Market is quiet. Bought a new construction. Incentives: 5% + $5k off list price + free fridge & washer/dryer. Total about 7% discount.

Where? Houston ?

What kind of financing?

.

Austin.

Cash.

No more purchases this year. This year, bought one in Katy and bought one in Austin. Next year, plan to buy 1-2 houses ![]() Last year, didn’t buy any. Average over 2 years is 1 per year… in lined with LT plan.

Last year, didn’t buy any. Average over 2 years is 1 per year… in lined with LT plan.

Which area in Austin?

.

Leander. Many new construction there.

Cool. Congrats! Living the dream!

My plan is buy one a year too.

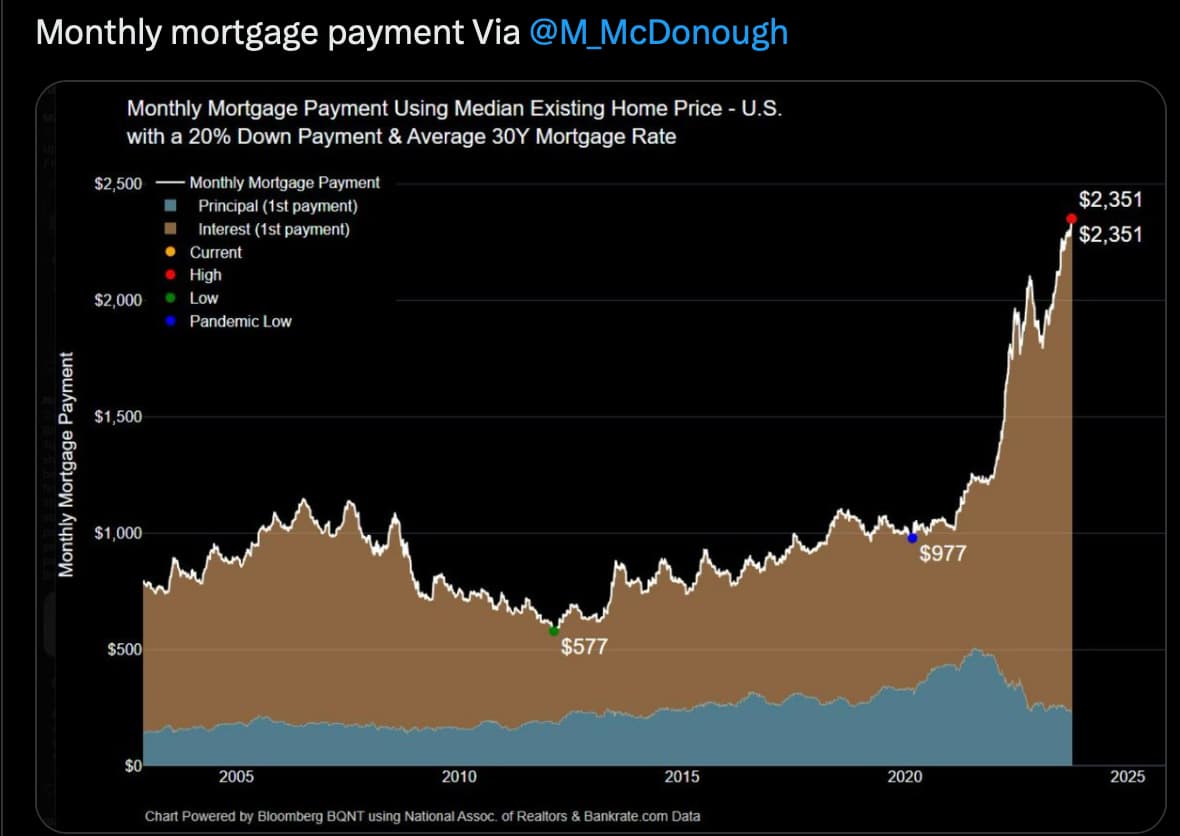

I’ve bought nothing this year so far. I feel like prices are still high everywhere. Waiting for the 7%+ mortgage rates to kick in.

.

This is a perennial price vs mortgage rate debate. Should we buy…

Option 1: When mortgage rate is high and demand is low. Price is relatively low.

Option 2: When mortgage rate is low and demand is high. Price is relatively high (as in higher than option 1).

The issue is most people have way below 7% and won’t sell. Inventory is going to remain tiny unless we go into a recession that increases unemployment.

.

Investors who have seen house prices tumbled 20-30% from peak and their stock portfolio crashed by over 70% are under immense pressure. Hold risking more downside or sell to have better sleep. Their hope of Fed pausing or even cut rates keep getting extended… from soon to now which could be 1+ year away.

How to interpret?

