Because Mortage rate is fixed for 15-30 years and inflation is variable, and will not stay at 8.6% for 15 or 30 years, and highly likely will be much lower than 8.6% annualized in the US in a year or 2.

If inflation decreases, then people should be able to refinance at a lower rate.

That’s true @refinance at lower rates later.

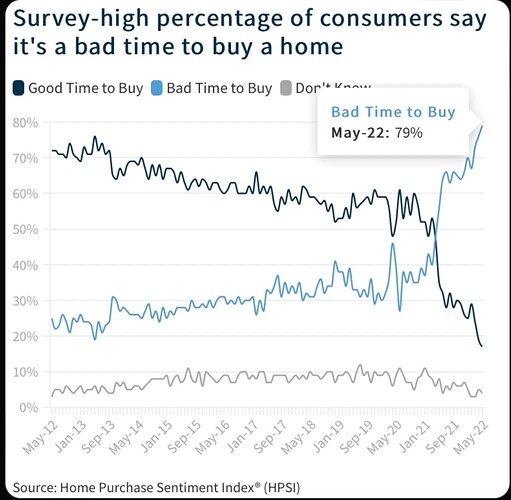

House prices are already down at many places compared to early May pending. So, maybe people are waiting and watching.

I bet anyone who needed to sell this year is regretting not listing earlier in the season. It’s rare for this abrupt of movement in rates, so everyone will have to re-calibrate. We usually get a seasonal price dip in the fall. If mortgage rates stay this high, spring of 2023 will be interesting.

Interest rates will likely be higher. My guess is that should translate to higher Mortage rates, probably not as much rise in % as the rise in Interest rates.

Seasonal dip is about 5-10%, media is trumping up for sensation, is too early to tell. Mortgage rise may cause a correction of 10-20%, media claims would be a crash, generally accepted to be more than 30% price decline. The true direction would be next Spring.

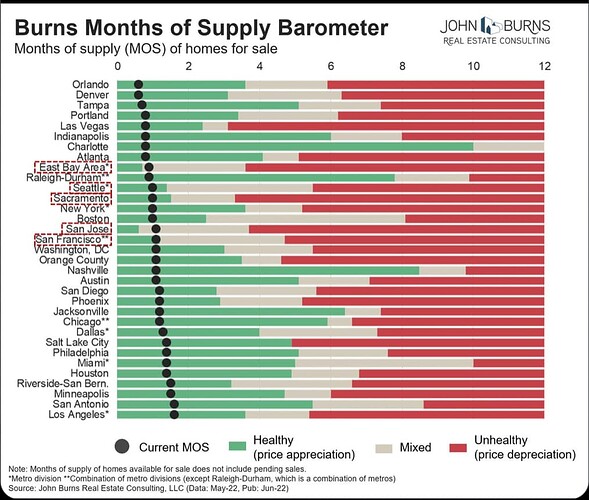

Always thought balanced market for everywhere is 4-6 months. Apparently I’m wrong. It varies by cities.

It’s amazed how they purposely create a headline that’s doom and gloom while:

“There were 1.16 million homes for sale at the end of May, an increase of 12.6% month to month but still down 4.1% from May 2021. At the current sales pace, that represents a 2.6-month supply.”

Affordability is down. Bullish for condos. The last to appreciate and the first to collapse in a down market. The canary in the RE coal mine.

People are still buying and inventory is still very low.

That’s funny. They say it’s stifled demand yet we’re at 2.6 months of inventory. The number of homes for sale is lower than last year. It’s reduced the number of people looking to sell.

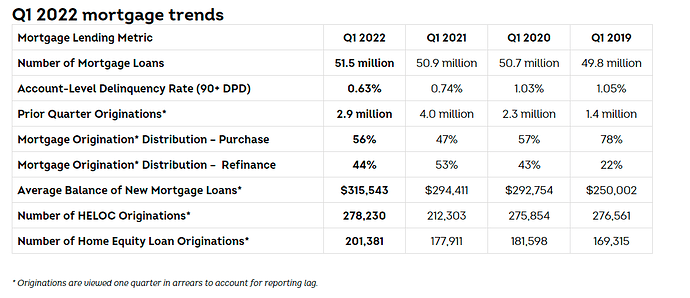

Consumer credit trends in the mortgage sector: Q1 2022

While rising interest rates and limited housing supply have caused a slowdown in mortgage originations, homeowners are tapping the equity they’ve built in their homes, and home equity loans reached an all-time high of approximately $20 trillion in Q4 2021, up 4% YoY:

- Mortgage originations declined to 2.9 million originations in Q4 2021, a -28% YoY decrease but still well above the 2.3 million observed pre-pandemic in Q4 2019

- Rate and term refinance originations dropped dramatically by 58% YoY

- Purchase share of originations increased for the third consecutive quarter, up from 47% in Q4 2020 to 56% in Q4 2021

- Cash-out refinance decreased by only 6% YoY, while HELOC grew 31% YoY in Q4 2021 and 13% YoY

- The average loan size of new mortgages grew to $315,543, an increase of 7% YoY

Our view: Right now, there’s less incentive to go through a rate and term refinance, and for those looking to purchase a home, low inventory and high home prices present a challenge. For lenders, the substantial increase in HELOC and home equity loan origination presents tremendous opportunity if they can identify and reach consumers in the market to tap their available home equity.

Good. Can increase rent ![]()

![]()

Rent has always been lower than mortgage payment, which place that the article implied is the other way? Anyhoo, higher mortgage I like, can increase rent just below mortgage payment. Thank you, Mr Powell.

That rent increase on the graph is delicious. Funny because my potential tenant said I could have charged more than 3600 rent for my new 2 bedroom. Mortgage is 3500. New tenant was willing to admit there are not many affordable SFR for rent due to competing AirBnBs.