5% is within daily volatility of sq. Glad i have sold junes though.

Fintech is out. Cloud is in.

• Arista Networks (NYSE:ANET) has tumbled in late trade, down 8.6%, after posting Q1 earnings that beat expectations but contained a lower gross margin view.

• Revenues were up 41% Y/Y and up 1% from Q4, to $472.5M.

• Meanwhile, non-GAAP net income jumped 87% to $134.1M from a year-ago $71.8M. Gross margin on a non-GAAP basis of 64.4% was up slightly from last year’s 64.2%, but dipped from Q4’s 65.9%.

• Revenue breakout: Product, $407.6M (up 39.9%); Service, $64.87M (up 47.1%).

• For Q2, it’s guiding to revenues of $500M-$514M (vs. consensus for $504.2M), non-GAAP gross margin of 62-64% (light of consensus for 64.2%), and non-GAAP operating margin of 32-34%.

Wow, their margins and growth rare are nice.

anet bombed, anyone buying?

I bought enough ANET. Just sitting tight now.

Is about whether results justify the high valuation. WS is seriously questioning that. Quoting results is better than last quarter or y/o/y or good guidance is not the issue. Is valuation justify those excellent results and guidance?

Right. Valuation may be getting ahead of itself. Anyway it still looks like a very good company to me. I plan to sit tight for now.

As the results come out, WS would tell us which one they think their valuation is too high or which one they think is ok.

I want to recommend dxcm dexcom. its a company that just got approval for a unit that eliminates having to make diabetics prick their finger to take blood monitoring tests. It is in limited testing right ow but soon to go nationwide. I bought some on monday.

Cloud Kings continue to do well.

So do 10x,

10x is flying

cloud kings continue rule

Risk appetite returning again.

Unfortunately I was frightened into closing the entire 10x by Jil… Can I claim compensation?

Closing part is true, the other part is not. Need to do some personal stuff… can’t monitor these highly volatile stocks especially when some of them is risky calls. Taking a break for a few months… at least 2 months. Hopefully, they didn’t go too high when I return ![]()

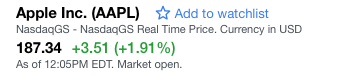

Anyhoo, the one that really matters,

Even the annual dividends is more than what I make from 10x so far.

Again, buy and hold always win. Should have held on…

Yes, it drops 5% and now recovered like 8-10%… held would have be better… just worry some of them may turn out to be IRBT… cloud stocks feel like dotcom era  Can these high flying stocks survive possible entry by FAANG? A good example of dotcom survivor is AKAM (used to own it around $200s), still trading below the initial euphoria. Only AMZN manage to pull away.

Can these high flying stocks survive possible entry by FAANG? A good example of dotcom survivor is AKAM (used to own it around $200s), still trading below the initial euphoria. Only AMZN manage to pull away.

This is perfectly the winner in the long run.

As I assured you, for the first time, in my life, trying to hold forever (even if I see recession). Let me revisit after 5 years.

Strictly keeping the ticker details with me !

Not fair. Please PM me the one. Frankly, I believe one of my 8 choices is the one… still not sure which one, need time. IRBT doesn’t look possible. So seven to choose from. My feeling MU is not possible, though it is not likely to go insolvent, just volatile. So left 6 ![]() to choose one.

to choose one.

Recession is the opportunity to pick it up cheap, not run because of possible 20% decline. Selling is foolish.

Long term investors must resist behaving like a trader.

This is definitely bullish. The companies in this software space will be easy targets for SQ.