Singapore “taxes” 50% ![]() of purchase price.

of purchase price.

Malaysia, foreigners can’t buy affordable housing… forgot the cutoff price ![]()

Btw specifying races is racist.

Singapore “taxes” 50% ![]() of purchase price.

of purchase price.

Malaysia, foreigners can’t buy affordable housing… forgot the cutoff price ![]()

Btw specifying races is racist.

Today just hit 8%

I am waiting patiently for an RE slowdown (at least in tier 2 and 3 cities).

.

RE has slowdown… more slowdown? Because of RTO, prices have been inching up… reverse back to downtrend?

RTO is happening in tier 1 cities mostly. This should lead to softening in tier 2/3 for sure.

Today’s housing market is a toxic mix of high mortgage rates, high prices, tight supply and strangely strong pent-up demand — and it’s scaring off buyers and sellers alike.

![]()

Prices are still rising due to the supply and demand imbalance, but sellers are being more flexible. So a buyer could purchase now at the higher rates and hope to get a break on the price, or they can wait until rates drop.

![]()

…assuming bonds aren’t in a secular downtrend.

.

Sound like you’re suggesting buy now is wiser.

“You’re not going to see house prices decline,” says Rick Arvielo, head of mortgage firm New American Funding. “There’s just not enough inventory.”

Disappointing crash doomers ![]()

Ken H. Johnson, a housing economist at Florida Atlantic University, says the housing market is being pulled in two competing directions. “I think we are in for a period of relatively flat housing price performance around the country as high mortgage rates put downward pressure on prices, while significant demand from household formation and an inventory shortage place upward pressure,” he says. “These forces, for now, should balance each other out.”

I am in this camp.

Mark Severino, owner of Best Texas House Buyers, makes no secret about his favoritism for his home state — but he backs it up with facts.

“Clearly, I am biased to promoting building wealth in Texas,” said Severino, who offered three reasons “why Texas is the best state to buy a property in and build wealth over the next five years.”

Texas ![]()

New home sale continue to climb, sorry RE bears.

Builders are slowing new construction. So inventory of new construction would be low, couple with low inventory of existing homes, if Fed cuts rates, pity first time home buyers.

At the end of September, the number of properties listed for sale was down 8.1% from year-ago levels and the lowest count for the month since 1999, the NAR said last week. The single-family shortage is even worse; that inventory is at the lowest level since 1982.

That’s why so many buyers have turned to new homes. For their part, builders have been able to adjust to the elevated rate environment by offering financial concessions to lure in budget-conscious buyers. They’ve also ramped up building.

“Because of homebuilders’ ability to create more inventory, new home sales could be higher this year despite increasing mortgage rates,” Yun said. “This underscores the importance of increased inventory in helping to get the overall housing market moving.”

“I do believe that we’re going to remain in a higher rate environment for a while, though,” he said.

IMHO, 1+ years. Almost certain no rate cuts in 2024.

The yield on the 10-year Treasury — which fixed mortgage rates follow — momentarily surpassed 5% this week for the first time in 16 years. Concerns about the economy, geopolitical worries, and the Federal Reserve’s insistence that its benchmark rate will remain higher for longer have all propped up the 10-year Treasury yield.

Won’t drop till USG stops messing with non-democratic nations and re-adopt globalization.

Kevin called it re-globalization… apparently Yellen implies the long term interest rate would resume its downward trend after this “inflation” hiccup. Buy RE and wait ![]()

Ref: 1980s-style recession… transaction clash, prices drop for one year and then keep increasing.

Currently, experts think transaction will fall to as low as 3.8 million in 2024 but prices are expected to be sideways.

Wow, they didn’t even go for a click-bait headline about low volume that makes the market sound weak.

In short, while supply has not bottomed, prices have likely bottomed and are in an uptrend.

Prices in my neighborhood

Current market consensus is rate cut in mid 2024.

The Fed guy thinks Fed would cut in Q1 and next year could see crash up aka asset inflation… appreciating real estate prices and a bull stock market. Fasten your belt ![]()

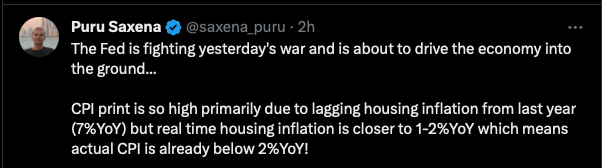

Talking about issue that he is not familiar with. Merely parroting social media sentiment.

A lot of things don’t add up. One of the reasons for soaring deficits is that revenues have fallen; it’s not just out of control spending.

In an expanding economy - even modest expansion - and with no tax cuts how do revenues fall?