I try to buy during fall.

You may be right @hanera

Many homeowners might be in my situation. I refinanced from ARM into 30 year fixed rate (2.625%) last year.

If I were to buy my home at todays price and todays rate, then my monthly PITI would double - 100% increase. This is several thousand dollars more per month. Hence, I am frozen in place.

Now, I have a decent SFH and not looking to upgrade. But if I was, there would be a big disincentive to sell and move up. So, people in similar position may stay frozen in place for next few years

People fearing selling is driving down supply. Bullish for RE prices. I would sell some properties but the cap gains taxes in Ca are ridiculous. And 1031 only trades a headache you know to one you don’t know. I think the supply of housing will continue to be inadequate for many years. We can’t build fast enough. Demand keeps increasing faster than supply… Every year gets more desperate for buyers. The government should be giving tax breaks to sellers to increase supply. But more likely the reverse will happen with a Democratic administration

This is where @SVRE got his housing crash idea from.

Number 1: Austin to crash 40% (from where I don’t know, guess is ATH, has ATH reached yet?)

Take note of his age. Stereotyping: Millennials who can speak confidentially. Data driven? History rhymes?

Never heard of this guy, but yes, I can see Austin RE (esp exurbs) going down 40%

This guy has been saying the same thing for nearly two years. 40% from which price point or date?

Inventory has doubled in terms of number of months, know how to interpret?

Hint: new construction, outlying exurbs, apartment, same supply/ smaller demand…

20/100 = 0.2

20/ 50 = 0.4

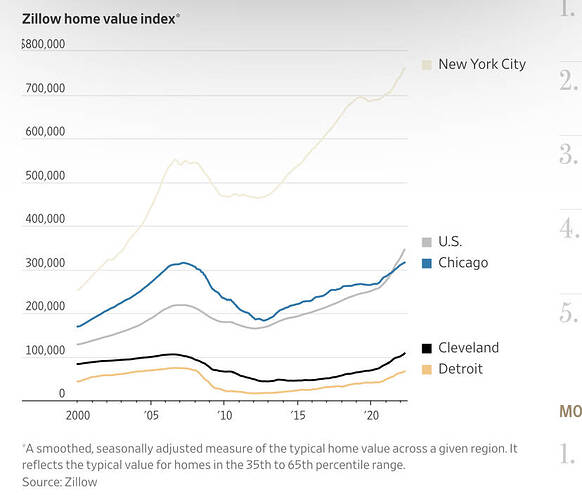

Housing Boom Fails to Lift All Homes Above Previous Cycle’s Peak

In 477 U.S. cities, the typical home value at the end of April was below peak levels from the early 2000s

There are many rumbling that Fed is determined to force the property trend to a correction because house rich people feel rich and is willing to spend causing inflation. Some even predict crash… don’t know what it means. Btw, seasonally, house price peak around Jun-Jul-Aug. So any current price cutting or weakening could just be seasonal and is not an indicator of a change in the multi-year property trend.

Zillow estimates of my CU SFHs have declined… 2-4% from ATH. Not much change for Austin.

Rentals are renewed at 5-15% higher ![]()

Long story. TL;DR no correction this year.

Declining mortgage rates…

…mortgage rates. I’m looking at the 30-year. It looks like it peaked out above 5%-- 5.3%. It has since ticked down to about 5.1%. What effect does this having on homebuyers?

Persistent housing shortage…

…LAWRENCE YUN: I mean, you know, sales are coming down. But the prices are still going up. Because of the housing shortage.

Rising rents…

…the rents overall is rising. In some places like Florida, 20% increase in rent from the year before as people are migrating into that state. Lawrence, how long can this continue for the fact that people are going to be facing a 30%-- 40% increase in their rents?

Waiting for significant house price decline? May have to wait for a long while. Price weakening from Summer to Fall is normal seasonal fluctuation.

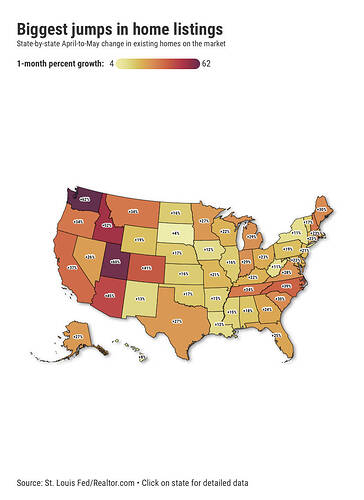

When listings were at the lowest point in history any increase is newsworthy. However listings always jump this time of year.

Exactly. Inventory in Austin has doubled from 0.3 to 0.6 months, big deal, I will wake up only if it climbs above 4 months. Moreover the increase is from new construction of apartments.

We will never go back to everyone having to go to an office. WFH is here to stay. It gives everyone freedom they will never relinquish. Besides it saves companies a lot of rent. There’s money to be made turning office space to residential apartments.