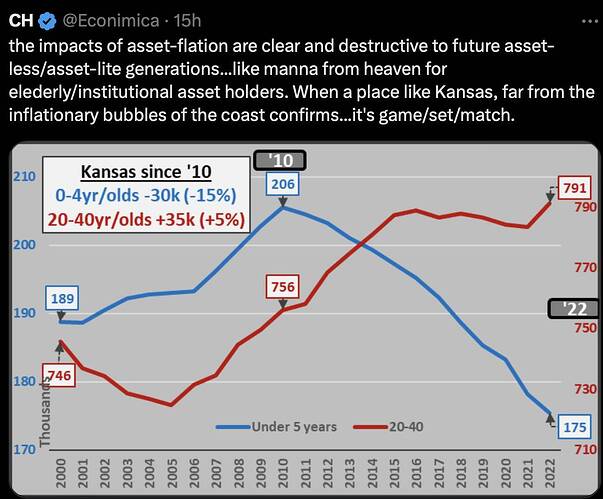

Bullish thought: Bite the bullet for 1-2 years, prices would jump up rapidly due to formation of families and insufficient supply.

Yes, I don’t think people will give up on having kids. They’ll just delay which will create a huge surge when the people who delayed have kids at the same time as people who aren’t delaying.

Finally I am seeing many multifamily selling at steep discounts in the prime Bay Area. Some properties are even selling at 2014 prices. Some are sitting in spite of huge discounts. Here are some recent date:

https://www.zillow.com/homedetails/22434-Salem-Ave-Cupertino-CA-95014/153299991_zpid/

Sold for 2015 ZEstimate.

https://www.zillow.com/homedetails/7198-Galli-Ct-San-Jose-CA-95129/153317282_zpid/

Sold for 2014 sale price. Sold in 2014 for 2.3M. Just closed again for 2.4M.

https://www.zillow.com/homedetails/1300-Arguello-St-Redwood-City-CA-94063/82959000_zpid/

Sold for close to 2015 ZEstimate. Seller purchased in 2021 and sold at loss.

https://www.zillow.com/homedetails/440-N-Rengstorff-Ave-Mountain-View-CA-94043/153163817_zpid/

Prime Mountain View location. MF w/ 1 acre lot. Seller just closed at 7.5M. Had purchased in 2018 for 9M.

https://www.zillow.com/homedetails/California-Mountainview-Mountain-View-CA-94040/2057481530_zpid/

33% price cut and still no takers. I bet another 50% price cut is needed to move this. Prime Mountain View large MF.

So many examples…

MF is very very weak and when we hit recession and when rates cross 8% (when not if), there will be a bloodbath as many MF properties are due for loan renewal. I see MF prices in prime Bay Area easily falling to 2011 levels in a matter of less than 1 year now. Time to dry the powder.

With this carnage in MF, what do you guys think of single family prices? I get that SF inventory is low and blah blah but such a huge gap between SF and MF prices is happening for the first time and definitely not normal and sustainable. SF prices got to given in, at least 35% SF price drop needed to match pre pandemic MF SF price ratio equilibrium. Heck, even new homes are now cheaper than used homes. How long can the dam hold the pressure?

.

Caveat: Didn’t do any DD.

Thinking aloud: MFs could have been overpriced and are correcting to a price zone that is consistent with SFH prices. Your statement implies that both prices are properly priced previously, now that prices of MF have declined a lot, prices of SFH must follow. Just a thought.

Not sure about this. Pre pandemic, 4 unit MFH were selling for 500-750K per unit in premiums neighborhoods (MV, Sunnyvale, Cupertino), while slightly larger sq foot SFH were selling for 2-2.5M and similar or slightly larger condo/townhomes for 1-1.5M. So that’s already pretty steep premium for living in SF/Condo/Townhome over a MF unit. I would assume that 2-3x higher price is the right premium, so pre pandemic seems like the right equilibrium. The MF crash is really ominous signal for SFH prices.

Also note that a ton of Bay Area RE is investor owned and from their perspective all that matters now is the cash flow and cash flow of MF was significantly higher than SF pre pandemic and higher now (due to larger MF price drop). This will be the most important factor going forward given that the RE appreciation game is largely over for the next 5 years. So now only stupid investors would hold SFH and lose money every month. Assuming that there are not too many stupid people in Bay Area, they will sell SF and invest in MF. And the fact that MF is falling like a rock now, is a strong signal that SF will fall too. Low inventory and low mortgage hostage owners have kept SF from falling but the dam cannot be held much longer with rising mortgage rates and falling demand and now rapidly falling MF alternative.

The rules may or may not be justified but such things are not uncommon in other developed countries. Foreigners of any nationality face severe restrictions if they want to buy property in Australia.

Canada taxes foreign buyers 15% of purchase price.

Switzerland is another tough one. The US is kind of an outlier.