UBNT is back below $60 on zero news after earnings.

Meanwhile, LQMT shot up by over 10% because Tony Chung resigns as CFO and joined as Director on the board, new CFO is Bryne Vance. Because of this, micro-cap portfolio is now up 8.84% vs Aug 28, more than 5% of top of yesterday :). LQMT  making me tons of money… hopefully it will become 10x or more :), currently almost 4x.

making me tons of money… hopefully it will become 10x or more :), currently almost 4x.

Stocks usually decline on a new CFO. That’s weird.

Not decline on a new CFO. Decline on exit of the CFO. ex-CFO didn’t exit the company, he joins as Director. When Fred Anderson resigned as CFO and joined Apple Board, AAPL didn’t decline also.

Since no news, short UBNT puts (Dec $55). Also praying for PANW would decline over the next few weeks.

Also, short NTNX puts (Dec $22.50.)

I still haven’t used the short a put strategy. I opted to buy and sell calls against the position. Volatility is so low right now. It’s not generating much yield.

Although technically short put is equivalent to selling covered call, short put is meant to buy stocks at lower price. For example, shorted LITE when it is about to hit the 200 SMA because I’m not sure whether it would touch the 200 SMA or bounce before that. If I’m confident it would touch 200 SMA, I would place a GTC buy like IRBT at the 100 SMA. Same considerations for 50 SMA, 100 SMA and 200 SMA whichever is applicable.

According to investopedia, definition of:

Investing is the act of committing money or capital to an endeavor (a business, project, real estate, etc.) with the expectation of obtaining an additional income or profit.

An investment is an asset or item that is purchased with the hope that it will generate income or will appreciate in the future. In an economic sense, an investment is the purchase of goods that are not consumed today but are used in the future to create wealth. In finance, an investment is a monetary asset purchased with the idea that the asset will provide income in the future or will be sold at a higher price for a profit.

In financial markets, trading refers to the buying and selling of securities, such as the purchase of stock on the floor of the New York Stock Exchange (NYSE).

Day trading – the act of buying and selling a financial instrument within the same day, or even multiple times over the course of a day, taking advantage of small price moves – can be a lucrative game.

3 brilliant ways CRUS is investing in the future

- Digital headsets are set to skyrocket

- Taking the drama out of microphones

- Voice ID is a huge market in the making

Cirrus Logic (NASDAQ:CRUS) is known primarily for the audio chips it supplies to smartphone manufacturers. This has long been the company’s biggest source of revenue, with Apple alone contributing 76% of sales in the most recent quarter.

High dependency on AAPL.

CRUS is not so attractive as diminishing sales & income.

It is a huge risk to rely on a single customer for majority of the revenues. Just look at Imagination Technologies and GTAT for examples of how Apple deals with these suppliers.

4 year chart of VEEV

4 year chart of CRUS

Return is comparable. Don’t see visible discount for overly dependent on one client. The bet is it is able to reduce dependency ![]() Remember investing is forward looking !

Remember investing is forward looking !

GTAT is bad management. Management lies that company is doing well and make believe by recruiting many and overpaying engineers meanwhile insiders keep selling shares. I knew this company as I lost a bundle believing management. The bet then is Apple will buy although is very clear from the onset that it might not depending on yield and quality… all speculators knew that. Bought this counter under the micro-cap portfolio… recover losses from profits betting on CRUS (yes when it was dirt cheap, sold all and now re-looking at it) and LQMT (yay!).

Apple says that it gave Imagination Technologies, several years ‘ notice. Didn’t buy this ticker because is not attractive, price too high and hyped is too strong.

Btw, are you guys parroting what pundits say or thought of it originally? That is thought is so and then realize pundits share the same view or read what others say and agree with it.

Having said above, have been wondering why Apple didn’t integrate the sound & voice chips into their own chipsets ![]() Guess is a matter of when. Seriously, the bet is on whether they can move forward before the eventuality of Apple designing its own sound/voice chips.

Guess is a matter of when. Seriously, the bet is on whether they can move forward before the eventuality of Apple designing its own sound/voice chips.

That’s my concern. At some point, the functionality of CRUS will be integrated into the processor. You can see that trend in semiconductors. It’d also save space. Everyone wants to save space to have a larger battery. I think the risk is even higher, since Apple designs its own processors for the iPhone and iPad.

Focus is on leading edge technologies such as big data, cloud computing and AI.

Why so limiting? There is nothing cutting edge about an audio chip.

I like companies with network effects and Redfin could be one.

Big data and cloud are not cutting edge. They are geeks gone wild. However I do believe in AI.

So we should invest in it now?

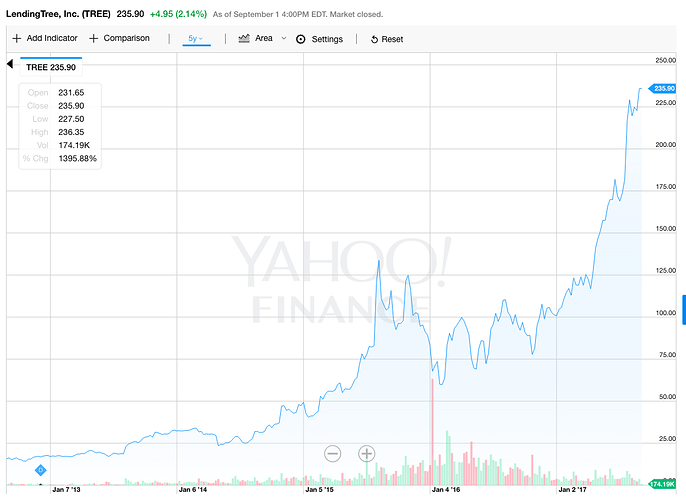

Up to you. ![]() My point is that there is nothing cutting edge about Lending Tree. What it has is a two-sided marketplace that benefits from network effect.

My point is that there is nothing cutting edge about Lending Tree. What it has is a two-sided marketplace that benefits from network effect.

Ok, I’ll consider investing if you are also putting money into it