Nest is a POS.

Ring, which Amazon just bought for $1 billion, was once rejected by ‘Shark Tank’

Sometimes a shark doesn’t know a good thing when he sees it.

Nest is a POS.

I am betting on the following:

Now if I didn’t have so much crypto and actually had cash to allocate, I would add the following:

Match is a very interesting pick. It has very good return on asset and on equity. Need to look into it.

PG&E has interests rate risks. Many buy for dividend income. When risk free rate keeps going higher and higher there is less reason to buy PG&E.

Costco and Walmart are direct competitors of amazon. I don’t dare stand on the other side of bezos.  people were taking about Home Depot and that’s one of the few retail companies not in amazon’s warpath.

people were taking about Home Depot and that’s one of the few retail companies not in amazon’s warpath.

How’s the growth potential for stitch fix? Isn’t it hard to scale?

The stitchfix selections are meant to become data-driven and based on machine learning over time, and less reliant on individual stylists. I believe they are already using data to recommend optimal sets of items to customers, especially for the first few boxes of things they send. And they’re expanding beyond women’s clothes to menswear and babywear. I can imagine them going beyond just clothing. More of a data-optimized, “push” vs pull system of shopping where they guess based on some preferences you give and their data, what you would like to decorate your home, or kitchen items, all sorts of things…and they just automatically send you stuff each month and you send things back that you don’t like.

EDIT: I read their 10k and they do sound very married to the idea of data science PLUS stylists.

That is a good point about Costco and Wal-Mart. Amazon does feel invincible right now and is way, way ahead of Wal-Mart ecommerce still. The founder of jet is running that now so Wal-Mart definitely has more of a shot than they did before. But maybe still not enough?

It takes much much more than just listing products online. Amazon is way ahead in its FBA program. Third party sellers send their inventory to amazon fulfillment network and buyers get fast delivery and painless returns. Walmart still relies on 3rd party sellers to handle fulfillment.

Walmart is using kitchen knife against amazon’s machine gun. No match at all.

Unless they are storm troopers. Then they cannot hit.

This time, after selling everything, I changed the picks based of lower P/E and dividend payers.

I am staying away from AMZN, TSLA, NFLX as they are high P/E. When economy crashes, these will be hit high, i.e. the fall of AMZN will be higher than fall of AAPL or BA.

Reg PCG, I stayed away when last qtr they stopped paying dividend in the wake likely law suit. They wanted to reserve cash for possible settlement. The results were good, but likely end up paying settlement cash.

IMO, WMT (bought today), COST and MTCH are really good.

COST is very solid, I made good money on it after WholeFoods acqusition drop. I <3 Costco as a consumer, too. Very pro-consumer, i don’t yet buy amazon threat to them.

AMZN and SPY fell by almost identical amounts during the Great Recession. By the end of 2010, SPY was still down 16% from the peak. AMZN was up 161%. AMZN maintained its annual revenue growth through the Great Recession. I’m not sure how many companies can claim that kind of revenue growth during that time period.

You are perfectly right. AMZN fell less than other companies. OMG, I need to buy AMZN soon !

AMZN (better than) > AAPL > GOOGL > SP500 > BA. Time frame: Oct 5th, 2007 and Mar 27, 2009

Sharks are such dumbasses.

Sometimes a shark doesn’t know a good thing when he sees it.

VC funding (aside from sharktank) in general is a high false-positive, false-negative event.

Many companies that we know today had funding crunch back in the day.

Today, small cap trounces F10.

Look at ANET !

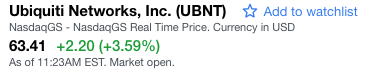

It appears I was too early on TWLO and VEEV. I’m not too worried since SHOP and NTNX are doing great. UBNT has almost recovered to my average purchase price.

UBNT has almost recovered to my average purchase price.

Sound similar to mine. $66.45 :), now $63.90

Seem like a rotation to small caps from mega caps.

Sold NTNX at $35 ![]()

Why? It’s earnings are tomorrow.

I sold some Mar $45 calls against my shares for an easy $0.20. The 0.5% yield for 2.5 weeks on 22.6% OOM is pretty good. It doesn’t seem like a lot at the time it adds up over a year. I thought about the $42.50 which would have been 1.2%, but I think hitting that is possible.

One of my goals is to generate 1%/mo from selling covered calls or secured puts.

Why? It’s earnings are tomorrow.

Both IRBT and UBNT tumbles 40% after earning worry me, so I sell ![]()