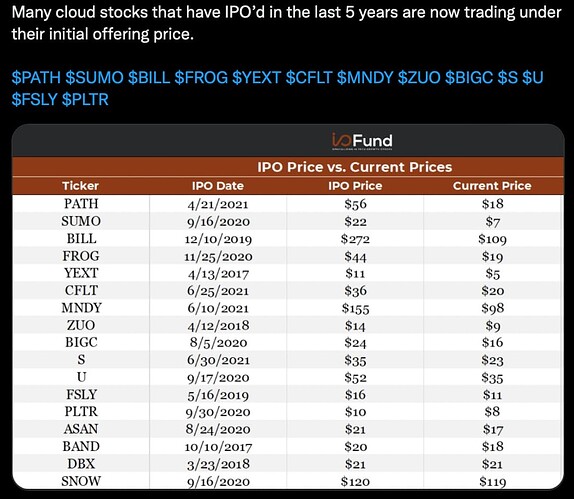

No wonder SNOW has tumbled.

Good article on Unicorns past and present.

Why am I posting here? B’coz can’t find a topic dedicated to Unicorns and instead of starting a new one, thought this might be most appropriate.

Why is SHOP shooting up today?

Other than the strong technical support at $30, I didn’t read any new fundamental news.

SHOP is the largest ![]() position in my speculative high growth portfolio.

position in my speculative high growth portfolio.

It seems to be bouncing really fast after the drop from the layoff announcement.

10x from last Friday’s close.

According to ARK’s open-source research and model, Roku’s stock price could approach $605, compounding at an annual rate of 53% during the next five years.[1]

Based on our assessment of 75th and 25th percentile outcomes, our bull and bear cases are $1,493 and $100 per share, which would deliver annualized returns of 88% and 3%, respectively, as shown below.

The revenue growth is still insane. There’s no post-pandemic slowdown.

Charts of SHOP looks so horrible, think I need to do some FA in the weekend. Wondering is it the business model of SHOP or eCommerce as a sector is under going re-rating.

Can megacap 10x? Some fintwitters think so, over a period of 15-20 years. IMHO nothing to brag about if take that long.

Most probably a new obscure company would be first ![]()

Sharing for information purpose:

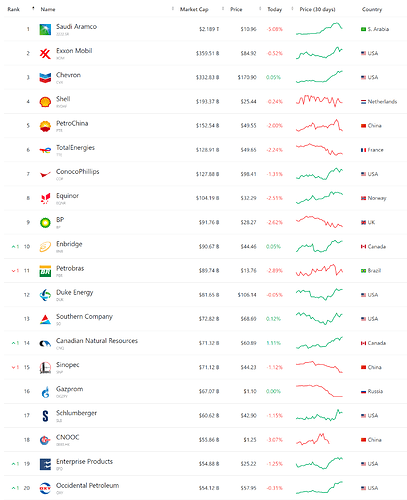

Mostly high amount investors, such as > 100M, need to look for stability (safety of their money) and look for top 20-25 mega caps.

Retail investors better bet is less than 10B or even risk bets are less than 2B.

The highest risk on very small companies, big investors can easily short them or make it up artificially. They behave like BBBY or AMC or GME. Volatility of small caps are high.

Even very big investors can not play like this with mega caps as they are linked to index funds. Index funds are linked to 1000s of mutual funds and pension funds and retirement funds. Their volatility is lower compared to small caps and most high amount investors look for it.

Now, coming to reality how megacap can become 10x. If there is future growth 10x possible in revenue and essentially 10x income growth, they can grow.

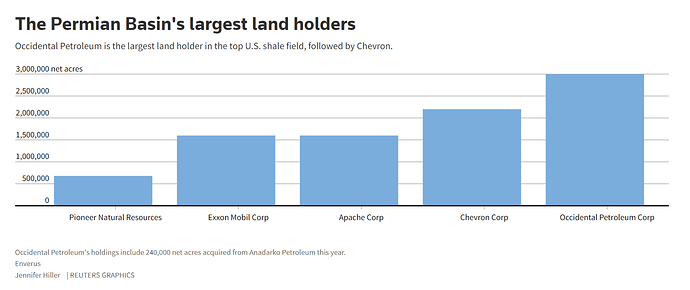

Now, look at what warren buffet does. Three big companies Chevron, Exxon and OXY in usa world ranked 2, 3 and 20 (OXY). Now, Russia supply cut to USA, permanent growth possibilities are high next 5-10 years as US needs to increase oil explorations.

If you see, oil field holdings, OXY is No 1 place, after anadarko oil fields are merged than Chevron, Exxon.

The possibility that OXY can be easily NO 4 in the world company holding vast oil fields next to Aramco.

Warren Buffett gets permission to buy up to half of Occidental Petroleum stake as he sees next 5-10 years growth.

Investor must focus on such deep long term analysis before a buy and hold.

Unfortunately, they company they are using is private. It’s a trend worth watching though. Higher labor costs is only going to increase the sense of urgency.

90% revenue growth and the stock doesn’t even move AH. That’s a bear market.

Moving 5 years.

Leading relatively new (compare with AMZN, yet listed 5+ years) e-commerce stocks doing ok.

On par or outperform AAPL.

This is a reckless opportunity (either bankrupt or win 3x-5x or even 10x) with BBBY.

The company itself 687M worth, seeking 1B equity offer to issue to get out of bankruptcy. If they get 1B funding, stock goes up easily.

If not, it is a gift to BBBY bankruptcy!

Let me test my luck this time as I failed to hold AMC which I bought 5000 shares at $2!

https://bedbathandbeyond.gcs-web.com/static-files/9bb45640-ea11-43fa-86c4-d1bf65a9d06b

Own NVDA TSLA BE ABNB