They are both clowns

.

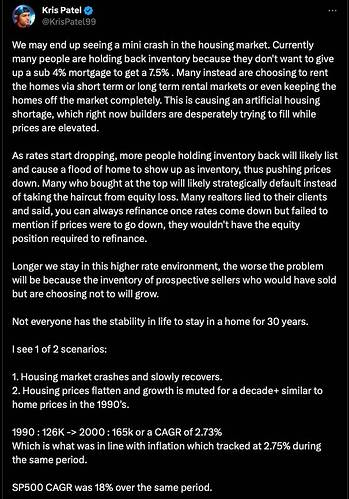

No need to bother about these two guys. There is only two possible scenario:

a. New bull market has started for property

b. Just a dead cat bounce

What you do depends on your unique circumstances.

For me, although I have planned to buy one in Mar, I have decided to just sit until Fed gives clear signals that it won’t hike any more. My rationale remains unchanged:

a. If this scenario is true, I have plenty of properties to ride the wave up.

b. If this scenario is true, I can buy more properties with the same money.

Cash is King.

![]()

Yes

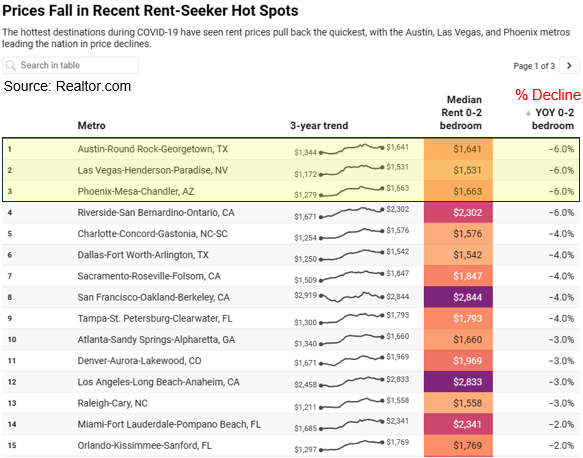

Everybody want to stay in SF that the rent has been declining.

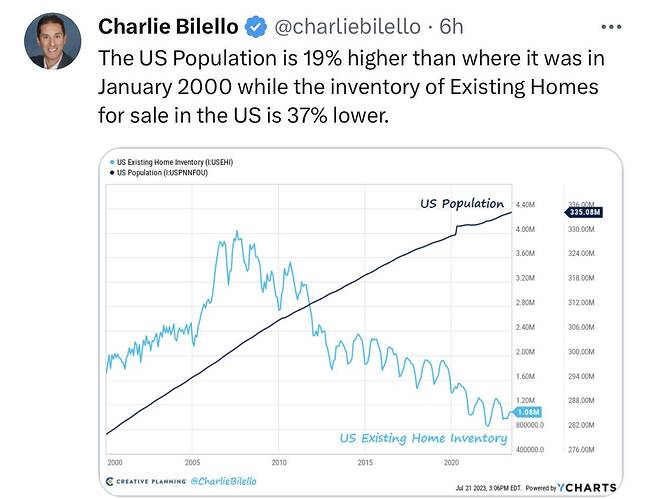

That’s exactly why there’s so littler inventory.

Bad news for realtors. Good news for sellers and cash buyers

Green shoots ![]()

While the Bay Area single family isn’t yet showing much signs of decline, multi family RE is now well into crash territory.

Some observations:

I’m seeing deals on large 8+ unit properties at 20-30% below 2022 levels. Mostly off market offers.

I’m even getting offers on some properties that just sold a couple years ago meaning buyer is gonna lose 25%.

Large multi family seems to have fallen to 2016 price levels.

Properties that are old and not maintained well are being offered at even steeper discount.

Some stubborn sellers are still trying to sell at last years price but they are just sitting. I bet they will eventually let go which will cause further decline in price.

2024 is the time to pull the trigger as prices will probably fall another 10% by then, while collecting 5+% on the dry powder. Fed hopefully stops raising rates by then which should stabilize prices.

Multi-family and commercial properties are under too difficult bucket for me. I will stick with SFHs.

What’s the difference if your plan is to rent them and hold for long term. MF gives much better cash flow. In Bay Area SFH are mostly cash flow negative and in this environment it’s dangerous.

Not buying in Bay Area. Two is enough ![]() Hodl.

Hodl.

Multi-family is more complex to manage. Many potential flare points.

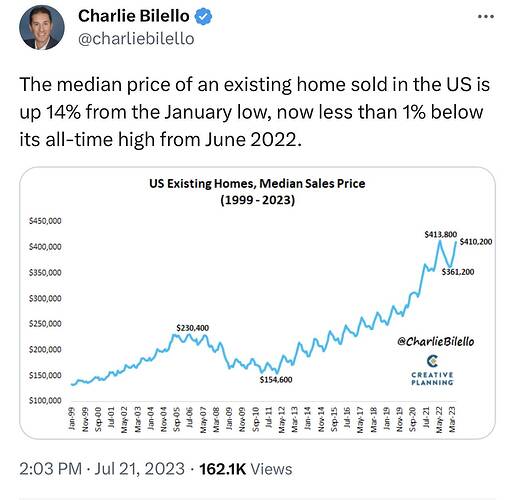

Based on every fundamental, rent to buy ratio, income to cost ratio, monthly mortgage to income ratio, SFH RE seems to be in an even bigger bubble than in 2007. It has to burst the only question is when?

Monthly SFH ownership cost is almost 2x higher than just 3 years ago. Anyone who says it’ll go higher is smoking something that I also want.

.

True.

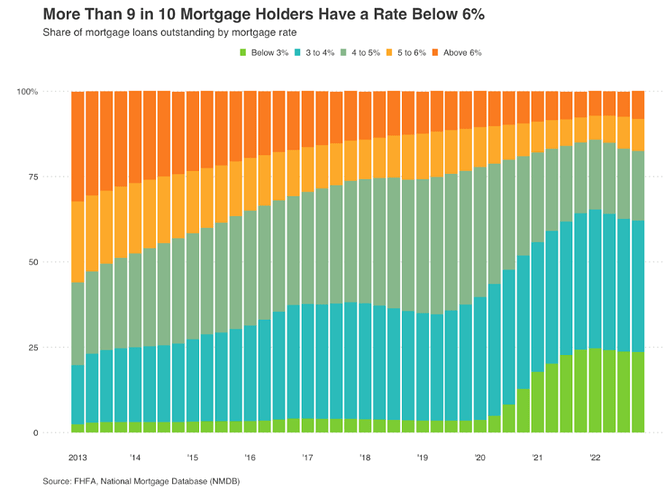

Won’t burst.

Mainly because of high mortgage rate.

Housing become unaffordable mainly because of high mortgage rate. So once rate goes down…