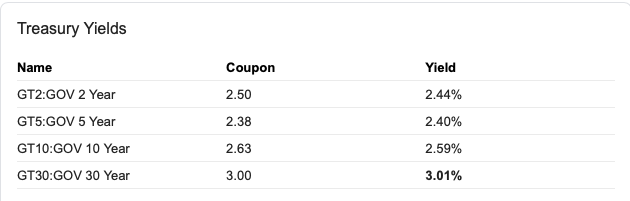

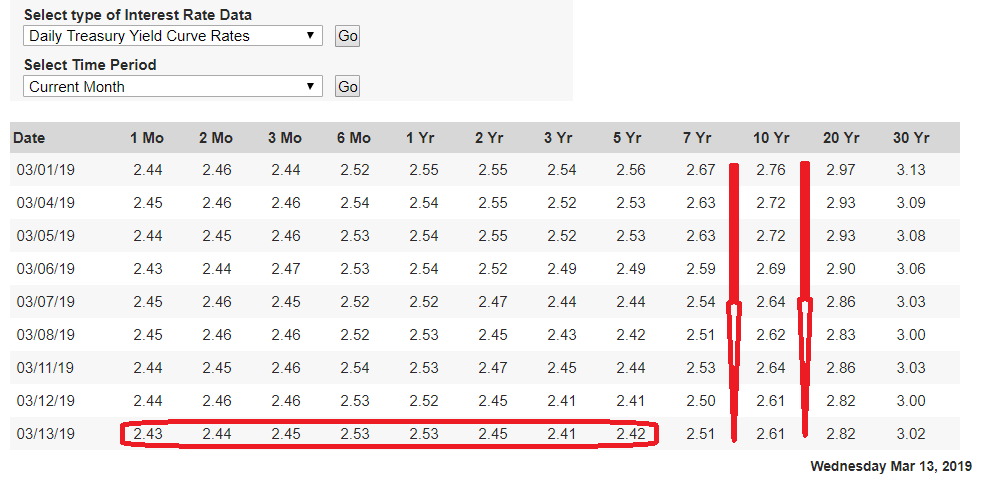

Yes I notice is dangerously about to invert. I have raised 95% cash in 10x portfolio. Wind down margin drastically in option trading portfolio and day trade in small quantities. Current rally is not very healthy. Feel like a bull trap.

since september market has been stagnating. My guess is we wil trade sideways, so enjoy lows, sell highs.

Powell says that no recession, he mentions challenges overseas.

Trade talks, Brexit, what else?

No growth in Europe low tonegative rates like in Japan

Any FED chair ever said he/she foresee recession?

If some chair says, think what will happen?

I feel the same, skeptical on the recent times market reaction.

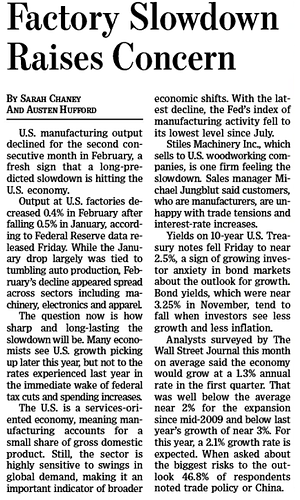

Why the Worst May Already Be Over for the Global Economy

Led by the Fed, many central banks have either held back on tightening monetary policy or introduced fresh stimulus, soothing investor fears of a slowdown. Fed Chairman Jerome Powell says he and colleagues will be patient on raising interest rates again, while European Central Bank President Mario Draghi has ruled out doing so this year and unveiled a new batch of cheap loans for banks.

Elsewhere, authorities in Australia, Canada and the U.K. are among those to have adopted a wait-and-see approach. China, at its National People’s Congress this month, signaled a willingness to ease monetary and fiscal policies to support expansion.

History shows country enter recession in 6-8 months after yield curve inversion happens. FED is Stereo typical now, telling the same over and over.

At this stage, the market reaction is scary (to attract all innocent investors believe we are fine and trap them invest) as it looks like SNAFU.

I am not sure about Powell. His words last December was scary. He should have skipped 2 rate raises last year. Damage is already done. But I don’t think we have a recession in 2019, maybe 2021 or even 2020

Powell did increase to reduce/control when economy goes to recession. Otherwise, they do not have tool to manage other than printing QE money again. This will take USA economy like Japan.

My thought process is based on history that recession hits 3-9 months after inversion. Banking/Lending operations will be reduced as there is no spread to gain.

We are clearly seeing this with mortgages, real estate operations now. YOY RE prices reduced. RE is No 1 consumer lending business.

We also see with Car payments, 7 Mln getting defaulted.

What makes you think that it may not be 2019 as we still have 9 months to finish?

I think they could prevent yield curve inversion while maintaining a flat balance sheet. As bonds mature, they just need to buy a different duration. Right now, there’s not enough demand for longer-term bonds. That’s why yields are so low. As shorter-bonds expire, they could buy longer dates ones. They’d done similar stuff before.

“Right now, there’s not enough demand for longer-term bonds. That’s why yields are so low.”

Low demand for long term bonds should increase rather that decrease their rates.

Bond price is in reverse relationship to their yield.

Higher bond price means lower yield.

Lending Market inefficiency. Lending industry needs to increase the long term rate profitably which they are not doing it.

Since FED kept long term near zero, it is hard for FED to control if economy tanks at lower rate. They just made to 2.2%-2.5% and planning to continue for 5 or more years until market comes up on their own.

Only if market long term rate improves, our economy grows after dip (likely this year).

Yield and rate are two different animals. Yield of issued bonds/loans is affected by demand of bonds/loans, coupon rate of issued bonds/loans remains the same regardless of demand. However, coupon rate of future bonds/ loans is affected by demand of bonds/ loans. Hence, if the demand for bonds/ loans are low, need to increase coupon rate of future bonds/ loans to attract buyers or sell bonds/ loans less than parity thus increasing yield.