SF could become a Detroit situation. While Detroit was declining the surrounding areas flourished. People and businesses moved to the suburbs. San Jose could benefit a ton. It’s much safer than SF.

.

SJ should expand the airport so tourists don’t have to transit in SF.

Hopefully, EM manages to persuade Austin to expand Austin International Airport, so don’t need to land in SF and SJ, directly to Austin ![]()

If you believe history repeats itself, SF will evolve and change once again. It has always been a boom and bust town, but yet has remained way more than relevant.

SF is an international city. San Jose, uh, no.

Based on what.

- Tourism is plummeting and leaving bad taste.

- Homeless, crime, filth everywhere.

- Businesses leaving one after another.

- Citizens are leaving too.

- Food scene and nightlife scene all getting worse by day. In some stupid peoples mind SF is still a great place to hand out but based on last 2 years of visiting SF, its difficult to find even a decent restaurant or service there.

- Techies are displacing whatever was left, and now techies themselves are going to be displaced.

Detroit was lost as car and banks filed bankruptcies during 2008-2009.

The current correction/recession wave does not destroy the tech industries, but adds WFH as norm for some parts of tech workers.

The industry will still grow with productivity, cost reduction in overhead, employees can be hired anywhere in USA or world for the same work they perform locally.

It will stabilize real estate rather than going like Detroit. But, WFH sure will affect CA government and NY government charging high income and corporate taxes.

Now, tech work force becoming world wide commodity than local hiring. Next transformation is taking place in USA.

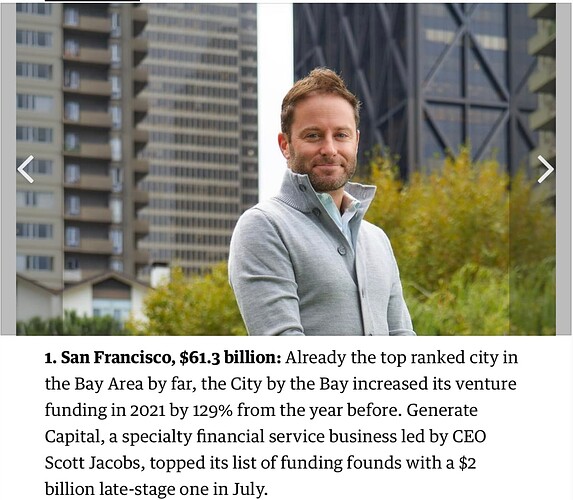

And San Francisco alone, a city of only 800K people, has 6x the VC funding as the entire state of Texas, pop 30m.

Detroit was like that too in its heyday.

SF had its Detroit moment in the 70s. The hippie invasion progressive politics and racial strife turned the City into a shitshow. 100,000 people left. The recovery took 15 years. But RE prices kept going up. Time abides. Detroit will always have bad weather. SF will recover

Every top city in its heyday looks alike. Doesn’t mean every one of these top cities will all decline like Detroit did.

People should really study Detroit’s history before throwing that analogy around.

Ok, that’s laughable to say people should study Detroit’s history.

Meh, even Curry misses a shot now and then…

I would bet SF recovers waaaaay before San HO becomes an international city (LOL). yeah, emphasize the HO part…

Must I repost this??? What has changed in SJ? A great hockey team? Nope…

Oh, wow, wonderful rings with lights in the downtown??? Please…

San Jose Is The Most Forgettable Major American City | FiveThirtyEight

Now that rates are just a hair under 6% (again), the case for renting and waiting is stronger than ever. Don’t think house prices will zoom up crazy anytime soon. Rent for now and put the money into stock market sounds like a better plan than sinking all in to real estate at this point in time. House prices two years down the road won’t be that much more expensive compared to now. They may even get cheaper although that’s a low probability event.

I disagree house prices will go sideways. I bet we are at the front end of a 40+% decline in home prices. If anything mortgage rates will keep pushing up as Fed unwinds MBS and raise rates.

I anticipate at least a 30% decline from here. People holding onto a home just because they have a low interest rate will surely be tested as their home values go below their purchase price !

Is why I say the article that said got equity + low rate then wait is dumb. If for whatever reasons want to sell, sell now.

So long is TSLA or AAPL or S&P, is a good plan.

House prices are sticky on the way down. People making payments on their 3% mortgage aren’t hurting for income. Investors may have incentives to sell because they don’t need a replacement home. Home owners though will need to buy something else if they sell. They are far less likely to sell in a 6%+ rate environment.

In the Bay Area stalemate is the most likely scenario, not a 30% price collapse. Fringe towns like Austin and Boise that have seen huge price gains though, I am not sure.

.

Jealous?

I hesitant to make any guesses to price trend. Too many factors, pros and against, happen at the same time. Prices spike nationally, not just in a certain city or a certain state, spike nationally, by different amounts. Saying one place is more or less likely to decline more or less won’t be correct, regardless of the reasoning. For whatever reasons you want to sell, just sell. If buy for Primary, just buy. If buy for investment, just wait, stay cash, too much uncertainty.