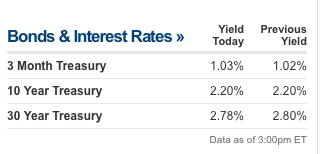

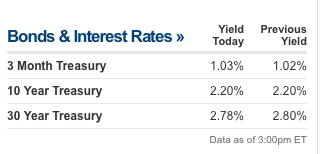

Jil brought up that inverse yield could lead to recession. So is relevant to monitor the difference in yield between 10-year Treasury vs 30-year Treasury. Today, yield difference is 0.58%.

Jil brought up that inverse yield could lead to recession. So is relevant to monitor the difference in yield between 10-year Treasury vs 30-year Treasury. Today, yield difference is 0.58%.

Can you report every week?

Even if yield got inversed, still can’t sell AAPL.

Why not? FB and AMZN have more upside than AAPL.

Because need to pay a lot of tax after selling.

You can watch it daily here

Do not compare 10 year with 30 year.

The theory is when short term (1 month or 3 month) yield exceeds long term (10 year or 30 year) yield, we are bound to face recession.

Economy is aggressive on short term gains (day trading) than long term (investing). This means everyone is getting quick money, but not really stable long term return.

Below are fine.

3 month vs 10 year

or

3 month vs 30 year

Does the inverted yield cause a recession or does inverted yield happen because of recession? I think it’s the later.

Who would buy a 30-year or even a 10-year treasury? The rate sucks and you have zero protection against inflation.

Practically, when someone assures me 10% (Yearly ROI) for a month and 10% (Yearly ROI) for 10 year note, I would prefer to choose 1 Month. This means basically I can get same or better returns shorter instrument than long term instrument.

Lenders are working on spread and processing fee, quick money and borrowers taking quick cash, and earning higher return in shorter period.

For example, recently my friend was telling me that he invested 150k in stock and borrowing 150k margin to make quick return. He locked it with TREE made 100% returns in a year. He is aggressively looking for quick returns. Many follow here aggressive on quick returns.

For example, nowadays no one has a fear to overbid a home as they think home prices are going up forever. Similarly, equities were spiraling easily during such period, people borrow short term, buy stocks and sell soon with higher returns.

After 4 FED rate raises, Short term increased to 1% to 1.125% level while long term reduced from 2.5% to 2% level.

Two things are happening.

Yes, inverted yield shows the sentiment of investors/lenders/borrowers…etc going for short term gain. When this happens, prices are spiraling madly and bullish economy can not long last later.

What is going to keep AAPL rising? More $1000 phones??? Who needs them ??

Materialistic people who like to show off and always need the latest and greatest gadgets…

iPhones are replaced within 1-3 years. There is a subscription program where you can get yearly update of iPhone + AppleCare… very reasonably price… many consumers subscribed… so guaranteed revenue for Apple. There is a company called Brightstar that buy second hand iOS devices in US and sell to emerging economies. So the number of iOS installed base is rising and very large… these guys buy apps

iPads are extremely useful, Macs are very good… replacement cycle is a bit long though… about 5-7 years because quality is too good.

Apple Watch is now the number 1 watch company  Selling tons of them.

Selling tons of them.

AirPods (wireless EarPods) are so white hot… mine arriving on Sep 22… still can meet demand after 1 year… demand would increase some more because of cellular Apple watch… AirPods are insanely great… use it once, you won’t do without.

Dividends ![]()

1.58% at current price.

Compared with dow dogs: JNJ 2.54%, PG 2.95%, KO 3.16% which all serious dividend investors keep buying, AAPL is a bargain that even WB can’t resist buying in.

At this point of time, only three stocks I dare to go all in: AAPL, FB and NVDA i.e. FAN ![]() but since I’m all in AAPL, no point replacing AAPL with the other two for the same reasons as you.

but since I’m all in AAPL, no point replacing AAPL with the other two for the same reasons as you.

Cellular Apple Watch + AirPods would help AAPL hit $1T pretty soon… their revenue should one day rival iPhone. Don’t buy AAPL today is already bad, sell??? Some people always think like traders and don’t seem to get what is meant by an investor.

I understand go all in with AAPL and FB. Don’t know about NVDA… too fast too furious.

Same reason, I can’t go all in with TSLA and NFLX either… too much too soon.

Latest forecast: 2.2 percent — September 15, 2017

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2017 is 2.2 percent on September 15, down from 3.0 percent on September 8. The forecasts of real consumer spending growth and real private fixed investment growth fell from 2.7 percent and 2.6 percent, respectively, to 2.0 percent and 1.4 percent, respectively, after this morning’s retail sales release from the U.S. Census Bureau and this morning’s report on industrial production and capacity utilization from the Federal Reserve Board of Governors.

Apparently relatives giving baptism/birth gifts.

As I said already, version 6 , 6 plus getting outdated and be recycled with 8 or x.

$999 do not care, iPhone X will fully booked on first day oct 27th ! In market, money is there to buy any quality item and Apple is known for quality.

Dec 2017 Apple qtr alone profit is likely reach $18 billion.

All these are calculated and accounted by big brother like warrant buffet before putting billions on AAPL!

Would be nice if you could do a 1031 exchange for stock, right?

There is a way… You can set up your property as a REIT… Then exchange into another property set up as a REIT

You can if it’s in a Roth IRA account. I’m sure most people here don’t qualify to contribute. I still have one from when I started working. IRA account lets you defer the taxes. Granted, both mean you can’t remove the money until you’re 59.5.