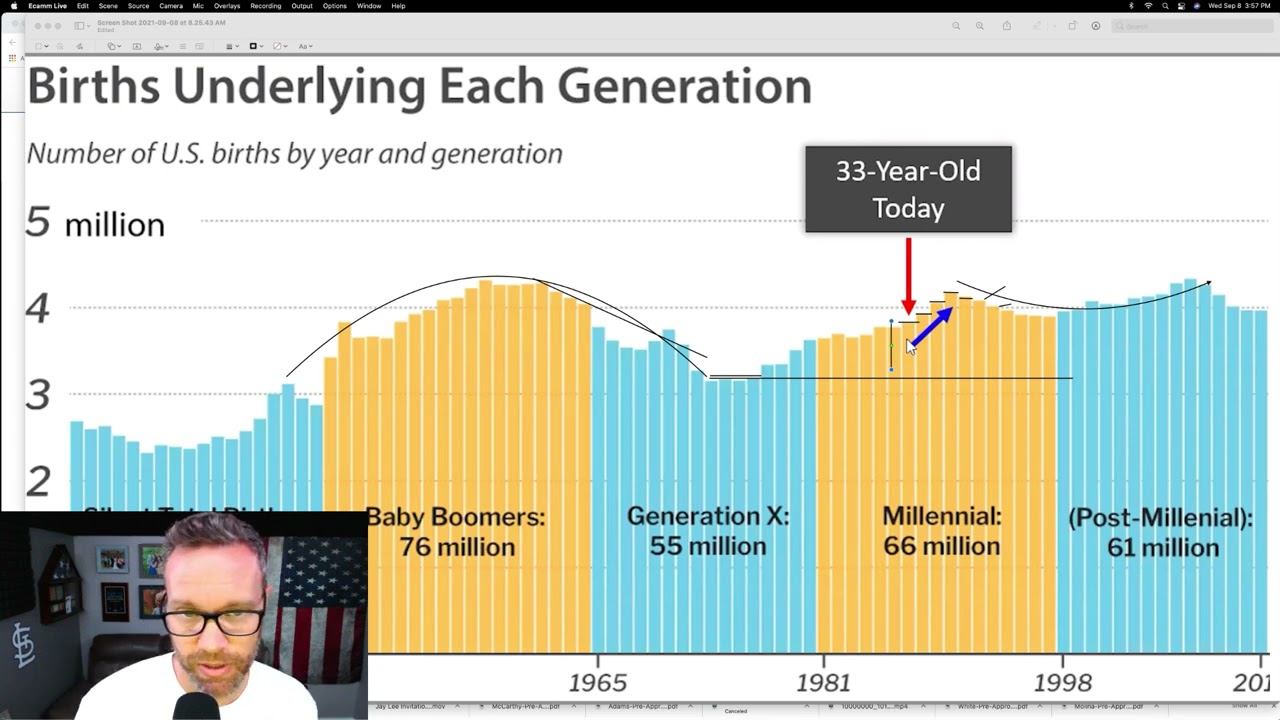

Who is the guy that post the video below. Is he Patrick or @manch ![]()

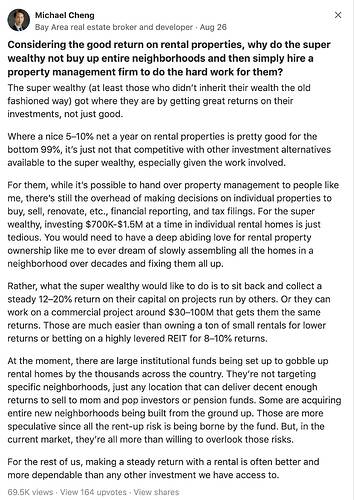

Michael Cheng is the guy who tried to outsmart Nancy Pelosi by buying the alleyway in her hood. Did not know he’s on Quora.

Another good one on Quora.

James Smith

Landlord and Real Estate Investor (1999–present)[Aug 10]

Why are rental properties not good investments?

For the United States

Short answer: They are good investments.

Long answer: They are good investments, just not for everyone.

Rental properties are not passive investments. If you choose to invest here you need to understand that there will be hands-on work even if you think that you’re going to turn-key your rental business and have a Property Manager “do all the work”.

The reality is many investors are lazy bastards and do not want to put in the work.

Many that think they are willing to put in the work find out after jumping in that it really is not something they want to do, so they exit quickly. (I love buying from failed investors.) Commonly these people end up making little money or even lose some.

