If you believed that, then you should sell everting and re-buy when it drops 50%.

My entry point is around 1/2 of current value plus they are all nicely cash flowing so do not want to sell and pay taxes. Will buy more when prices come back to earth again.

You will never get this time! Right away I can tell you - Your expected drop is unrealistic - as you had not seen 2008-2011.

The abnormal came in when 2008-2011 that was real estate downturn. Long time statistics shows normal downturn home price drop is around 20% (max).

That is the main reason, banks/Fannie loans insists 20% down payment so that banks will get back their money.

Since this recession is cause by supply chain, Russia war and having high down payers of bay area, the prices won’t crash that much, still less than 20% on Median price.

In case of price dropping more than 20%, where the holders walk away from mortgage payments and millions of homes will go to banks inventory without payments.

Then, big banks will file bankruptcy like the way it happened in 2008 ! FED won’t let the real estate drop that much as this has become their own issue again !!

Those days will never come back soon in next 20 years !

I think I will get 50% (from ATH) off deals, just need to be patient.

Keep in mind that only less than 1% of total homes (those sold after 2020) will go underwater after 25% decline. Fed wants them to go underwater because bubble housing costs are not good for 100% of the people.

At 40% decline, probably all homes sold after 2017 will be underwater but not so much because they are still financed at 2% meaning if the holders foreclose them to buy another, they will end up with higher monthly payments (at 6-7%) so they will hodl even if they are underwater.

So that’s my base case. I am assuming another 10% off because 10% variation is normal in any market if you have keen eyes for good deals.

What makes you think there will be a flood of sellers to boost inventory? It is literally at historically low levels. You either need inventory to increase 2-3x or demand to crash to near zero for a 50% crash in prices.

It does not matter what inventory level is. There will be fewer buyers and that will do the trick. And by the way, there are many sellers out there (again macro trends like remote work, declining and ageing population, little to no immigration, CA exodus, etc.). They are just hodling out for a fat payday. Unfortunately they are destined to lose this battle at these interest rate levels. You cannot fight gravity for too long.

Complete Day Dreaming ! Good Luck !!

You really do see every equation as single variable which is 100% false and leads to inaccurate analysis with the wrong conclusions. Why wouldn’t the many sellers out there have sold this spring or last spring when the market was obviously hot?

Among those affected most are recent college graduates and other new entrants to the workforce, who have little in savings and cannot afford to buy a house.

Why do we expect recent college graduates to be able to buy a house?

…young workers have felt the sharpest pain, many of them taking on … roommates to afford housing costs.

Thought many of us started this way? We rent a house/ apartment with room mates.

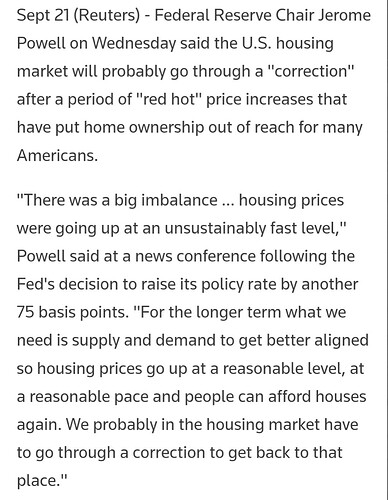

Fed chair calling out housing bubble and correction I.e. 20+% price drop is unprecedented. It didn’t even happen in 2008 crash. Fundamentals are much worse this time in terms of affordability, inflation, debt levels, and mortgage rates. Deniers never learn.

With all the illogical analysis when you forecast 50% price drop and still wants to hold your properties (intelligent way), why do you feel others will foolishly sell it scared by price drops?

You think those who paid $2M or 3M or 4M are foolish enough to run away from the home by raise in mortgage rates?

You do not have any clue what happened in 2008 and how it happened. Just because FED mentions correction in housing, never think bay area is going to get affected 50%.

Let is see in 2023 Dec, whether Deniers never learn or Dreamers never learn !

I think everyone one on this forum will be buyers with any significant downturn. And no one are sellers.

People HAVE to sell for multiple reasons. For buyers though, affordability is key - trifecta of wages, interest rates and home prices. Home prices have artificially benefited from ultra low mortgage rates leading to a wide gap between wages and home prices. Buyers simply can’t afford paying these prices ! Sellers will have to settle for lower if they NEED to sell - and most shouldn’t have a problem doing so as they have plenty of equity built up!

I will try your strategy. Making 50% below asking offers. Not holding my breath. Meanwhile we rented a 1 bedroom in Tahoe for $1400 in one day. Waiting list is a year in my town.

I agree with @acre and @Elt1 .

Places like the Bay Area will dip some but not anywhere near 50%. In fact Bay Area will be resilient through this downturn. If I bought a place in Boise I would be freaking out right now.

Bay Area homeowners in prime areas locked in at 3% are just not going to sell. Ironically, many of them won’t sell for the same reason REInv (cough pandey) won’t sell his $20+M in real estate. Kids in school, need a place to live, etc.

Time will tell folks. Just be patient.

I also wonder why you don’t like housing bubble to burst. As RE investors it will be an awesome opportunity for you to grow your portfolio.

Current inventory in South Lake Tahoe is 151. Was 225 in June for sfhs. Was 350 in 2008. 250 is average. Low inventory benefits sellers not buyers. Look at Altos Research videos. Inventory is up from the AT lows but at 500k it is half of the average Nationally for the last 10 years. New construction in less than 1m per year compared to 2.5 m in 2005. There is a National housing shortage. People are homeless, doubling up and driving rents to record highs. Multi family prices are going up even though sfhs are down 10%… if you think prices are dropping drastically sell your mythical $30m inventory… I will offer 50% below asking.

Its foolish to sell if cost base is low (thus low property taxes) and has debt at 2.5% and when the properties are generating almost 10% cash flow tax free.

If anything I will buy more but at the right time and at the right price and the right property with good upside. Patience.

And prices will fall, stop trying to convince yourself otherwise. If prices do not fall, Fed will get even more aggressive. You are basically saying that RE holders will win against Fed; well good luck with that. There is an old saying that never fight the Fed unless you want to lose your pant and shirt.