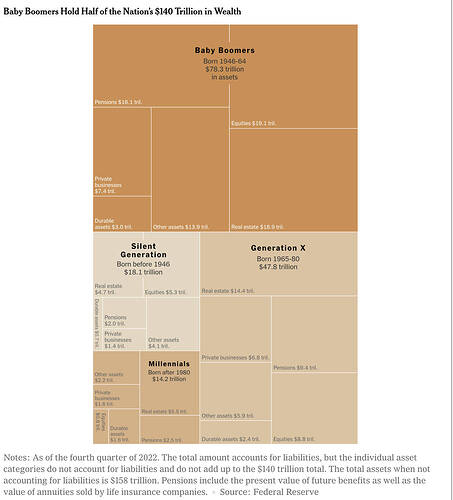

It’s a Boomer world.

Still waiting for those trillions of boomer wealth to pass down to the kids.

The Greatest Wealth Transfer in History Is Here, With Familiar (Rich) Winners

Actually us Boomers would love to spend some of that 80 trillion in assets but products are of such poor quality these days compared with what we grew up with that we’ve stopped bothering.

Wasnt this the same generation that took everything offshore and focus profit maximization and shareholder returns above all else or was that the generation before?

Well, yes, a little of both generations.

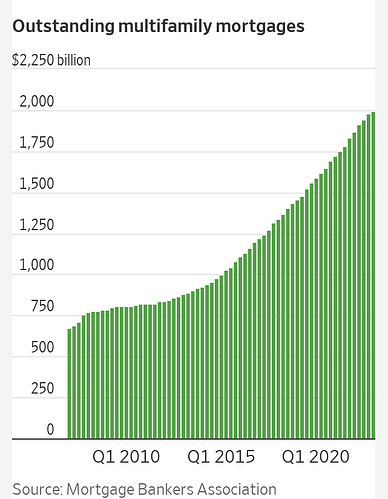

Even some veteran real-estate investors that weathered past storms look vulnerable. Veritas Investments, one of San Francisco’s largest landlords, and partners defaulted on debt backing 95 rental buildings during the past year. It stands to lose more than one-third of its San Francisco portfolio as a result.

Government regulators make housing unaffordable everywhere

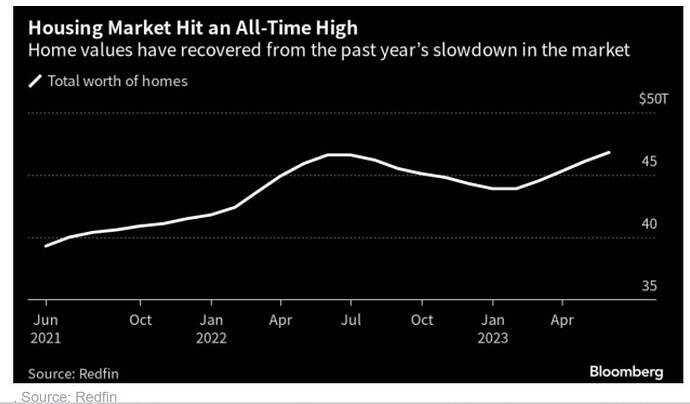

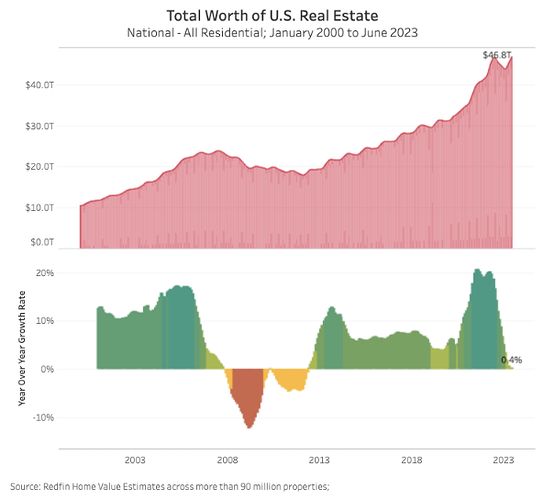

Fake news. Home prices are going to zero! You’ll have to pay people to live in them for you.

California; Washington, D.C.; and Georgia Lead for Investor Share in Q2

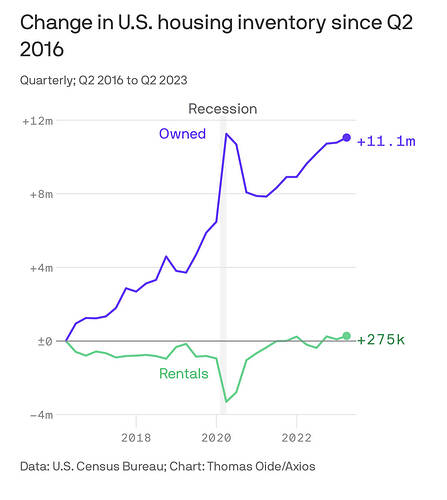

Median price was up 1.9% yr/yr though ![]() Doom and gloom sounding headline that obscures the reality that home prices are increasing. Inventory is abysmal.

Doom and gloom sounding headline that obscures the reality that home prices are increasing. Inventory is abysmal.

You may be wondering how you can sell a closing deal during inflation, well in order for you to achieve that, you should know that there are a few steps that you should follow. In first place, you should always stay informed, and acknowledge that what goes up, must come down as well.

A bit OT. They try to put a nice spin on this but I don’t find a system that drags upper middle class people back to the stone age to be particularly comforting. Hope that’s not our future.