I find stock picks by Puru is not much better than a fin twitter e.g. CFLT and AFRM, dives 10-20% after ER. His skill is in hedging and fast response to changing environment.

@hanera Just to simplify language:

Hedging = managing risk= avoiding possible loss = protecting your principal (that is what you already have)

I think you have hedged your position better if you are only down a few percentage and still making gains.

I am trying very hard to execute trading well, my knowledge of trading concepts and TA don’t seem to help much. My main problem is I have huge inertia to change direction. Such inertia seem to be an asset for buy n hold investing in AAPL and S&P index fund/ETF. Is a liability in trading.

Good traders like Puru, Jim Cramer and Mark Minervini are able to change direction very fast. They can don’t love the stock!

This is the exact reason I can’t do trading. I act so slow.

Besides ability to act fast, what is also a requirement for hedging to work is an understanding of upcoming risk (that is to be hedged). If you know market is going to crash, you can take a step. But if a risk cannot be seen ahead of time or cannot be estimated, I am not sure if it can even be hedged.

So, ability to act fast is fine. But, can we know a risk coming ahead of time?

.

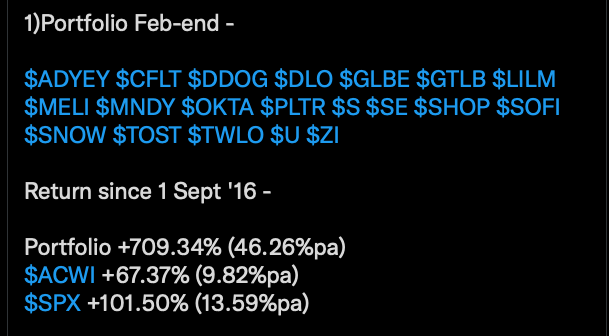

More lemons. ZI, SE and TOST.

Update Feb 16: more lemons AMPL LILM

7 out of 19

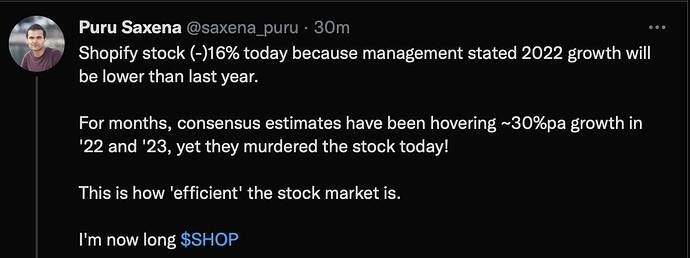

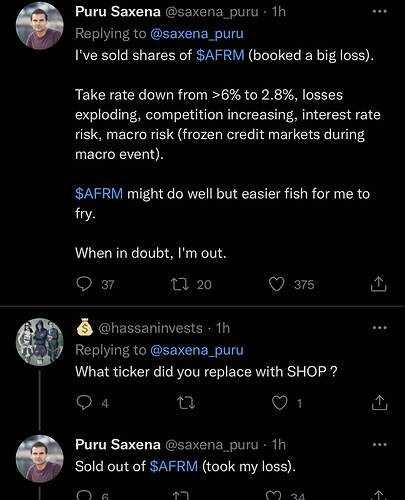

so he sold both AFRM and SHOP?

Sell AFRM

Buy SHOP

Didn’t read any. Wonder where he gets that impression.

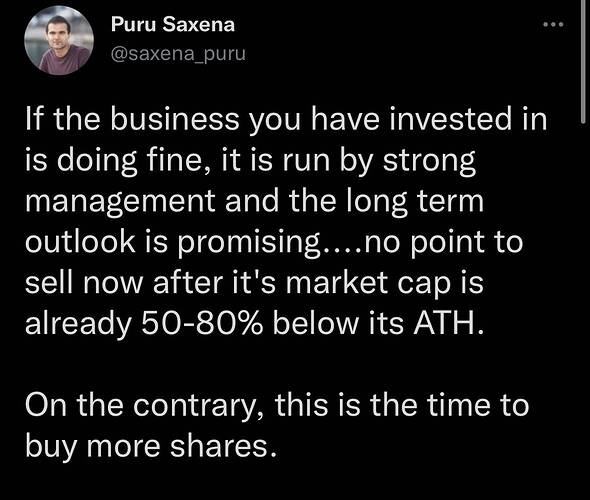

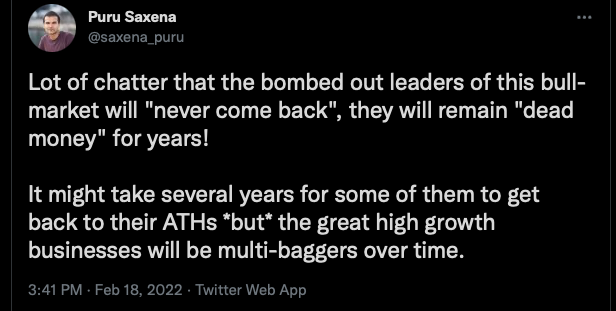

What if bought near ATH?

