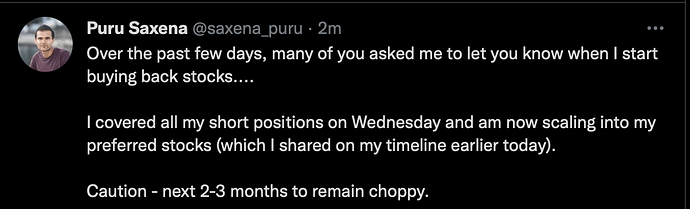

He uses the words, “bear market” ![]()

Now you are talking. Already started nibbling. Not NET ofc, too richly valued.

Identifying above is not that hard. What I need is have the resolve to sell 100% and short when the market has peaked (wave I or wave 1).

Is going to be similar to Feb/Mar 2020. Buy the right stocks, get 2x to 10x in 2022… which are the right ones? Not sure what are those, merely added to RBLX U and MTTR ![]() my 1-2 decade long investment.

my 1-2 decade long investment.

Puru decided to post his trading action daily… good time for us to learn trading ![]() from an experienced ex-fund manager.

from an experienced ex-fund manager.

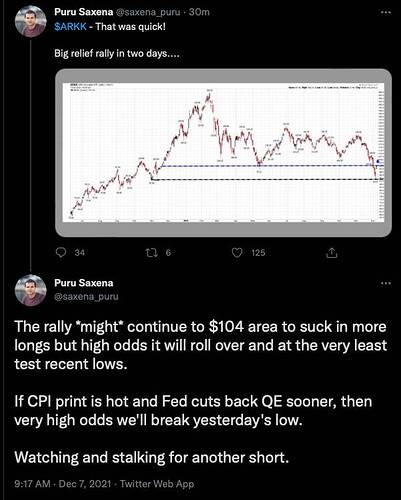

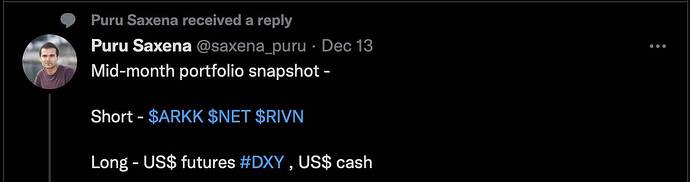

Re-short at $104? Somehow I feel is not right to short. Should have some kind of Santa Claus rally according to Face Ripper but he is referring to S&P. ARKK is index for hyper growth.

keep in mind though that other than high p/e and CPI, the economy is doing generally OK. So if a price drop comes, it is only to reprice the market to current realities (P/E and CPI)

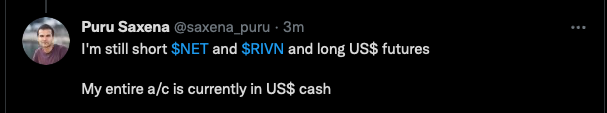

Puru added to ARKK short.

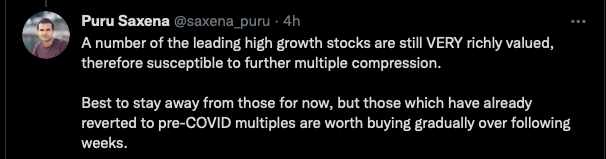

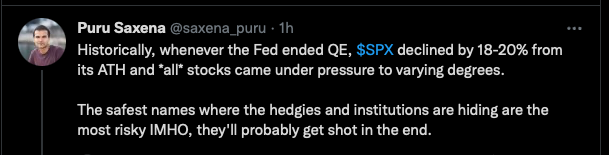

Curse FAANG+ without mentioning it. He is a non-believer in megacap and is taken aback with the strength. Most risky from what perspective? I believe if there is an eventual price drop, would be less than the decline by growth stocks. In fact, some of the growth stocks might not be around.

Many Puru copycats but Puru didn’t long value, only short ARKK, short RIVN… the obvious ones. He didn’t dare to short TSLA, short crypto or short AAPL.

I am short ARKK ![]() 2nd time. Short on Friday, close on Monday. Short again yesterday. Wish Puru and me luck

2nd time. Short on Friday, close on Monday. Short again yesterday. Wish Puru and me luck ![]()

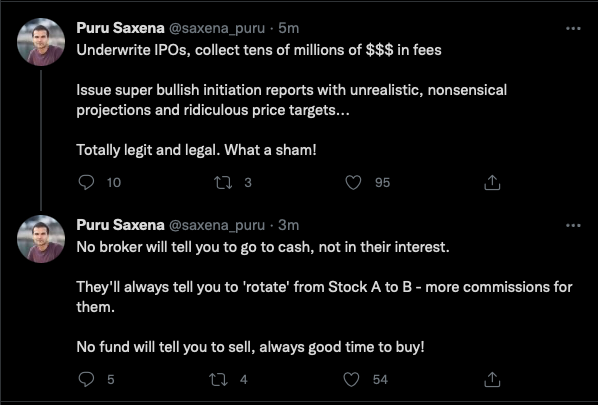

What he said is true. But saying this so publicly would be burning the bridge. In a recent interview, he said that he won’t start a hedge fund managing retail investors’ money but would be willing to consider joining a hedge fund managing institutional monies.

Anyhoo, Puru omitted that they cause the financial crisis in 2007 and go scotch-free. Best, one of them became the Treasury Secretary. This is America.

