TWLO shouldn’t have resistance until the prior ATH. I doubt it’ll be smooth up to there, but that’s the major resistance point. I still think they are leaders in what’s a very early trend of connecting to consumers via apps. People are going to demand more customer service not less.

What is meaning of mooning in this context?

Why do stocks drop after reaching all time high (ATH) only to return back after some time (6 months to year).

I know, want to capture a few dollars ![]() trim and GTC to buy back at $115, drop to $117.23 and re-bounce.

trim and GTC to buy back at $115, drop to $117.23 and re-bounce.

Edit: Look like early by 1 day. Market dropping fast.

Mooning is a silly word invented by crypto currency traders. It means price appreciation to a very high level. Another popular one is to misspell hold as hodl.

Technically is called digestion. Many reasons such as…

- Rotate out of the winner which likely to have lower appreciation rate to the higher appreciation rate stocks.

- At ATH, stock prices tend to be ahead of fundamentals, run up due to exuberance, humans calm down and want to play safe so lock in profit… never wrong to take profit…

- At the bottom, stock prices tend to undershoot the fundamentals, so buy back.

Pay attention to the stochastic and RSI, and articles from sell side analysts. These analysts tend to publish reports to catalyst the change in trend, might be paid to do so. I have friends who are stock analysts, they always write two reports and publish the one the boss wants them to.

Is all about psychology. You should take a course in psychology. It is also taught in business school. And in US college system, can take it as a GE course.

Splunk is one of the leading-edge companies involved in Big Data and SIEM. The company is in the midst of transitioning its business model, and this has clouded its financials, including margins and revenue growth.

Given the fact that Splunk is a high-growth company, an investment in it should not be judged based on value metrics. Growth in ARR is in excess of 50%. Cash flow is negative but should bounce back strong in FY22.

Splunk Is Still A Great Buying Opportunity

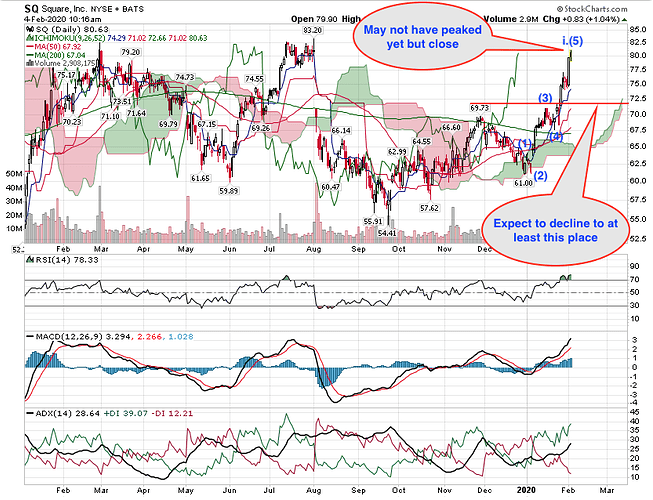

Chart looks like about to have a short-term pull back.

Should a stock be bought if the earning are to be reported in two three weeks? Or should it be after earnings?

I prefer after because you avoid big swings. I don’t see an advantage of buying before a big event unless you know the outcome of the event which would be insider trading. It’s unnecessary risk.

I read about a guy who ran a commodity trading team before hurricane Katrina. Everyone knew the hurricane was coming, but the severity and impact on oil drilling and refining was unknown. People were really just guessing. He made the firm close all oil positions before the hurricane hit. His reasoning was after the hurricane impact is known, the direction of the move will be certain, and the oil price move will last months. It’s better to preserve capital, miss the initial move, and buy after the outcome is known. They had a record profit the year after the hurricane.

I guess the opposite question from pandey@hotmail’s Qn

Say, you bet the farm(@40% of your portfolio value at that time) on one single stock, and it’s up 40% in the last 7-8 months, what do you do before the results? Sell options on it? Reduce stake but not sell the WHOLE lot? Of course, I believe it’s a great stock long term, but should I take some profits off?

Sell OTM calls.

Theoretical question is impossible to answer. Case by case.

Hedging an existing postion?

Sell covered calls? limit gain, still unlimited loss.

Long puts? unlimited gain, limited loss. need a little cash standby or use a little margin.

Open a new position?

Long underlying, unlimited loss and gain

Long call, unlimited gain and limited loss

Make your judgement call.

TWLO and SQ are roaring.

could you explain how to interpret the red and blue arrow

Red arrow means still trading within the triangle, support is the bottom up trending line. Even so, usually it would either break slightly below or reverse before hitting.

Blue arrow means breakout, would establish a new ATH higher than $101.15. Careful with fake breakout, the norm is +3% above the resistance downtrending line to confirm is a true breakout. So if you go long upon breakout, need to place a hard sell stop just below the support line.

@marcus335 Any plan to scale into new ideas in this correction or sticking with TWLO, UI, and SHOP? My cloud portfolio comprises four stocks: TWLO, SQ, VEEV and OKTA. Sold off SPLK and SHOP and they have yet to pull back low enough. Was thinking of TEAM like @pandeyathotmail, but it keeps shooting up.

I’ve started watching SPLK and OKTA.

MF pumping OKTA hard. Many articles recommending OKTA. After the first article, scroll down for five more articles recommending OKTA as the stock to invest for long term.

Cybersecurity Stocks: Zero Trust Boost Expected At RSA Conference

“The modern world demands ‘zero trust’ approaches to security, which in turn are predicated on effective Identity and Access Management (IAM) to ensure every user and entity is permissioned, authenticated, and entitled per defined policies and constraints. We believe pure-play vendors like Okta, Ping Identity Holdings (PING) and CyberArk are the largest beneficiaries.”

In addition, Needham analyst Alex Henderson is upbeat on Okta.

“We continue to believe that Okta is becoming the de facto leader in cloud identity and see identity as a crucial element of Zero Trust network architectures, which we view as the future of security,” he said in a report published on Wednesday.

Must own one of the three: OKTA ![]() , PING and CYBR.

, PING and CYBR.

Salesforce Leads Five Top Software Stocks Near Buy Points

The IBD buy point is a buy signal for momentum traders. The five stocks mentioned in the article are: CRM, SPLK, TEAM, AYX and CYBR. I own none of them and interested in SPLK and TEAM.

Sold off SQ. Look risky to hold on to.

Cut TWLO by 1/3, 2mrw earnings so reduce a little exposure, hope to buy back after earning.

Update:

Market is still a raging.

Joining the euphoria, decided to buy 100 CFRX this morning, … shoulda buy 10,000!

Market is messing with me.

OMG, I hold huge numbers CFRX. Will take some profit tomorrow