Like NIO jumped from $1 to %50, I see OSTK jumped from $2 to $121 (peak) this year.

Since my last post a month ago, Gevo has gain more than double. Anticipate it open more than $5 tomorrow so no longer to be classified as penny stock ![]()

All good news coming next year.

Company will pay all the debt on December 31 2020.

It has optioned to right to purchase 239 arc site for expansion project.

I has $1.5B long term revenue contract…

They are all positive in my opinion.

I have added quite a lot since last month.

Off course these are just my opinion. Do your own DD.

But it only has 50 people? What can you do with 50 employees?

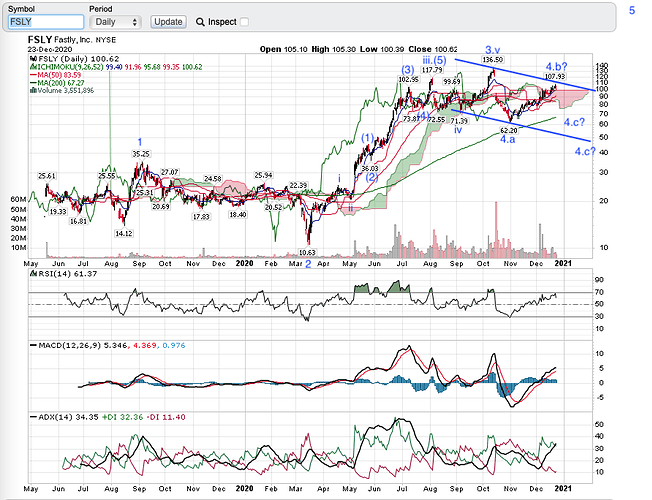

FSLY,

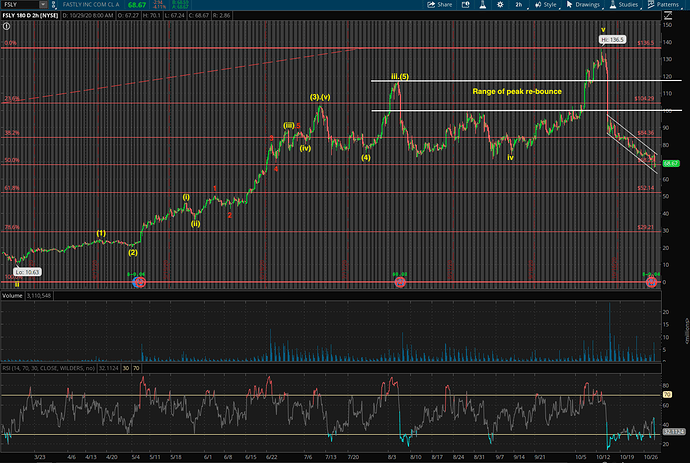

Can’t remember whether I have posted the Primary degree EW picture, so post again (outdated btw ![]() ), need this to see the lower degree EW picture,

), need this to see the lower degree EW picture,

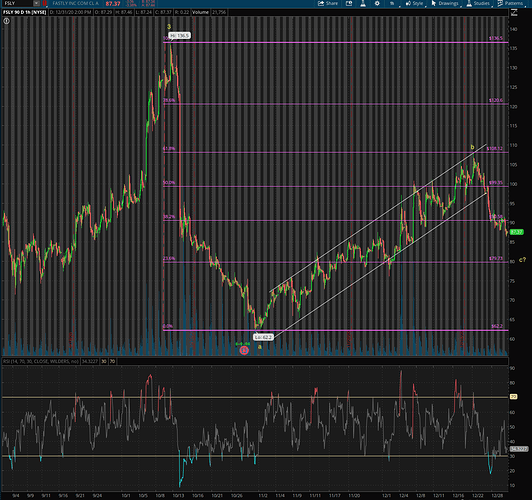

Wave 4 in progress, in wave c (don’t know where it will complete as I have no clue whether wave 4 is going to be a flat (expanded or regular) or a triangle or a combo ![]() Anyway I have expected it to be a wave 4 so didn’t buy much, now need to time when it will end to make a BIG purchase

Anyway I have expected it to be a wave 4 so didn’t buy much, now need to time when it will end to make a BIG purchase ![]()

Just do us a favor and tell us when to buy.

Aggressive and impatient: Buy today ![]() If didn’t then AH or Monday PM or morning.

If didn’t then AH or Monday PM or morning.

Conservative: Buy @$80 which I opine is where it would go (I could be very wrong).

Conservative and patient: Buy at 200-day SMA, estimate to be around $75.

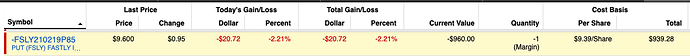

What did I do? Short a put as the first position. Will add if drop to $80, possibly buy shares. If drop to $75, long calls. Simple?

Edit:

Busy trading QQQ and MU, didn’t realize I created this EWA on FSLY on Oct 29, … problem with too many counters to monitor…

Bear case for Bill.com:

Well, in 2021, BILL is a bubble begging to be popped. As if to invite the dot com bubble comparison openly, it even has “.com” in its name. Who does that anymore?!

Hmm… you don’t say…

![]()

@mcp

Did you get any $Gevo? It has been hot and almost 5x stock for me.

When it hits $15, I’ll retire for real ![]()

Dems support Green, so IMO this is a good bet for long hold.

great! I have 1856 shares at 3.57 avg price. Yes I believe it’s long hold.

Great, I have some Fcel as well.

I missed the Plug boat.

Green Energy is been hot lately.

do you have IDEX?

Yes but not a lot.

I have big chunk on GeVo.

yes that’s better and safe. I will come out of IDEX soon after covered call expires.

i am not a fan of biofuels. I’ve seen this play out before, infrastructure and will to do this isn’t there, no matter how the politicans talk.

Biofuels are just a subsidy for big Ag. Even Trump is against them.

This time is different ![]()

me too…long hold

True !

Word of caution:

Lot of Hypes around GEVO. Looks like company is built of power point slides than actual R&D technology…etc.

Looks like dot.com kind of hypes, they converted 12% notes into shares by end of Dec 2020. By hyping vested banks/underwriters, they may even come up with follow-on shares to get funding…etc.

I do not see any real value behind the company. If I were you, I will take the profit run away. It is like TLRY, hyped to $300 and then closed now around 20s.

As long as price is going up, enjoy the ride and come out profitably. Ultimately, people will get profit or good experience.

I find some patent references, they fought over it and won.

Additionally, review this document

In parallel, Gevo will lead development of the jet fuel market. Gevo has been producing and selling alcohol-to-jet fuel (ATJ) derived from isobutanol since 2011. To date, Gevo’s ATJ has been produced at its demo biorefinery in Silsbee, TX, using isobutanol produced at its Luverne, MN, fermentation facility. The company has successfully flown tests flights with the U.S. Air Force, U.S. Army, and U.S. Navy and now expects to secure the MIL-SPEC certification (JP-8 and JP-5) enabling bids on future RFPs for renewable jet fuel by the Defense Logistics Agency. Gevo also intends to begin test flights with the commercial aviation industry, including Alaska Airlines, following receipt of ASTM International certification, expected before the end of 2015.

Look at, review and decide.

IMHO, you have not done DD throughly for this company.

It holds plenty of patents that was evaluated roughly $412M.

https://www.google.com/amp/s/seekingalpha.com/amp/news/3609772-gevo-ip-portfolio-valued-412m

Yes I agree the stock is hype but the company has good plan bright future (contractual revenue of 1.5B for 10yrs, partner with Koch Brothers…

I will hold this long. Likely will comeback to this post in 6 months to update the price ![]()