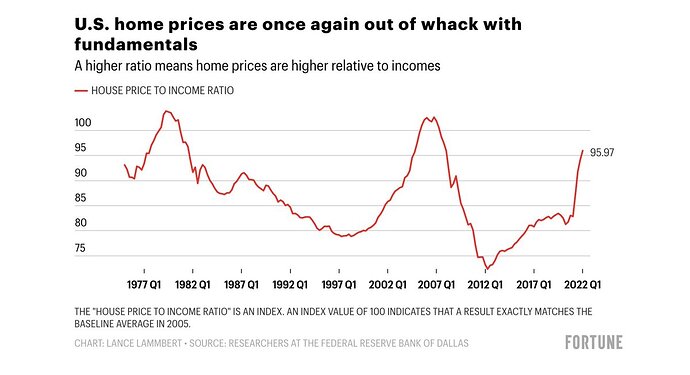

I have always said unemployment is the key to the prices of housing long term. But I think it would have to go to 10% to have a major effect. And even then I won’t worry. Unemployment in the BA was 10% in 1975. And house prices were going up at more than10% annually. This is not 2008 when people were getting no doc 125% loans and never made their payments.

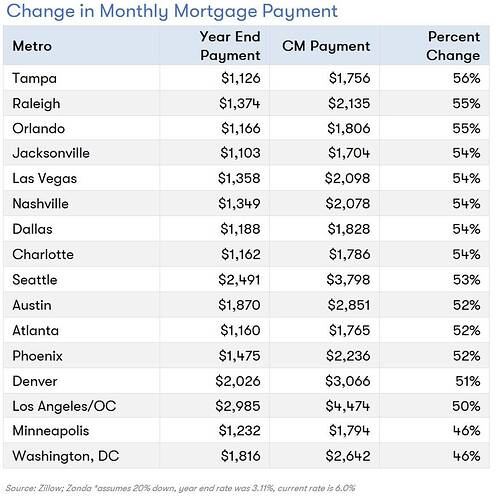

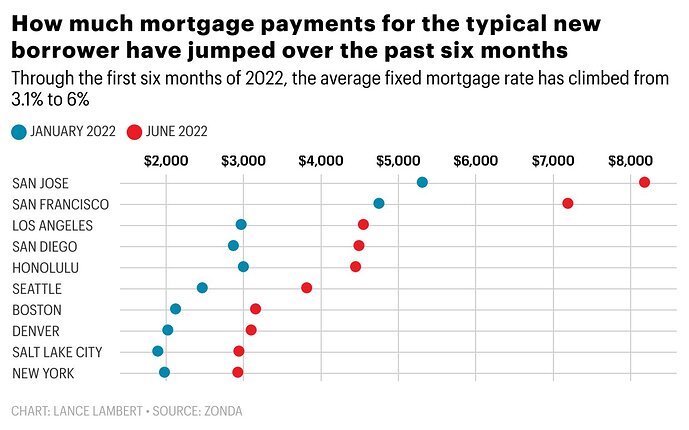

To me, the issue in the major coastal markets I follow is affordability. Yes, the supply of new listings will go down because trade-up buyers won’t want to give up their sub-3% rates, but there will always be a steady supply of houses coming onto the market due to deaths, divorces, job losses and relocations. The problem is if tech compensation goes down due to a combination of factors (layoffs/weaker job market, poor stock market performance, etc.), it becomes very difficult for buyers to afford a $15–20k monthly payment for a 3/2 or 4/2 starter home.

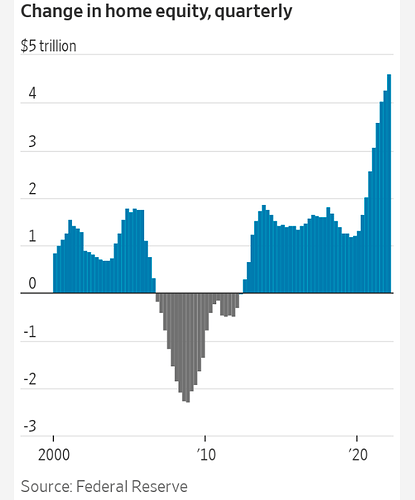

U.S. Home Equity Hits Highest Level on Record—$27.8 Trillion

Soaring home prices have driven up home equity, but rising interest rates are making it more expensive to use

Um, people shouldn’t be using home equity for consumption spending. It shouldn’t matter if it’s more expensive to use home equity.

Usually when prices are declining, sale volume would decline and hardly any good quality houses for sale. So don’t expect to buy your dream home in a down market.

Powell made it obvious that Fed wants house prices to decline to a level that first-time home buyers can buy home at lower price but at lower? higher? mortgage rate (guess can re-fi to lower rate later). However, he would be disappointed because cash-rich investors would outbid these first-time home buyers for good quality houses.

J Powell’s approach won’t help first-time buyers. People like Kevin Paffrath (and his subscribers) is well aware of what Fed wants to do and has liquidated all rentals long ago and sitting on $20M cash.

What homes are they going to purchase? New construction isn’t in the first-time buyer price range. People who already own those homes aren’t going to sell and give up their 3% mortgage rate to buy something else. The only people selling will be death, divorce, and job loss. That’s going to be very little inventory.

Inventory is climbing in Tahoe but so are prices. No houses in North Tahoe under $1m. Basically none in South Lake under $500k.

Inventory still half of normal. Condos for sale almost non existent and prices climbing the fastest.

New builds almost non existent. Where are the 150m Gen y and z going to buy. All the tertiary markets have skyrocketed in price. Trailer parks? High rises?… people want sfhs. Not trailers and apartments

Move out-of-state where their pay can afford the new construction or resale. At the same time, join a WFH company if your current company is not.

Alternatively, rent from landlords like us.

Builders Are Slashing Prices to Sell Homes in Fast-Cooling US Markets

The rapid rise in mortgage rates leads to discounts in once-hot boomtowns across the Sun Belt.

The Dallas area has a record of more than 41,500 homes under construction, a 10.7-month supply at the current sales pace, about twice the normal level, said Ted Wilson, principal at local industry consultant, Residential Strategies Inc. The pipeline has expanded because of construction delays caused by supply chain snarls and the labor shortage, along with the surge in starts early this year, he said.

Inflation = 8.6%

Mortgage rate = 6%

Mortgage rate adjusted for inflation = -2.6%, why won’t one borrow mortgage? Because expect house prices to drop more than 2.6%?