I owned WDAY  Well done

Well done

slack/WORK - current market cap is $24B, WSJ reporting valuation will be north(hasn’t reported how much north) of $17B & deal with CRM supposed to be announced tomorrow.

Sell or Hold?

ADDED LATER:

Salesforce’s deal to buy Slack is expected to be announced Tuesday after markets close, sources told CNBC’s David Faber. The deal is expected to be about half cash and half stock, the sources said, and will price Slack at a premium to its current price. Salesforce is set to report quarterly earnings on Tuesday. Shares of Slack rose about 8% Monday on the news. Salesforce shares fell about 1.5%

My guess is current price will be Tuesday’s closing price?

I don’t try to play the acquisition game. There’s people with far better info than we have.

ok the language from wsj is:

Slack, with a market value of more than $17 billion as of Wednesday morning,

which is last Wednesday.

I sold my piddly holding.

Benioff has done strange things before like buying Mulesoft for a ridiculous amount. I’d be shocked if the acquisition price is in the 50s.

Did you miss a “not” after the is?

No i think > 50 would be too high to pay.

Slack is a money pit - hasn’t shown any inclination to make profits.

I am holding 9 calls. Let’s see what happens tomorrow.

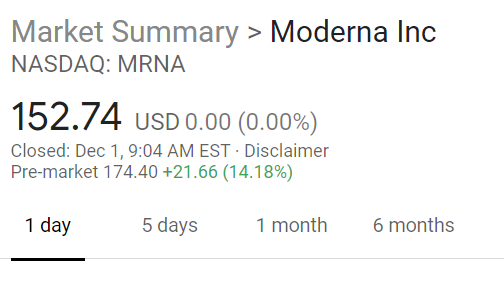

MRNA, True 10x winner like TSLA now, yet to reach 10x (was $19 last december) soon.

Now, this stock is crazy stage, spiraling exponentially.

Moderna’s Covid Vaccine Found 94.5% Effective in Early Analysis

Why Moderna’s Vaccine Win Is a Giant Leap Against Pandemics

Company Profile

200 Technology Square

Cambridge, MA 02139

United States

Sector(s): Healthcare

Industry: Biotechnology

Full Time Employees: 1,100

Moderna, Inc., a clinical stage biotechnology company, develops therapeutics and vaccines based on messenger RNA for the treatment of infectious diseases, immuno-oncology, rare diseases, and cardiovascular diseases. As of February 15, 2019 the company had 11 programs in clinical trials and a total of 20 development candidates in six modalities comprising prophylactic vaccines, cancer vaccines, intratumoral immuno-oncology, localized regenerative therapeutics, systemic secreted therapeutics, and systemic intracellular therapeutics. The company has strategic alliances with AstraZeneca, Merck & Co., Vertex Pharmaceuticals, Biomedical Advanced Research and Development Authority, Defense Advanced Research Projects Agency, and Bill & Melinda Gates Foundation; and a research collaboration with Harvard University. Moderna, Inc. also has collaborations with Lonza Ltd. for the manufacture of mRNA-1273, a COVID-19 vaccine; and Catalent for fill-finish manufacturing of its COVID-19 vaccine candidate. The company was formerly known as Moderna Therapeutics, Inc. and changed its name to Moderna, Inc. in August 2018. Moderna, Inc. was founded in 2010 and is headquartered in Cambridge, Massachusetts.

Just FYI: I read the book (as usual) finding the next Starbucks, like that I found TSLA, but missed.

I do not want to miss MRNA now, the company made a break through in Covid medicine and have a huge potential. Even today morning, I bought 300 shares of MRNA at 165 pre-market as expected to go higher (FDA approval is not yet there).

@Jil is in FOMO mode.

MU is also mooning  So is SOXX/ SOXL. MU is HOT! because of BIDEN victory. It was depressed because of Trump. The compressed spring is being released - BUY! 4%+ and still going up - beat TSLA. My semi portfolio is leading the other two portfolio by a large margin

So is SOXX/ SOXL. MU is HOT! because of BIDEN victory. It was depressed because of Trump. The compressed spring is being released - BUY! 4%+ and still going up - beat TSLA. My semi portfolio is leading the other two portfolio by a large margin

QQQ/ TQQQ are mooning because of AAPL, TSLA and NFLX.

What “book” is that??

On MRNA & BNTX, yes, I was in FOMO mode.

I bought 200 MRNA shares at $94, went up and this is 300 shares at $165.

Similarly, for BNTX, I bought around 200 shares at $86 and now another 100 shares, averaging $105/share.

Yesterday, I bought two leap calls for 2023 expiry 33% up singe day not cashing it. Madly behind MRNA, I do not know right or wrong.

It is true FOMO as there is lot of potential for both companies as they need to eliminate Covid-19 crisis, governments are ready to pay any amount to get this eradicated.

All I know is the stock equities I own plenty are UP! AAPL, QQQ, MU. Those I have little are DOWN.

Edit:

MU up almost 6% ![]()

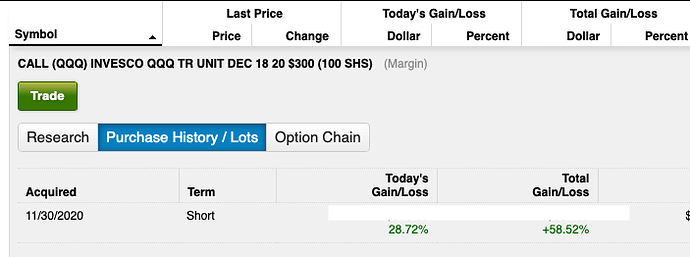

It’s been incredible last 2-3 weeks especially the options. FOMO is here and maybe we’ll last another week or two. I haven’t quantified anything but I haven’t seen premium movements like this ever on the long side. I’ve been cashing out 25% at 2x gain, and another 25% at 3x gains to make sure I don’t get burned. I’ll let others ride for 1-2 weeks and btfd from profit only.

Unfortunately I think I have been cashing out too early. Currently only holding 1/4 of previous size for MU and none of SOXX/ SOXL. And about 30% of previous size for QQQ/ TQQQ.

Through a combination of cash and stock, Salesforce is purchasing Slack for $26.79 a share and .0776 shares of Salesforce, according to a statement. That comes to about $45.86 a share.

since both are linearly related, question is to buy crm or work?