Nobody believes you. In fact inventory is shrinking. The only sellers will be the 3Ds… which means only a desperate seller will sell now. The rest will ride out any downturn and can easily get high rents if they choose to move.

![]() With all due respect, need people like you to catch the falling knives and get bloody hands in buying the dips in next 3-6 months.

With all due respect, need people like you to catch the falling knives and get bloody hands in buying the dips in next 3-6 months.

Many such people out there hoping that Fed will save them from losing their pants.

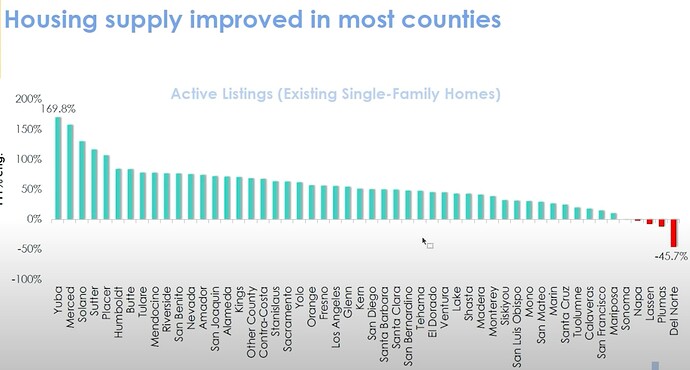

“Not enough inventory” is a myth that just won’t die. There’s plenty of inventory. Do your research. There will soon be glut of both existing and new homes, its coming.

.

Depends on how you measure.

In terms of months of supply, new construction is at ~10 months, yes a lot.

In terms of number of units, can’t remember quantity, is less than potential demand especially in 2+ years later.

It may be like this => So long is TSLA or AAPL or QQQ/SMH, is a good plan.

That’s pretty useless. Everyone knows days of supply is the correct metric. Also, you should compare to 2019. 2020 and 2021 weren’t normal years. Last I saw, inventory is about half 2019 levels. By your logic, 2019 should have been a huge crash.

July median time to get under contract was still <20 days. That’s not an indicator of excess inventory.

Article above clearly shows supply is extremely low compared to demand.

People love to pretend the world is a single variable equation, and their variable is the only one that counts. Multi-variable math is hard…

The RE industry and agents have been spinning this shortage story forever. There is a permanent shortage of homes according to them and still there are record high vacancies. In US there is one home per 2.3 citizens. That’s more than one per family of 3 or 4. And glut of new ones are coming. With dying population and little to no immigration if anything there will be glut of homes.

Real estate is more localized. It’s like me saying usa median price is $428k and mean is $348k so it should be easy to buy below $500k home in Bay Area. Anyways we have to wait and see.

But keep in mind that work from home or hybrid makes it less localized. I strongly believe we will be back to office soon but many folks on this forum do not think so but still keep drumming about forever RE price growth.

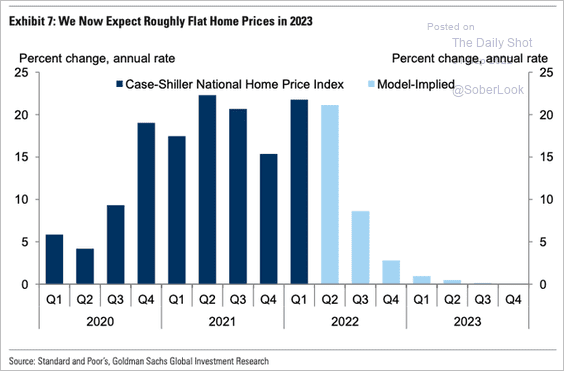

I’m not an expert but we saw a glimpse of purchasing power of people driving it 40%. Now the decline may be there’s a waiting game. Imagine ppl saving again for down payment and in 2023 if rate becomes 4.5% then again it will go up. Unless there’s mass layoffs I don’t see drastic reduction in price but there will be decline. Just my prediction and I might be wrong.

That % is smaller. I’m not sure whether that would affect drastically.

Various reliable economic sources, such as The Ascent, seem to confirm that mortgage demand will also keep falling in the future. There is a real possibility that mortgage applications could drop by approximately 33 percent in 2022. This event will support the general public opinion that relatively more affordable renting has become part of the American Dream. A shortage of available homes to purchase on a budget and the lagging building of new residential properties only enhance the US rental market’s potential. Still, suppose you wish to think about accomplishing long-term family goals. In that case, you shouldn’t throw the idea of buying real estate out of the window, even if it implies more substantial monthly payments.