That’s why your posts are meaningless. Stop talking nonsense and let’s stick with my original analysis.

It’s proven that your conclusion is wrong for real estate

It can not be infinity, Risk of ownership and Rate of interest until you paid off the home is there and year over year growth is also there.

It can not be infinity. It is part of your pay, you worked for it. In addition, you would have also paid taxes on some Fair market value. That is the price you paid.

If you see percentage wise, I would have gained equally well with TSLA. But, hard to calculate for me.

On any case, I understand buy and hold is always better, as long as we choose right stocks.

Knowingly I trade, that becomes a habit.

Unless I buy some stocks and forget my password, I am unable to control it.

They can both be treated as infinity because all costs were offset by rent / dividends. That means I never paid a penny. So any future cash flow in terms of rent or dividends, or the capital gains upon selling, can all be treated as infinite gain

Hand it over to @hanera. He will be more than happy to “safeguard” it for you and never allow you to touch your stocks ever again.

The calculation is not right: Here is the example.

First case: A friend bought a home during 2011 for $360k with down payment of $12k, refinanced three times cash out. Now, the home valued at $650k, with a loan of $600k.

Second case:A friend got a home $800k, later refinanced and got $1.2M loan, lived 8 years, filed Short sale sold to $700.

Third case: A friend got a home with down payment of 200k, refinanced later, got 200k back. He then purchased another home with that 200k, refinanced later got the money back, purchased another home…he ended up buying 5 or 6 homes with original 200k part of it.

All these are complex calculation and definitely have initial investment, mortgage payments (leverage) and risk.

The profits can not be infinity.

This is what exactly TSLA is doing with repeated loans, making a big investment projects with his innovation without diluting shares. This is similar to Amazon and NFLX operations, high P/E, but risky adventure.

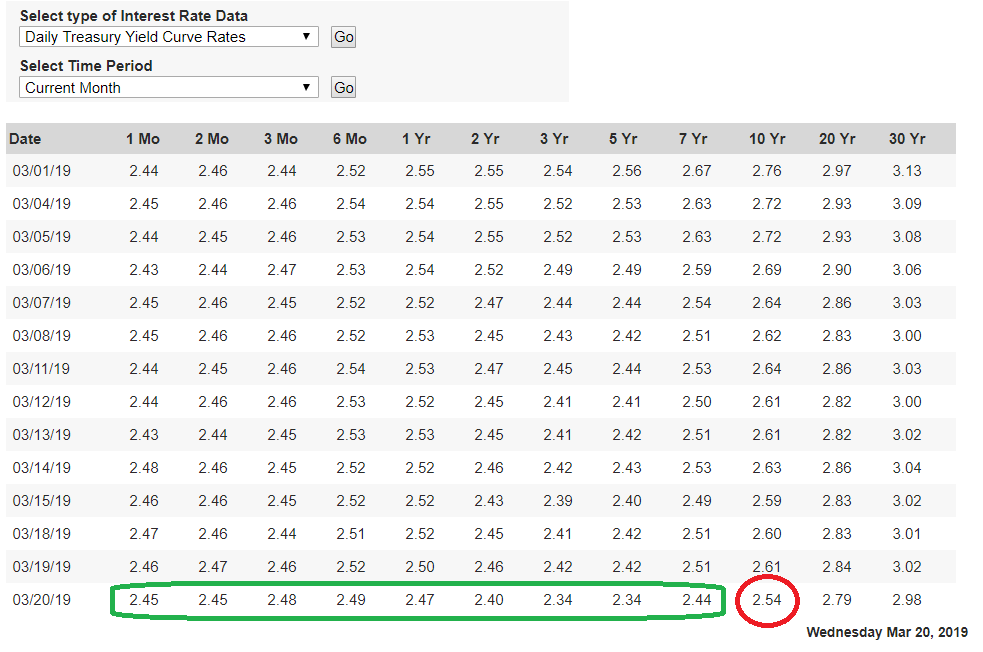

It is possible that current bond price + interest is less than purchase price of bond.

Good to hold or have to hold ![]() because of above.

because of above.

Talking about Primary or rental? Please include cost of mortgage, maintenance & repairs, asset replacement, if rental (vacancy), property tax, tax deductions, etc. After account for full expenses and true capital invested, is much less.

Exactly. Many people have difficulties using the right denominators to compute return. Is like statistics damn statistics, statistics didn’t lie, people make the incorrect inference.

The only ONE way to get rich, filthy rich, BUSINESS. Even WB is running businesses besides owning many partial businesses.

![]() Can only connect the dots going backwards.

Can only connect the dots going backwards.

Refinance means should include the cash out as part of the computation of return of the package (RE + whatever investment made by the cash out). Is no longer a pure RE investment anymore.

Actually your pay check should somehow involved since mortgage amount is affected by it.