Buy n hold is just so much less tension than trying to hustle and trade. Maybe a professional like this Puru can come out ahead trading, but for most of us ordinary Joe’s, DCA buying snd holding makes the most sense. Just don’t sell in recession, even if one is not able to BTFD.

MELI is a very hot stock that many fin twitters and fin articles are promoting. I didn’t own any.

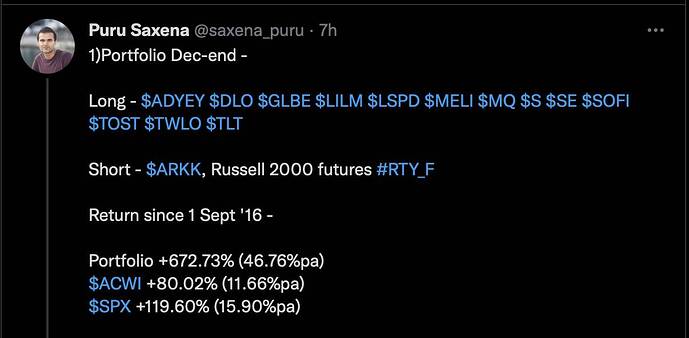

LSPD MELI MQ SE TOST are e-commerce/fintech.

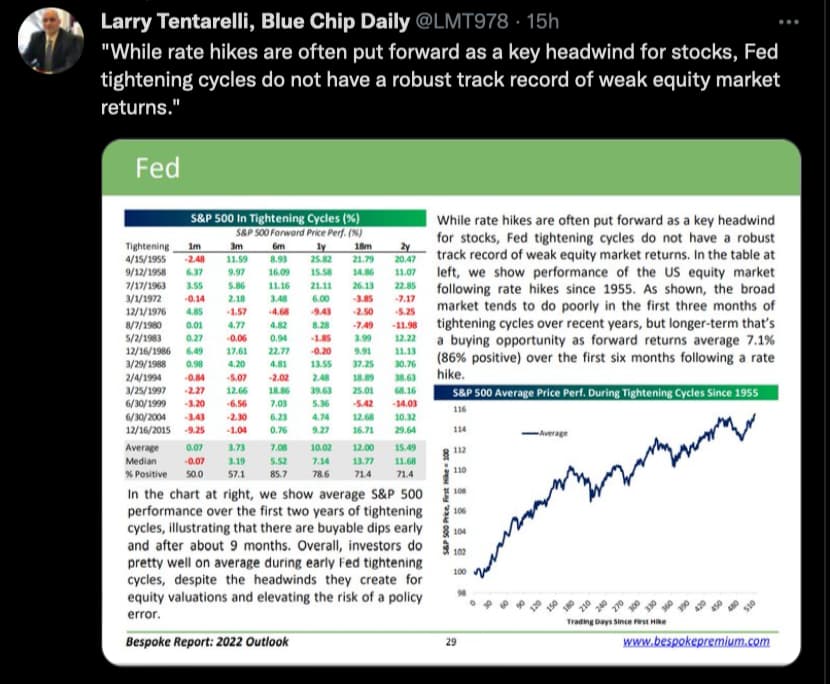

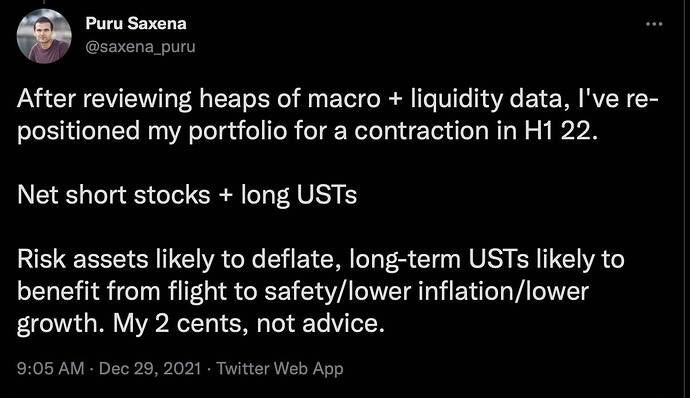

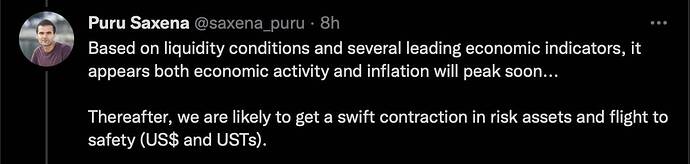

Counter to Puru’s belief that Fed tightening led to weak equity market returns. Anyhoo, Puru actions seem to be consistent to the counter. The ‘shock’ effect of tightening is only 1-3 months.

