Since you have FUBO, did you own HUYA2? I sold it because of Trump tariff tantrum.

Nah. Concluded that Chinese stocks are too complicated for me. Besides the usual business and market stuff need to worry about politics as well.

Cathie is very bullish on Baidu tho because of its autonomous driving. I think it’s one of her top 5 holdings in ARKK.

There is no single solution fits for all.

I know what I am doing and how to handle during bullish and bearish times…

Don’t be sensitive like @Jil Read the nuance!!!

Not commenting on Beth’s EW guy and his EW skill or commenting on Beth’s knowledge and skill or commenting on suitability of trading approach to @Jil.

What I mean is for “buy n hold” (according to you, can only know by survival biased*) stocks, should not adopt a trading approach.

*You could well be right BUT… if you have high confidence that it is a buy n hold, don’t adopt a trading approach.

Do I always need to talk like a liberal art, saying the idea this way, then express in another way, yet talk about it another way before you guys can understand the nuance? I expect high IQ SWEs can understand the meaning immediately with a few words and phrases without needing an essay.

Less than 10 years, trader can do better than buy n hold… nobody dispute that except traders are always proud to point that out…

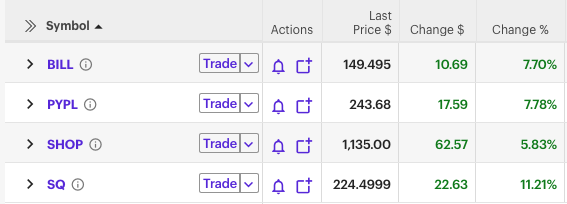

I bought these yesterday in a buy n hold account (not trading accounts). Won’t be selling any of them regardless of what happen by May possible crash till Mar 2021… Will add much more ![]() if true.

if true.

I don’t believe you.

![]()

I am not @Jil He always say this price won’t be reached ever, and won’t sell for two years, next moment, he sold.

Anyhoo if the crash turns out to be true, I would close all VOOs and buy these four stocks. VOO would also be decimated but the recovery of these four stocks would be WAY HIGHER than VOO. I only need to do the transaction (sell VOOs buy these four) in Mar 2021 ![]()

A Chinese saying describe @manch personality…

船头怕鬼,船尾怕贼

Chinese has always believe in…

一命

二运

三风水

四积功德

五读书

六名

七相

八敬神

九交贵人

十养生

This is interesting comparing SHOP and U.

Both have an interesting dual revenue model of a baseline subscription then usage based services on top of it. The subscription is the moat but usage based services become the real story. Usage based is great since revenue with each customer grows as they grow.

I’m not sure how accurate the game list is on Wikipedia, but the number of games developed using unity peaked in 2017. It’s actually declined every year since, so they are generating more revenue in a small base of games. I think that’ll make it difficult to sustain growth.

Don’t buy U because of games. Is like buying TSLA for cars or buying AAPL in 1998 because of candy iMac . Buy U because of VR/AR + more just like buy TSLA because of power distribution + more.

If I am not wrong, market cap of SHOP is much less than $10B when IPO. Market cap of U is pretty high.

Finished reading the article, MF is talking big, this type of biz model is no different from App Store… quite common right? Is not a super duper new biz model. Developer pays a small sum to join the developer program (annual subscription), can offer free or paid game (usage or revenue sharing).

Great slide deck from a hedge fund, “A few things we learned in 2020”:

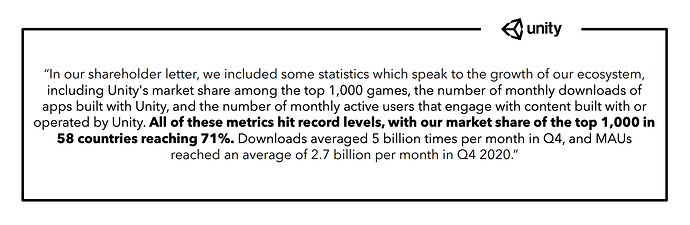

with this quote from Unity in their 4Q20 earnings call:

I notice recent Cathie buys are stocks that have declined by a lot…

U SKLZ ADPT RPTX TDOC TSLA EXPC

She didn’t add to NET FSLY and didn’t bother about SNOW. No cloud security stocks. Why?

My worry about TDOC is…

螳螂捕蝉,黄雀在后

蝉… Current healthcare system

螳螂 TDOC disrupts current healthcare

黄雀 ZOOM disrupts TDOC the disruptor

This guy is very bullish on TDOC. You can read to see if he’s convincing.

This twitter thread by the same guy captures the TDOC bull case better. Click on the link below to read the whole thing. His argument that ZM is a doctor-led system vs TDOC being patient led is pretty insightful. Haven’t looked at it from that angle.

That makes more sense in the growth if they are going beyond games.

Insane growth. Nobody will go back to signing papers after they experienced e-signing.

check out Novavax after hours.