders to them? If these two companies are not working to fix covid-19, what will happen to world wide economies? What will happen to entire stock market then?

There is no contest here. Nobody knows who or what anyone on the forum is worth. But a correction is coming and is due. The catalyst could be the Trump circus on Jan 6. A 10-20% drop would be a good thing. Even a 35% drop like last March is survivable.