IQiyi Ranks in 419 Place on Fortune China List

Realized my wife has been watching Chinese movies & TV shows using iQiyi, thought is YouTube.

IQiyi Ranks in 419 Place on Fortune China List

Realized my wife has been watching Chinese movies & TV shows using iQiyi, thought is YouTube.

Iqiyi is owned by Baidu. Bullish on my stock pick.

Good. IMHO, Charlie Munger is right that Americans are underinvested in China. Since 2012, China has a plan to open Chinese market and allow more freedom akin to the developed democracies. Is just can’t go at the pace of what Trump wants, sometimes I wonder whether he is trying to win political points. If China continues to open up, Trump wins since China did what he wants. China tries to save face by closing, Trump wins since China risks hampering its development, 2012 report said China has to open to survive.

Anyhoo, assuming China continues to open up and per capita continues to increase, China stocks would worth a lot more decade later so is the right time to long China stocks. We know the mega cap are BIDU , BABA and TCEHY. Time to buy some mid caps ![]()

Sounds good except BIDU really is a mid cap. BABA and TCHEY are mega caps. So BIDU should have much more potential than the other 2.

Close enough. In fact a bit surprise that market cap of BIDU is so low. Why is it not of the same order as BABA and TCEHY?

Because it’s not a mega cap

It is an inevitable trend that people shift from traditional TV viewing to online streaming, and iQIYI is riding on such a multi-decade industry tailwind, and thus the company can be a great multi-year compounder. While the company still needs to spend aggressively in the next few years to fend off competition from Tencent Video and other short-form video platforms, iQIYI stock could be an attractive long-term hold. However, I don’t think iQIYI’s current valuation contains enough margin of safety to build a large position. Its original content production capability is the key KPI that investors should closely monitor.

Manch,

Any comment of above view? Not enough Margin of safety ![]() despite depressed price from ATH. Do growth stocks ever are?

despite depressed price from ATH. Do growth stocks ever are?

This analysis is crap. You can cut and paste and say the same thing about Youtube. Then in that case just buy Google, the parent of Youtube.

Manch,

Bzun 12x over 2 years. Did you own it?

Manch went into hibernation. Wonder what he is up to?

He’s at camp and should be back today. Why am I the only one who knows what’s going on around here

Hard to keep track…

Yeah came back into civilization just now. Good that at least one person cared where I went.

Oh come on. I obviously cared, otherwise I wouldn’t even have bothered to ask.

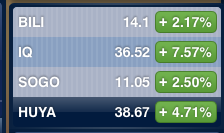

Despite China stock market is in bear territory, BISH (bili,iq,sogo,huya) continues to blast upwards ![]()

Going forward, entertainment is BIG.

AMZN will soon become the #1 stock in market cap. How soon? Your guess?

AAPL can still retain its #2 for a long time.

Wrong thread. Should be under the F10 thread, FANG, ANT, BAT. AAPL’s market cap is kind of cap because it keeps distributing dividends and buyback shares, so is a matter of time AMZN, FB, MSFT and GOOG would overtake AAPL’s market cap. Companies themselves are not interested in such title, analysts and journalists have nothing better to do. For an investor, you’re only interested in dividends + capital appreciation (1 or both), the must is no negative capital appreciation in the long run, in fact, must appreciate faster than general inflation and growth rate of an index fund such as S&P ![]()

Roller-Coaster iQiyi Stock Could Drop by 50% or More

There are a lot of investors who don’t want to miss out on the second coming of Netflix and are willing to buy IQ stock at any price to get in on the action.

“In the midst of the trade tensions with the People’s Republic, China-based companies keep coming public here, and their stocks have been roaring,” Cramer said Jul. 5 on Mad Money. “Many of these names, though, [are of] dubious quality.”

manch, any comment? Is IQ of dubious quality? Is its valuation too rich?

According to the chart, IQ has declined 50% from ATH already, it is showing signs of recovery, so I am not sure what the author is talking about. 50% from here?

IQ is much inferior to Netflix. China has a very different market dynamics. It has many players each has a sizeable chunk of the market. It doesn’t follow the West’s consolidation pattern. At least not yet.

I don’t know how high or how low IQ will go. I still own it and will likely add to it. I will let the market tell me.

Usually a new industry starts off with many players and then consolidates into an oligopoly as the industry matures. Is still early.