I like your answer. The problem I see is that recent stimulated market performance of tech companies has made folks think of 300 to 500K/year and that has translated into a risky investment. There is a reaosn why google and amazon hardly pay more then 200k cash.

Of course it can. Just think 20 years down the road. they will be worth $10M a piece.

No, I don’t I was just giving a different perspective, I can name several more companies like pure, app dynamics, nimble(before it bites the dust, touched 3B valuation and produced 100’s of millionaire), even unknown companies like which did not make success were acqui-hired and their employees became multi-millionaire

Money making is never easy. I think investment decision in real estate is tougher then this (until you spend same time in understanding market as you have spent in understanding your career/domain/industry). A lot of folks found it easier to predict the fate of the startup, for example the list of companies which I send - if you join any one of them chances are huge you will make lot more then google or facebook.

I think it’s partly a matter of luck whether a startup’s specific trajectory actually leads to employees making real $ (impossible to tell in advance bc it’s about how much they raised, preferences etc as well as success) and partly a matter of skill (some things you CAN see or evaluate in advance, but many employees do not have the background to be able to.)

For example, this article on square shows how employees might not do well: https://fancymollusk.com/2015/11/23/how-much-did-employees-make-on-that-square-ipo/

Another thing I’ve seen - some large acquiring companies give employees great retention packages to encourage them to stay. It depends on the situation. Some do not, and only founders/leadership get good packages.

Sometimes a company is acquired by another company and it’s not a great acquisition price/payout - so a bunch of people leave. Lo and behold the acquiring company starts to do better! The stock triples, now that is a real amount of stock and would have been worth staying for!

Your breakout list is good but I see places like Medium on there that have had layoffs. A layoff means the person vested only a fraction of their stock at best, and is not going to benefit from an acquihire situation which is designed to reward who is still there, not employees who left.

if you have 20 years of a horizon, then why not spend in outskirts, why Sunnyvale which has huge entry cost and that too due to reasons which are attractive in short-term - close to few tech giants with risk

- the fate of those tech giants not guaranteed.

- other areas will emerge with better facility and infrastructure - I hear stories about san jose

Because real estate is not purely investment but also has emotional component. A lot of people just like living there no matter the cost.

I do not intend to discuss deep on startup/large companies here - maybe some other place.

Risk is everywhere, in general, it’s getting tough for google/facebook/Amazon(AMZN was never preffered employer) to hire top talent (they in fact are lowering bar). Places like Sunnyvale getting lots of hype which are related to these companies and I am not sure it’s best option.

PropertyRadar was foreclosure radar. Other than tracking foreclosure leads, what else can it do?Other than online information, does it provide any physical assistance? It mentions door knocking, but I can’t believe they’ll send poeple to do door knocking for you at that price.

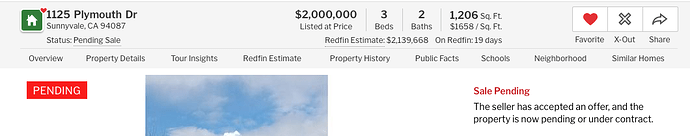

No takers for 1125 after 12 days. Enough is enough?

1074 Plymouth Dr sold for $2.213 mil on Mar 29, 2018.

There is also a Plymouth Ave in San Francisco.

Can’t win!!! Even a teardown gets 300k overbid…

https://www.redfin.com/CA/Cupertino/10385-Moretti-Dr-95014/home/784813

It is not only Cupertino, over bids are everywhere. I lost a bid 350k over list price, not Cupertino…hmmm

Guesses? Seem to be on a somewhat busy road.

https://www.redfin.com/CA/Sunnyvale/830-Henderson-Ave-94086/home/667326

Looks like the home did not get offers when they listed 1.788M (Apr 12, 2018). Now, they low priced to bring competition. My guess is between 1.675M to 1.725M as of now.

There was a home in PA, where it was really nice (one of the few nicer homes somewhat over our budget back then), but it was next to a busy road:

https://www.redfin.com/CA/Palo-Alto/735-Coastland-Dr-94303/home/1411617

Listed for 2,788,000 first, didn’t sell, dropped to as much as 2,399,000, but finally sold for 2.9 higher than its original price. Stayed on market for quite a while for PA standards.

Here’s the history:

https://www.zillow.com/homedetails/735-Coastland-Dr-Palo-Alto-CA-94303/19499851_zpid/

like every weekend? we are not bidding actively for the past couple months, though.