Both NVS and DOCU drop AH.

Finished one round of reading, so much facts, barely get what he have said. One issue is how do patients like me, get into TDOC/LVGO platform or why should I switch to it? I am a habitual person, so I email/ text my Primary doctor of any issues arising regardless of where I am. So how does patient-led or people-led led me to TDOC or LVGO?

I think the insurance company has to set it up for you. Or some clinics that organize that way. Maybe ask people like @marcus335 whose companies pay for TDOC visits?

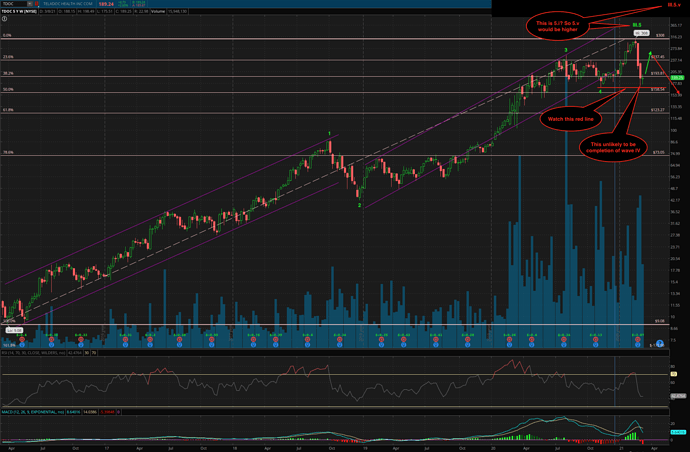

TDOC is hot but the chart says more downside?

As a stock owner of LVGO/TDOC your optimism makes me feel good but, perhaps again playing the devil’s advocate, I’m somewhat worried whether the new TDOC will become a healthcare titan that easily given the emerging and existing competition; while not all of these companies operate on the exactly same area it feels there’s a bit of gold rush in this sector and any change in regulations or perhaps even macro economics could tilt the situation towards other players. Not in any particular order, but companies like Ontrak (OTRK), MTBC (MTBC), CVS Health (CVS), UnitedHealth Group (UNH) and more remote like Veeva Systems (VEEV), Guardant Health (GH).

TDOC should bounce up over the next few weeks, not sure after that.

Goldman put a price target for U at $126. I wonder how high it could go.

Earnings guidance disappointed but still very solid company.

.

U is a long term (>5 years) play. Ignore quarterly performance.

Insane growth.

I wish CRWD dropped more in the sell of 2 weeks ago. It’s still too expensive for me.

I didn’t know they bought humio recently which means they should now be able to offer log analytics to customers.

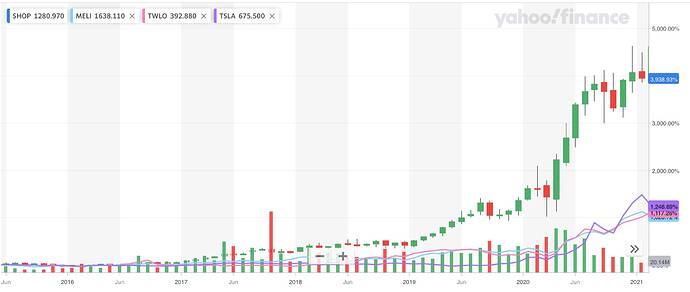

Similar situation as SHOP a few years ago. Outcome would be determined by CEO TDOC. Is he as good as CEO SHOP? So many investment gurus including MF, JC, Cathie, recommend TDOC yet it tumbles by over 40% from ATH. Is TDOC an outstanding stock at reasonable price or is already a have-been?

Something like SHOP ![]() TSLA MELI TWLO are not good enough.

TSLA MELI TWLO are not good enough.

SHOP IPOed at less than $5B ![]() Is about $137B… plenty of room to go up to $1.5T (AMZN market cap).

Is about $137B… plenty of room to go up to $1.5T (AMZN market cap).

My current hopefuls (less than $10B) are:

U

CRSP

NVTA

TWST

BILL

ESTC

FSLY

How about CURI? 0.9B market cap. 10x would still be less than 10B.

ROKU is 44B today. Could it reach 500B? I think so. In a future world where AAPL, MSFT, AMZN and GOOD are worth 4T, why can’t companies like ROKU be worth 1/8 as much?

Are you expecting Fed to print that much money? I have expected AAPL to hit $1T but not because I think its business would do that well, is because I think US dollar is fast depreciating (aka Fed printing money). $4T for AAPL? It means Fed has to print a lot of money. If Fed continues to print uncontrollably, I would soon be buying bitcoin… that is the same reason why I had wanted to buy bitcoin at $2k-$3k but forgotten… US dollar is fast becoming worthless.

If you don’t think AAPL will double in your lifetime, why are you still holding it? Shouldn’t you sell them all and buy something with better prospects?

You have forgotten what @wuqijun said. Just use margin to buy other hot stocks… that is what I did for a taxable account. Anyhoo, I did sell some AAPLs (hell froze over) in an IRA account to load up some U, some TDOC, some BILL… IRA is non taxable so ok to just sell ![]() … in any case, can’t margin… can temporarily margin though… need to settle within (can’t remember how long) days.

… in any case, can’t margin… can temporarily margin though… need to settle within (can’t remember how long) days.

Well Wu thinks there is still a lot of upside left in TSLA. But you seem to think AAPL is done growing.

It’s not that hard to double. At 8% a year, which is what S&P does on average without counting dividend I think, it takes less than 10 years to double.

Are you saying AAPL will lag S&P in the next 10 years?

Did I say so? I have no idea how big AAPL can go. Is better to use margin in taxable account… why pay tax (selling AAPL means need to pay a hefty capital gain tax).

Somehow Fed has to rein in printing money some day… which should lead to deflating of stock prices. So although it appears that you have “reduced” NW but in reality, you can buy the same number of assets because those are deflated too. Just like now, you feel good that your NW is growing… did your NW expressed in terms of your Primary increase or decrease?

Another example, I use to be able to buy one rental in Austin every year, then lengthen to 1-2 years, now I don’t know when. My purchasing power is dropping FAST.

In short, NW in nominal dollar makes you feel good, your real NW should be expressed in your Primary or dream home.