Game of trade believes the same. Fed tightening has only temporary effect. Fundamentals of economic environment and performance of companies matter

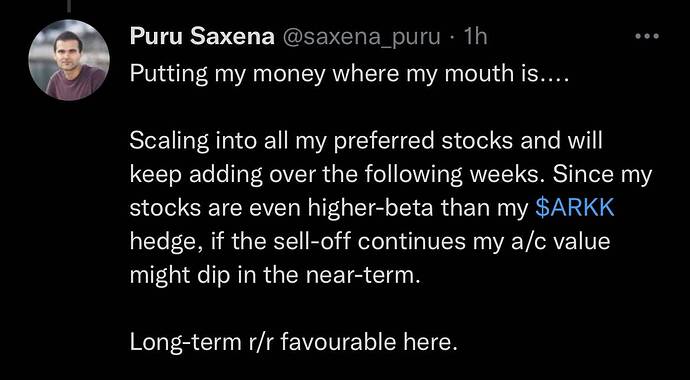

Can you summarize the first lines of second tweet in simple English

.

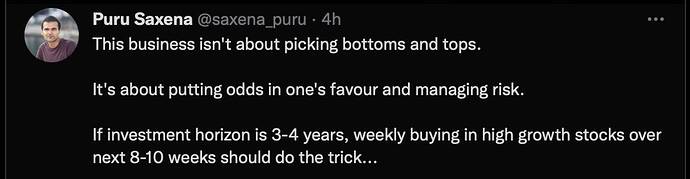

Rectified in original post. Essentially, start scaling into beaten down growth stocks over 8-10 weeks.

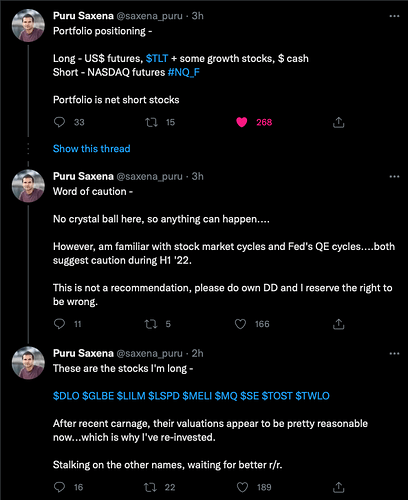

Whoa, re-positioning, so fast? Apparently he is net short stock but continue to scale into growth stocks.

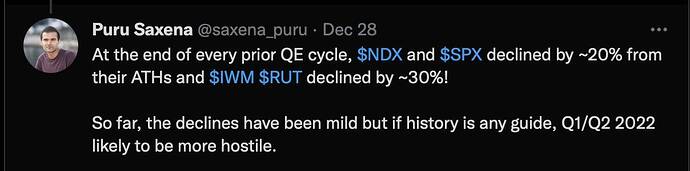

He always quote history of QE…

He thinks should long US$ and UST, and that SPX would tumble by 20% from ATH at the end of QE. History rhymes, not repeat. He is right about holding US$ and UST but it is unlikely that SPX would decline by 20%.

