The U.S. Is Running Short of Land for Housing

Land-use restrictions and lack of infrastructure have made it harder for developers to find sites to build homes; ‘almost across the board, you’re fighting for land’

Surprisingly no Boise and Austin.

Austin was #11.

I was trying to reconcile how Redfin shows YoY decreases and S&P shows YoY increases. Redfin is looking at the amount of decrease in the YoY price increases from Feb to August. That’s pretty convoluted. They are saying in August Seattle homes have a 17.7% smaller YoY price increase vs. what they had in February. Prices are still up YoY. Redfin is leaning into the fear sells. Maybe they are trying to motivate more people to list homes for sale, so they can make more money.

The CNBC headline is hilariously misleading. I wonder how many people just scroll headlines and think they are informed.

Mortgage rates now heading to 8%. I am seeing price declines in PA and LA and MP now. I am also seeing cap rates on MFH rising, some are even near 8%. I think I will jump in after another 30% decline in next 1 to 2 quarters. 8% mortgage will literally push the Bay Area home prices down by 50% from ATH. It was long due.

I saw one PA house selling at 2015 price!

But, why do you think 8% mortgage will drive bay area prices (esp in high cost cities) even lower? I would assume price would more correlate with stock market.

Which one?

Stock prices are also driven by interest rate. As I said many times, interest rates are like gravity that decides how high all inflated assets fly. Stocks will also reduce into half. 2018 levels easily. Plus layoffs. Plus CA exodus. Add all of them and you have a recipe for 50% RE price drop in Bay Area.

He is dreaming like that !

Those who wait for 50% drop will never buy a home in bay area in next 10 years

or

They will get a shack like this for 50% deal ! 205-Ramona-St-94401

Let him bid here and see how he is outbid by cash offers !

There are so many deniers, its astonishing. First they denied inflation, then they denied any price drop, then they denied mortgage rate hitting 7%, 8% and now they are denying bubble pop.

Try to talk meaningfully, otherwise bloggers will set you aside like the way buyinghouse left this forum.

No false accusation. If you make such, your integrity is spoiled and no one believes (even if dream!) you.

Who in forum denied inflation?

Who denied price drop? Tell me one person here who denied price drop? (Do not publish biased partial cut page, post full details).

Who has denied mortgage hitting 7%?

No dream talk ! Show me proof… first for your claims who denied each one?

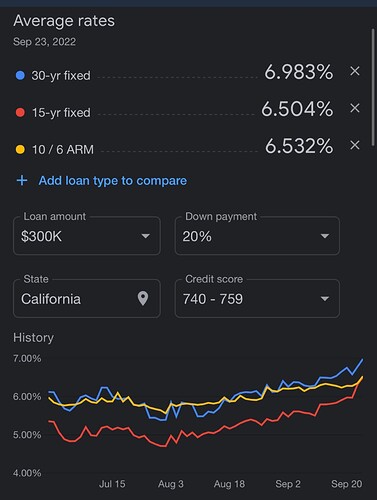

Just 3 months ago someone was vehemently arguing that mortgage rates will never cross 7%. Most people here denied that outright. Well it’s already at 7.1% and headed to 8%.

Now at 8% mortgage only a crazy will think that RE will only drop by 20%. RE worldwide has been artificially inflated by free money policy. The only reason RE grew faster than income over last two decades is falling rates (gravity). Now it’ll all get undone. It’s common sense. Now rates literally quadrupled and you are saying RE will only drop by 20%. You should really share what you are smoking with all of us.

When tide goes out we know who’s swimming naked. Looks like many people are. You should pray that Bay Area RE only drops by 50% not more.

.

OT: Rising rates is not the most scary thing happening worldwide. Is un-globalisation. Globalisation led to low inflation, rise of the software industry and world peace. What would be the outcome of un-globalisation?

Only if mortgage stays at 8% for a few years. Given that BARE homeowners and investors are financially strong and savvy, a few months of 8% mortgage won’t cause them to budge.

I think the era of low mortgage rates is over. Should the steady state rate be 4%? 5%? 6%? 7%? 8%

Proof ? Give the correct link or full page screen shot!

No pep talk !