MOAR SHOES!!!

I invest in what I know and use. Apple, HD. Costco, Wallmart, Microsoft, Amazon, Ruger, Facebook, Vail.

@Jil wasn’t bad too but he traded instead of owning them. Now he should be looking for another SHOP instead of TSLA. His pick was SHOP TDOC VEEV

This thread is too long and outdated. Why don’t you start a new one with everyone’s new picks for 2021?

Here’s the more recent list. There’s a lot fewer stocks under $10B, since the market has run a lot and companies wait longer before IPO. Then here’s the ones if it’s expanded more to $20B then $50B market cap:

If I bump to $20B, then that adds:

AVLR

DT

NET

ZEN

MDB

TER

WORK

ZS

COUP

I didn’t check those for founder led. The next group under $50B:

RNG

OKTA

DDOG

CRWD

DOCU

I didn’t check those for founder led either.

@marcus335 Your comment about spending more on sales vs engineering is true. I was shocked to recently learn that my employer’s sales organization has as many employees as we do engineers.

Why does your criteria not use Rule of 40 or do you think that’s not relevant in the current market?

I’m less concerned about profits in a highly growing company. I care more about a high gross margins, since that is the key to big profits later. If gross margin is low, then it’s impossible to end up highly profitable. I do think it’s worth looking at cash flow, since that’ll determine if a company can fund itself or will need to keep raising money. I don’t like a high cash burn rate.

I also look for founder led, since it’s hard to get top talent to run a small company unless it’s the founder.

Quantity is important. A 100% return on $1 million is better than a 1000% return on $50k. So be happy with your aapl due to the quantity of it.

![]()

You sense I am not envy of your TSLA gain ![]() ?

?

Our CFO showed us some of the board deck today. It’s interesting how he thinks about software company valuation. He did a cut of >30% revenue growth and operating loss of $10M or better. He had different views ranking by revenue growth rate, price/revenue ratio, then 1-yr and 2-yr stock performance. The cohort absolutely killed the market average return.

Release the list of cohort! We’re hooked.

I can’t remember the full list. It had a bunch of names we discuss here. I’ll see if I can re-create it.

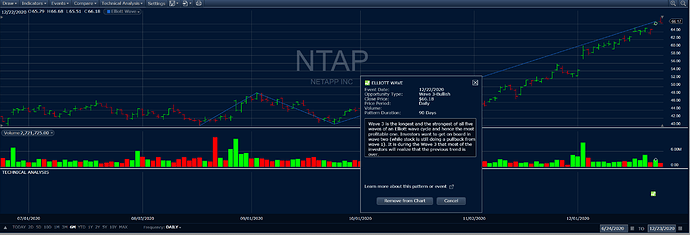

I see the possibility of NTAP May drop sometime soon ( wave 3?).

Do you see similarities? What level it can drop?

NTAP. Didn’t do a count. TA is bearish. Bearish gravestone and decreasing volume. Should close two gap ups till $60, depending on market conditions might attempt to close $55 gap.

Looking at the your graph, it seems to indicate current picture. It didn’t indicate whether it is going to complete or not.

Refer to my graph. Length of wave iii is 2.88 of length of wave i. Wave iii could have been completed. If not completed yet, should complete not higher than $69.

Right, but my algorithm indicated peak is now and possible down period ( like TSLA ) in 2-8 days range.

BTW: not a stock advice, viewers be careful it can go wrong

Didn’t realize I own a 10x over 9 months (from low in Apr). Ofc, quantity is too low, so didn’t hit $10M like @wuqijun ![]() Also didn’t add more at the low, best is 4-5x

Also didn’t add more at the low, best is 4-5x ![]()