https://finance.yahoo.com/news/us-mortgage-rates-fall-5-140000735.html

If you are betting on lower house prices because of increasing mortgage rates, you could be disappointed.

…rates slipped for the second week in a row…

https://finance.yahoo.com/news/us-mortgage-rates-fall-5-140000735.html

If you are betting on lower house prices because of increasing mortgage rates, you could be disappointed.

…rates slipped for the second week in a row…

I would not cash out refi IF it was my primary. Anything outside that, yes I could/would, to what extent depends on my risk tolerance level.

.

No point in CA, likely mortgage interest (max loan $750k) + state income tax is greater than standard deduction.

Agreed. Personally I would open a no-cost HELOC to have optionality even if I have no intentions of using it.

Except the rates I get are not even close to 2.625% but I did get some mid-high 3% rates (with points) last year. Those are not getting refinanced any time soon. ![]()

What are these kids buying with only $40-50k down payments in SF and SJ?

My guess is they are buying through a government program with income restrictions.

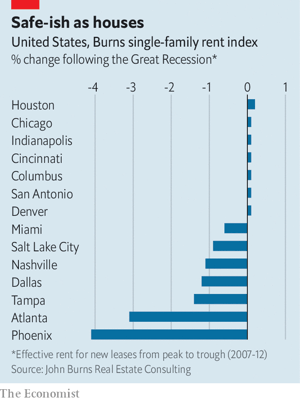

Over the past decade, chronic underbuilding and the influx of millions of millennials into the homebuying market have resulted in a major mismatch in housing supply and demand. Despite the fact that mortgage rates are skyrocketing, housing prices are not expected to slow down any time soon. The most likely effect is a slower rate of appreciation.

Typical view of a renter and/or waiting-to-buy-a-house buyer.

The major tailwind is demand >> supply.

Btw,

and

Surely demand is drying up now that interest rates are higher and stock market which fuels the down payment has gone down.

I am surprised if any one is writing $2-3M or more offers on Silicon Valley shacks at this time. Why should they?

It appears that you didn’t read the memo that both demand and supply is shrinking because of high mortgage rates.

Mostly affect first time buyer. Investors are more savvy and sitting on tons of cash. Just this forum, quite a few of them has $$$ waiting to ![]()

Is it hunting season yet or still early?