manch

May 1, 2018, 10:23pm

1855

SHOP customers are naive people who believe their 5-item online shops can compete with amazon. These people will burn their life savings on Facebook and Google ads, and quit after a year or two.

hanera:

marcus335:

On the call, they commented they’ve been hiring some top talent, and that talent is expensive. That’s why the stock comp is higher creating the delta between GAAP and non-GAAP earnings. The tech world is reported in non-GAAP, because stock comp is not a cash expense.

Why do they need so much top talents? New direction? New products? Too much stock comp will haunt the stock… eventually it will catch up with valuation. Increasingly I’m worry that these companies keep paying stratospheric dollars for talents, and are their clients real consumers like us or some other startups like themselves?

Are clients of SHOP mostly established companies (small to big) or mostly startups? If mostly startups, I’m totally worried… once angels become nasty, they are not able to pay SHOP… That is, SHOP would crash along with those companies.

It works out to 7.6% of revenue. That’s pretty small compared to most tech companies. They are a tech company and software engineers are expensive. They’ll keep developing new features and products. Most of the revenue is from larger businesses.

The small customers are a small percent of revenue.

1 Like

tomato

May 2, 2018, 4:42pm

1857

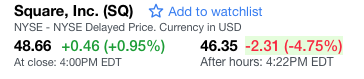

what’ll happen to SQ today…

Options market is heavily tilted towards calls, so people think it’ll go up.

tomato

May 2, 2018, 5:15pm

1859

SQ is a pretty volatile stock…

1 Like

tomato

May 2, 2018, 6:30pm

1860

Now it is up 3%> option buyers already make money.

1 Like

tomato

May 2, 2018, 7:20pm

1861

I had some Jun calls, felt too close for a potential downfall. Sold some, bought some january ones. if it drops, will buy more.

tomato

May 2, 2018, 8:23pm

1862

SQ dropped 4% AH. Not as bad as i was thinking.

manch

May 2, 2018, 8:44pm

1864

Square’s expenses were too high they say.

Dorsey-led Square’s quarterly loss widens as expenses soar

https://finance.yahoo.com/news/dorsey-led-squares-quarterly-loss-203457846.html

1 Like

tomato

May 2, 2018, 8:44pm

1865

Amazon.com Inc. is offering to pass along the discounts it gets on credit-card fees to other retailers if they use its online payments service, according to people with knowledge of the matter, in a new threat to PayPal Holdings Inc. and card-issuing...

There’s also this, doesn’t affect SQ so much since amazon is online and sq is offline.

manch

May 2, 2018, 8:45pm

1866

That came out during the day. Square still closed positive. PayPal dropped like a rock though.

hanera

May 2, 2018, 9:06pm

1867

Is this legal? It amount to dumping below cost😏 Can’t sell a physical product below cost but can sell a service below cost?

Their GM is pretty good, so they aren’t selling the product at a loss. They aren’t covering their corporate expenses. That’s super common for young companies as they scale. The troubling part is expenses are growing faster than revenue. That’s a pretty bad sign.

manch

May 2, 2018, 10:45pm

1869

Square rev grew 51% and operating expenses grew 47% YoY. So rev is still growing faster.

I see 45% rev growth.

" The company saw total net revenue figures of $669, surpassing our consensus estimate of $623.75 million and growing 45% year-over-year. Adjusted revenues came in at $307 million."

GPV growth was only 31%.

manch

May 2, 2018, 11:04pm

1871

“Q1 adjusted EBITDA of $36M vs. $27N one year ago. Adjusted revenue up 51% to $307M. Bitcoin revenue of $34M.”

Not sure what’s adjusted revenue.

1 Like

tomato

May 2, 2018, 11:15pm

1872

bitcoin revenue 34M - is that “total volume” or their commissions" If it’s the latter, it looks huge.

GPV so total value of transactions. Their commission is a small percent of that.

1 Like