My assumption is based on this comparison. In 2007, the drop was 20.3%, now 24.5%, retrace 14.65%, now 18.95%.

See in 2007 second drawdown is harsh, more than (14.65+20.3) 34.95. With FED aggressive rate hikes and excess inflation which makes them aggressive, I assume similar retrace like 2007, i.e., either 24.53+18.95 = 43.48 (appx 45%) or (2*18.95) 37.9%.

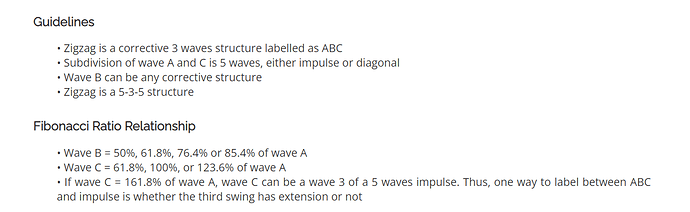

The recession wave behaves like this normally. Elliott Corrective ZigZag wave behaves like this.

BTW: Future is unpredictable and my guesstimate calculation may be 100% wrong. This is posted for discussion purpose, not to scare any one.

S T A Y - W I T H - Y O U R - D E C I S I O N S !

Never Believe anything I predict. It is worthless. Personally, I am a pure trader, never bothered to predict long term future as I strongly believe escape from any big drops. I do not have any attachment with any stocks or bullish run or bearish run, but making use of opportunity to buy low and sell high.