Those people should stick to indexed funds or mutual funds and be happy with their 7% average returns. It’s decent money, but once you account for taxes and inflation, they’re hardly able to pull off more than making sure that they stay ahead of the devaluation of the dollar.

For those that are willing to put in the time and effort, it can make you rich. Some will become “ready to retire at 50” rich, some will only become “I will be able to afford to retire” rich, and the very few will become “I just bought a new Gulfstream jet” rich. Your odds in the stock market are not nearly as good. I also invest in the stock market, but it really is a form of gambling. During the 2008 crash some of my investments lost 80% of value and dividends were cut to $0. My real estate lost a lot of value too, but none worse than 50% and all have regained 100% of their losses and returned 50% more on the plus side. What was never lost was the continual stream of money coming monthly from the rental profits.

People love to throw around numbers like the stock market provides better returns than real estate does, but they are just talking about property speculation. (Buying and holding property that goes up in value by itself.) The reality is that for-rent investments can return much higher returns, increase in property is an added boost when you sell, and it’s all wrapped up in a very nice tax-advantaged package.

I average a return on capital employed of 15 - 20% per year on the rental activity alone. I have done so consistently for the last 22 years. It took me from a negative net worth to a multi-millionaire. On top of that all, if I punched out today, I would realize a greater than 50% gain in the property values that is not included in the annual return figures.

I’m ready to retire today if I so desired, but if I had not invested in property I’d be looking at another decade or two of the 9–5 job until I would feel comfortable that I wouldn’t risk ending up in a state home for my golden years.

So James, why the heck haven’t you retired then?

Frankly, because I like my lifestyle and the work isn’t very hard. I net a 6-figure profit for about 100 hours of work a year. Why would I sell the cows when people line up around the block to buy the milk? I work hard and play hard all of the time. I take nice vacations with my family, live in a nice home, buy the things I want in cash, and never worry about having enough put away for the golden years. I have a lot of free time to enjoy life and real estate investment has made that all possible. When I’m gone, then my heirs can carry on the business for a very secure future or sell out for millions and blow it all in Las Vegas in Hangover style. (I won’t care, I’ll be dead). Until then, I’ll be raking in 6 figures a year.

So, yeah, rental properties are not good investments, but only for lazy bastards.

.

Dripped return is 11%. With Fed printing money incessantly, more like 15%.

My time worth more.

What? 50? I retired at 44! How hard can it be?

80% and you’re in fetal position? Mine dropped by 99% during Dotcom bust. So what?

I net 6-figure ridiculing you.

Not hard if you made your wife work.

![]()

That’s a bit of BS. Rents absolutely dropped in 2008. They dropped enough that many landlords became cash flow negative and lost the home. I remember how many listings would say to not disturb the tenants.

