To keep everybody honest, here’s first ever forum poll:

The current Bay Area RE cycle will peak in…

- 2016

- 2017

- 2018 or later

- What peak? It will go on forever

0 voters

And, the correction will last:

- 1 year

- 2 years

- 3+ years

0 voters

To keep everybody honest, here’s first ever forum poll:

The current Bay Area RE cycle will peak in…

0 voters

And, the correction will last:

0 voters

The peaks will occur at different times and any downturns will last for different periods depending on location

I may be in the market again come in 2017. Exciting…

I am still buying…But my partners want sell our Sac apartments in 2017…rents are still going up there as in Stockton and South Lake Tahoe

Definition of peak is not discussed. High end peak but low end still going up is considered peak right?

@Elt1is right about it depends where. The exurbs were the first to fall, fell furthest, and took longest to rebound last time. We should pick a specific city.

Let’s just use Case Shiller San Francisco index as the benchmark. I know it subsides into 3 price tiers, but for simplicity just stick with the overall index.

That’s interesting, because that was my perception as well. But this time it seems like the high-price places are falling first.

it’ll be a different kind of peak then.

It’ll be great if people who have voted give reasons why they think this will happen & reaonsing for when they think it will.

Is anyone watching sanjose market? I see a quite a few price drops for properties under 800k as well, any ideas? Are you seeing same?

Where are you seeing reductions under $800k? I think the under $1M market is pretty hot. It’s around $1.4-$1.6M where it’s stalled a bit. Then $3M+ seems to be super slow.

I think there are a few causes:

I have a hypothesis. What if the high end will correct for 10 or 15% sometime in the next 2 years, but the low-to-mid end simply never stops?

There is a huge pent-up demand who want to buy. Look at any employment stat and it’s obvious people have well-paid jobs. Many have been priced out of the markets they most desire. I’d love to live in PA too but alas I can’t afford to.

So unless these people never buy, at some point they will most likely have to settle for something less desirable and more affordable. What if the lower end will always have able and willing buyers, thus propping up the price, while the high end takes a breather?

Just a hypothesis. I don’t have any data to back anything up.

Obviously “high end” depends on locales. I think it’s safe to say anything above 1.5M is considered rather high end, from SF down to SJ, in terms of how much salary you need to make to afford the house.

Some examples here, I am not sure if they are priced high to begin with, but more listings are priced high these days ??

I am active in the Sunnyvale/ Cupertino markets. I voted for the peak to be in 2016.

My observation is for SFR and townhomes in these areas.

Of course, everyone likes to focus on the aspects that they want to see, but my observation is that the market has already peaked. Possibly in December 2015 or January 2016.

Some quotes:

“Last year, no matter what I did, I would get 5-10 offers. This year, we rarely get more than 3.”

“This product (SFR in a certain price range) has dropped about 5 to 8% since December”

We have a property in escrow (for sale) and we sell about 10% less than comps indicated in December. We also sell for 5% less than an offer that we turned down in February.

With one listing, we played with a low price. It was ridiculously low. Buyers were not willing to overbid much.

That is not saying that it never happens any more. Another quote:

“We are running out of stupid realtors”

And, from the same agent “We listed this house for $1.7m and got no calls for 30 days, then an agent brings us an offer at $1.8m” (that’s the species we are running out of)

Disclaimer:

I am the last one to indicate a correction. I like optimistic buyers, as I have more than 10 townhomes in the pipeline, that I most likely will want to sell in the near future.

Those 4 listings are all really close to major roads or a highway. I’ve noticed people are less willing to buy homes near heavy traffic. Those will slow down first, so maybe that’s a sign it’s starting.

Buyers are definitely much more picky now than last year.

“We are backing out of this purchase because my spouse’s parents don’t like that the house is not aligned parallel to the street” (was in contract over asking price, price has been dropped now)

“We are backing out because the NHD shows that the house is within 0.5 miles of a hazard” (a laundry salon or a car wash)

“We are backing out because we noticed those military planes flying in the area” (That applies to most of Sunnyvale)

Buyers used to be happy to get their offer accepted. That has definitely changed – approx since December 2015.

So, what changed? Price is getting so high it’s at the edge of people’s ability to make payments?

20 votes so far. Most people (40%) think 2016 is the peak and the correction will last 2 years…

![]()

The lower priced market in SF that I pay most attention to, that’s anything less than 1.3M (the current median), is still pretty it seems.

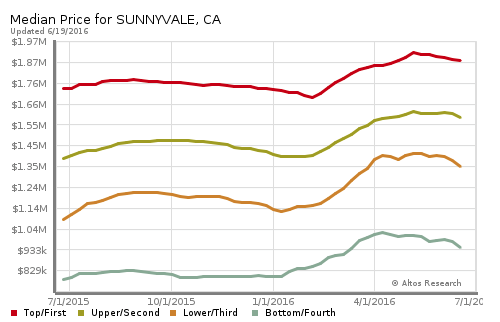

Here is a slightly outdated chart on Sunnyvale

The median and average prices are still up year-over-year, but decelerating…

More stats from here:

http://sanjoserealestatelosgatoshomes.com/sunnyvale-real-estate-market-trends-statistics/

CoreLogic Data for December 2015

CoreLogic Data for April 2016

Santa Clara Median Sale Price

Dec 2015 - $788250

April 2016- $860500

Gain of 9+%

ptiemann,

I value most of your updates in redfin as you are very close to this business.

I used to follow FED and many others here do not like FED or following FED.

Our Economy started tanking by around Aug 2015 onwards, but stocks reflected those in Jan-Mar 2016 immediately after 0.25% increase. This is not the last straw in the hay.

Oil impacts and China, second biggest economy, impact are wide. Sectorwise, oil failed miserably, followed by Biotech, then HighTech. Bay Area is concentrated with Biotech and HighTech industries. Whenever they get hit, it affects real estate after 6-9 months. This is main reason we are seeing them now.

My biggest surprise is from Jun FED rate increase. They are supposed to increase 0.25%, but withdrew knowing that they can not increase this year further as this election year. THIS MEANS FED KNOWS ECONOMY IS NOT STRONG and any increase in rate will likely harm than providing stability to the current status. They have seen the reaction after 0.25% increase

With this, there are few reactions can happen I guess.

If they increase rate any time in next 6 months, economy and stocks will be down for sure. (my guesstimate fed will not increase rates near soon one year, if increased economy affected is 70% chance)

If the economy is so week, there is a potential chance economy and stocks will be down without even 0.25% rate increase (50:50 chance)

3.If prolonged (more than 1) no FED rate increase, economy may likely grow ( my guess 33%). If this is not happening, 2015 is the peak as we always know the truth hindsight.

You see money does not flow into stocks or ETFs.

You see the growth of broad market index. I can provide many examples like this. So far, there is no indication of any positive sign except FED pulling off from rate increase.