Not every stocks get back to ATH. Some disappear, some got acquired e.g. YHOO, some hovering at below ATH e.g. CSCO

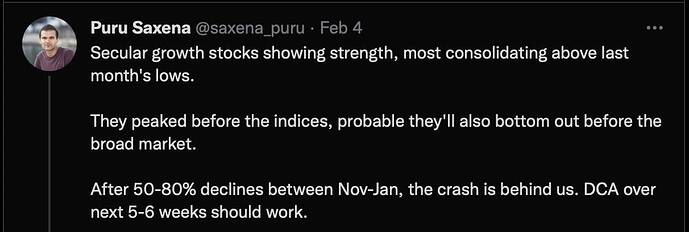

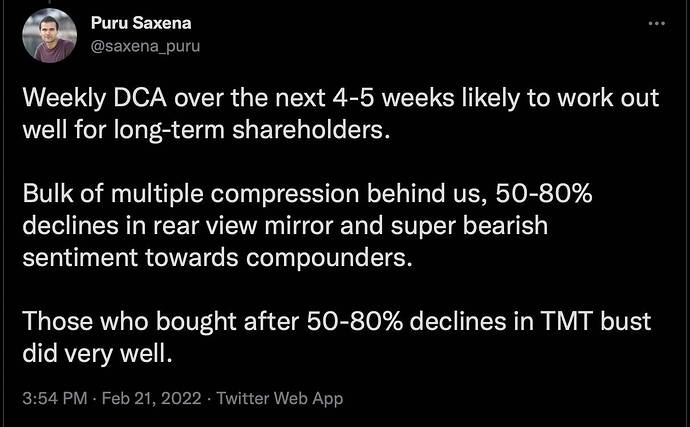

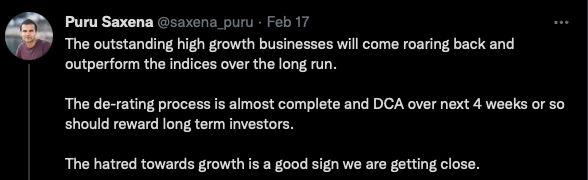

How come every day every week is DCA over 4 weeks? One month ago is DCA over 4 weeks, today is also DCA over 4 weeks?

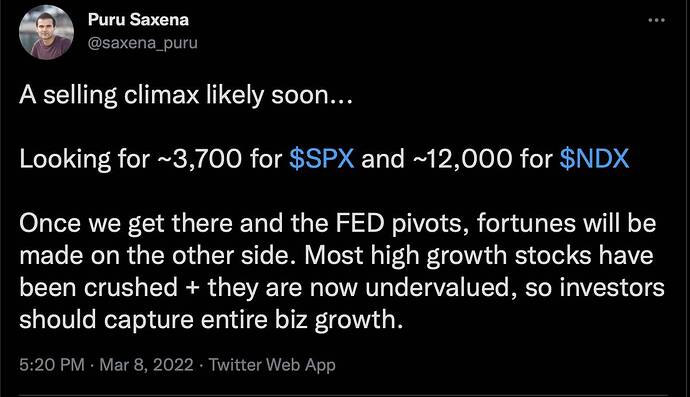

He said he thinks the bottom is in March sometime, doesnt know for sure obviously. In another interview from early Feb he said scale in over the next 8 weeks

His hedging and shorting work very well. 6.2% ytd even though his long stocks are decimated.

Didn’t follow his shorting strategy because can’t do in my trading account, and don’t want to long puts because too high premium. Losses in my trading accounts range from -10% to -25% ytd. Investment accounts, -7% to -8% ytd, AAPL and S&P.

Cathie sold out of PLTR while PURU added.

Changes from Jan end:

Added PLTR (too low to ignore) SHOP (too low to ignore)

Removed AFRM (I didn’t like this one trick pony), LSPD (never like this one)

Somehow he likes SOFI (potential digital bank) while I like UPST ![]() He makes me doubt my choice

He makes me doubt my choice ![]()

Didn’t follow him into recent hot stocks CFLT MNDY S… can’t spread my portfolio too thin… focus!

His return since 1 Sep 2016 is 46%, my CAGR for AAPL since 1997 is 31% ![]() and since Sep 2016 is 36%.

and since Sep 2016 is 36%.

Btw, recently Cathie has been pumping $ into TOST (surprise), SHOP (ofc) MNDY ![]()

This is a very bad comparison, Puru. Hardly anybody buy or even aware of ARKK in its early inception years. If I am not wrong, Cathie put in her own cash in early days to keep ARKK going. Most of the retail investors knew and bought ARK funds during late 2020 to early 2021. Telling them that ARK funds did well since inception is irrelevant to them. Yes, is the same word I have always told @manch, relevancy, context ![]()

Performance of ARKK vs SPX and NASDAQ is ![]()

![]()

Conceptually sound smart. Can you say that of AAPL in 1997 when late SJ joined Apple?

I can’t see any promising long term outlook then.

Historically bubble returned to its origin. Though Fed pumping would change that. I am wrong.

Time to buy? No more scaling over few weeks?

Anyhoo notice many stocks didn’t make a new low established last month.

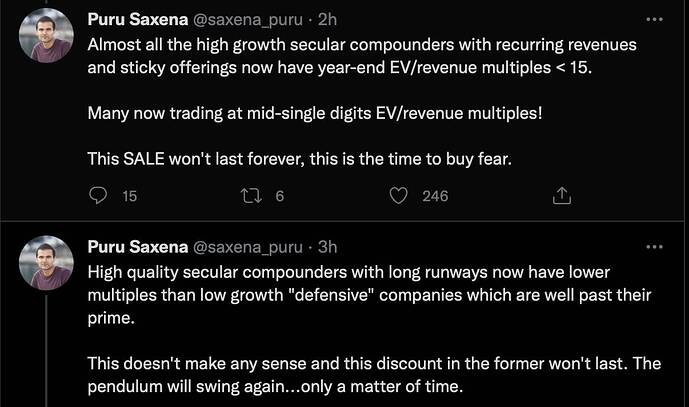

High quality growth stocks? Everyone have their own opinion. Thought SNOW SHOP SQ are high quality but they still ![]()

Unsaid assumption: Forecasted future revenue would be realized, and offerings remain sticky.

Put on your thinking cap as to what might happen in the future given current economic and political turmoil. Better give yourself a larger margin of errors. Market is always correct… high growth may not be that high growth, “defensive” matured companies are more able to navigate the turmoil.