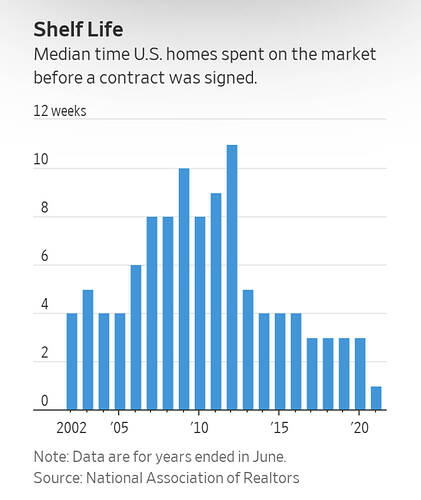

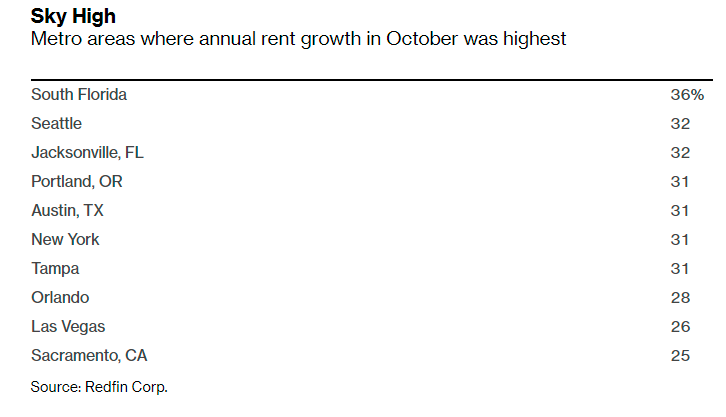

South Florida and New York See Apartment Rents Surge More Than 30%

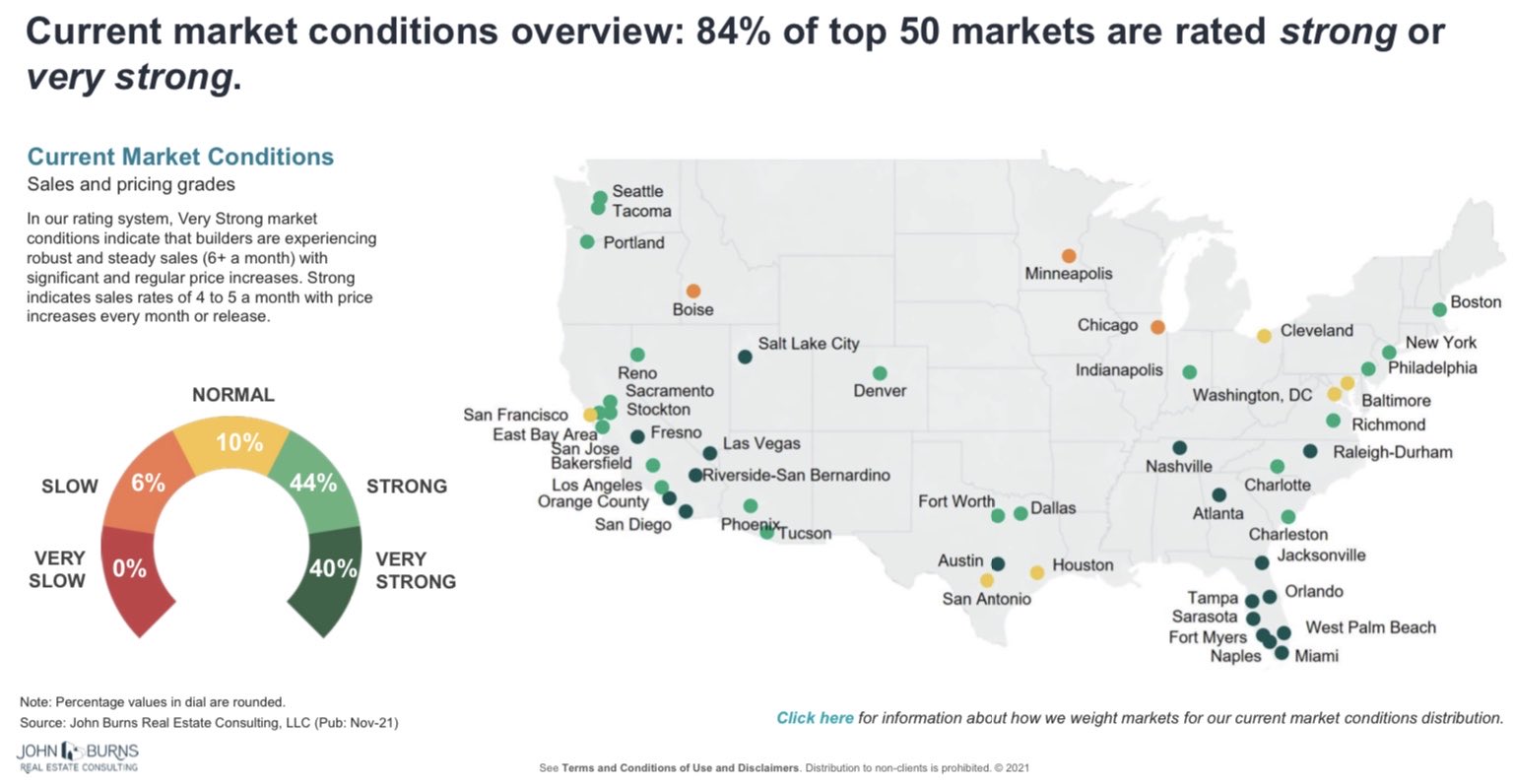

Nov 2021 stat. SoCal and Fresno are very strong. The entire state of Florida is very strong. Boise has slipped.

Title of CNBC is ignorant. It happens all the time… buyers always jump in during start of the mortgage rising trend to catch the lower mortgage rate before it goes higher.