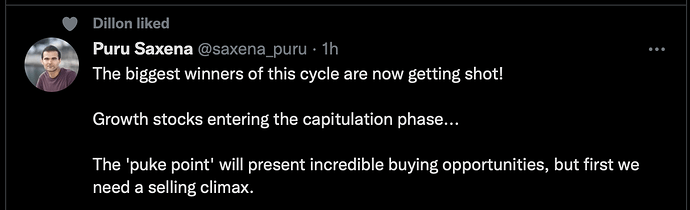

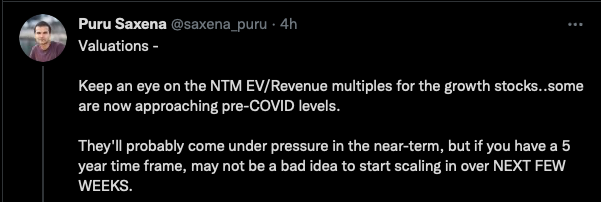

Huge reset going on. I hope it goes all the way down to pre-pandemic levels. That would be an ideal buying point but everything is murky right now. To aggressively BTFD or not…that is the questions.

.

Many people are saying it will.

If they fully raise the rates or even hints at q1-q2 next year, we will lose 10-20% right away imo. Even with initial rate cut, I don’t think it will go down to pre-pandemic levels. I still think a big washout in the big tech needs to happen which could take a bit of time.

If it is going to pre-pandemic levels, is VERY LOW. Some already did. I think for the recent “strong” stocks that are declining now e.g. @manch  sure win stock, NET, 200-day SMA is good enough for me to start “feeler” position. Luckily didn’t buy at $220 as suggested by @manch.

sure win stock, NET, 200-day SMA is good enough for me to start “feeler” position. Luckily didn’t buy at $220 as suggested by @manch.

This is very true. Roll the dice.

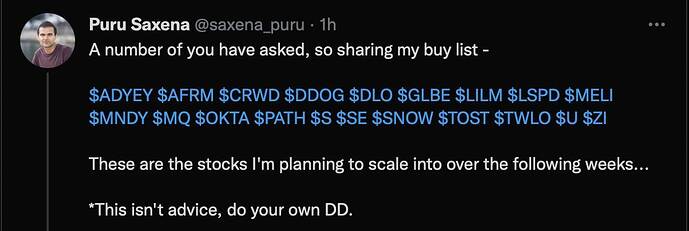

Puru is kind enough to share his buy list ![]() In the list, I am interested in:

In the list, I am interested in:

CRWD DDOG MNDY MQ OKTA PATH SE SNOW TOST TWLO U

Time to start scaling in ![]()

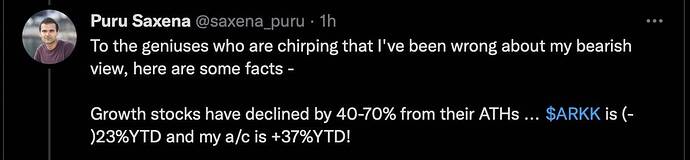

37% ytd is good but so much effort, why not just own AAPL ![]() 35%, effortless

35%, effortless

Exactly what I have done for AAPL for 25 years. I know a few people also did that and doing very well. Buy n hold investors vs traders. Nobody including Puru is an investor anymore, avg holding period 5.5 months.

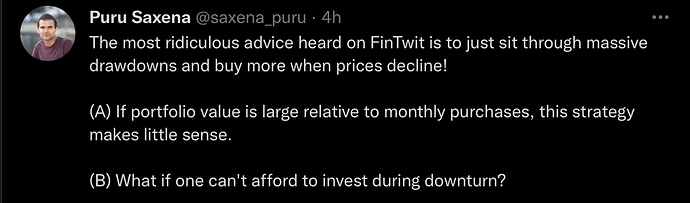

he has said before he isn’t drawing an income outside of his investments, so he doesn’t have any additional money to put in when things drop. So has to sell to raise cash

That is my question. If you are 100% invested and the value drops to 70%, where will you get money to buy at dip?

The only way I can see someone buying at dip is from the money that was raised by selling when stocks were still high in price. Or borrow from someone, or put more money from external sources.

What is the scoop?

.

Buy n hold investors don’t use margin nor hedge. Don’t BTFD. Whenever there are excess monies, buy. Excess monies can be from dividends, rents, etc … whatever left after living expenses.

Puru’s stocks are non-dividend paying speculative stocks ![]() , many are recent IPOs/ SPACs. He has to trade. His strategy is consistent with his stock choices. He is a non-believer in “matured” stocks like AAPL MSFT NVDA etc that pay dividends and do share buyback. My point is his opinion of “right” approach is due to his choice of stocks. Has he chosen other “safer” stocks, the approach he thinks is ridiculous is the better approach. That is, he is looking from his own worldview and thinking other people’ worldview is wrong… even he falls into this trap… I was just using his comment to illustrate even highly intelligent and wise people fall into this type of trap of not accepting other people’s worldview is as legitimate as their.

, many are recent IPOs/ SPACs. He has to trade. His strategy is consistent with his stock choices. He is a non-believer in “matured” stocks like AAPL MSFT NVDA etc that pay dividends and do share buyback. My point is his opinion of “right” approach is due to his choice of stocks. Has he chosen other “safer” stocks, the approach he thinks is ridiculous is the better approach. That is, he is looking from his own worldview and thinking other people’ worldview is wrong… even he falls into this trap… I was just using his comment to illustrate even highly intelligent and wise people fall into this type of trap of not accepting other people’s worldview is as legitimate as their.