Many investors no longer believe in holding cash, some view crypto as alternative to cash but recently they begin to view crypto as growth stocks, the alternative to US$ and UST is … FANGMANT… is the reason why they are appreciating… since they represents more than 20% of the SPX, doubt SPX would drawdown by 20% from ATH at the end of QE.

Ytd 21.8%, return of pure hyper growth aka no earning, stock investors is not as good as S&P gain of 27-28%.

Why could he be long on TLT and growth stocks at the same time? Could it (TLT) be a typo?

No typo. Is a hedged position. He is sacrificing some return to avoid disastrous drawdown. Cathie ARKK declines by more than 20% because of no hedging. Both Puru and Cathie are investing in highly speculative hyper growth stocks. In my trading portfolio, I follow them into such stocks, and suffer similar draw downs as Cathie though I hedged a little so slightly less drawn down.

Lesson learned is knowing when to switch to cash or hedge is critical for investing in hyper growth stocks.

Ytd return

Puru hedged pf > +20%

Cathie unhedged pf < -20%

Puru gave details in his tweets, recommended reading.

Since Sep 1, 2016…

If you happen to be all-in buy n hold any of these five (TQQQ NVDA SOXL TSLA SHOP), your return would trump Puru’s hyper growth stock approach.

Any of these three (AAPL MSFT NFLX), less but near to ![]()

Puru is in denial that return of buy n hold generals trumps return of an actively managed growth stock pf in the long run.

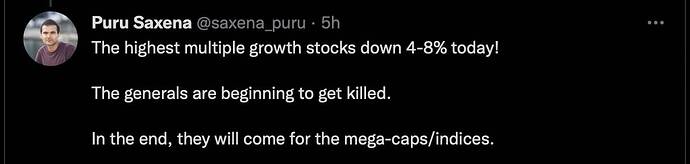

with techs going down, are Puru’s predictions coming to fruition?

Puru is net long? Optimistic ![]()

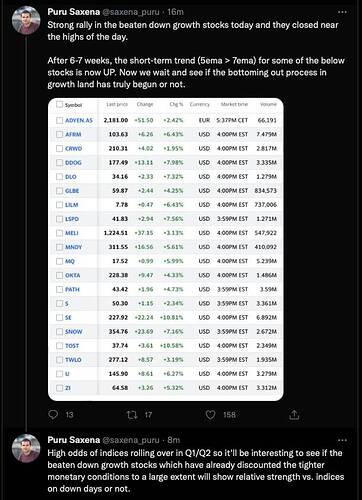

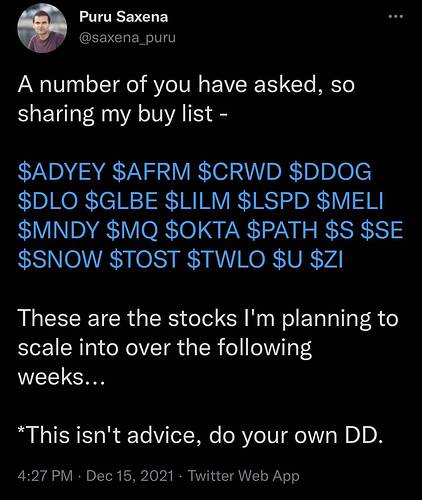

Of the above list, I have OKTA SE TWLO MQ TOST.

MQ and TOST are highly speculative i.e. might go bankrupt ![]()

OKTA SE TWLO should do well from a 5-10 years’ perspective i.e. not sure whether has bottomed or not, just carefully scale in (not DCA purchase, a lot of abuse of the term DCA).

Strict definition of DCA purchase is to purchase fixed dollar amount at fixed regular time interval for a long time (IMHO, for at least 5 years).

Puru is scaling into all his favorites instead of just a hand full. Bottom might be in ![]()

Previous handful…

Full buy list…

I don’t mean to brag, y’all, but…the great Puru himself “followed” me on Twitter today. I am not sure why, it is my professional account I used to follow energy people, so I dont’ tweet from it often, but yes, I was excited to see that.