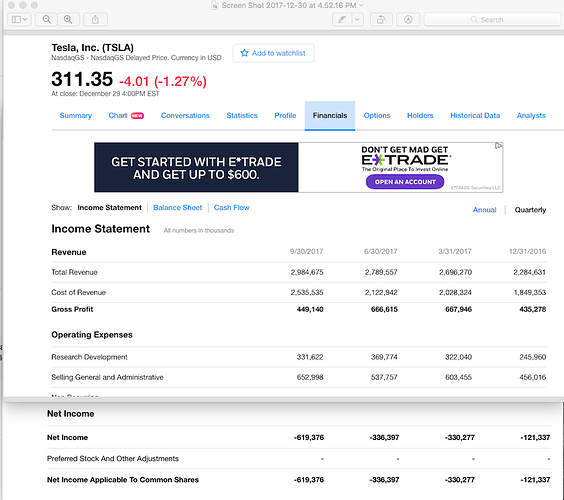

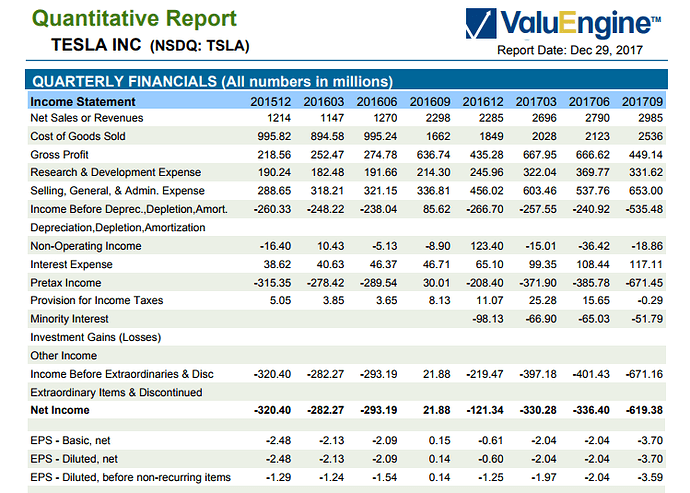

Financial Viability. The sum of the most recent four consecutive quarters’ Generally Accepted Accounting Principles (GAAP) earnings (net income excluding discontinued operations) should be positive as should the most recent quarter.

So basically Tesla is not financially viable enough to be in the SP500… lol

Source: https://www.wsj.com/articles/for-tesla-deliver-dont-promise-in-2018-1514564541

For Tesla, Deliver, Don’t Promise, in 2018

Elon Musk needs to make Model 3 dreams a reality to keep credibility with investors

By Charley Grant

Updated Dec. 30, 2017 7:09 p.m. ET

Elon Musk is best when he sketches out Tesla Inc.’s TSLA -1.27% distant future. In 2018, Mr. Musk should focus on the mundane present.

The new year will present Tesla’s greatest operational challenge. Rather than issuing promises of an electric semi truck, a new sports car and a pickup truck, as he did in recent months, Mr. Musk needs to figure out how to produce hundreds of thousands of mass-market sedans at a profit.

If he can’t, Tesla could find itself trying to raise capital in a less-friendly market, meaning his highly loyal shareholders could be hurt by a wave of stock issuance. So far, the investors have forgiven Tesla for its production problems. Shares were up 47% in 2017, and Tesla’s market value of $53 billion rivals that of Ford Motor Co. and General Motors Co.

But the gaudy stock performance belies a more-troubled picture.

Tesla delivered just 220 of its Model 3 mass-market sedans in the third quarter, well below its forecast of 1,500. Tesla, which will report fourth-quarter deliveries next week, said in November that it hopes to achieve a production rate of 5,000 cars a week by late in the first quarter of 2018, after previously predicting it would hit that milestone this year.

More downward revisions to growth expectations are possible. Analyst consensus calls for Tesla to deliver about 180,000 Model 3s next year; it will be very hard to hit that estimate without a quick ramp-up in deliveries.

The Model 3 was supposed to generate big profits for Tesla but is nowhere close to doing that. Analysts expect an adjusted loss of $8.76 a share in 2017 and $3.81 a share in 2018, according to FactSet. A year ago, those analysts expected a loss of 97 cents a share in 2017 and a profit of $1.59 a share in 2018.

Tesla investors have always been willing to forgive overly aggressive forecasts. But heavy capital spending to bring the Model 3 online, as well as Tesla’s 2016 acquisition of SolarCity, have strained the balance sheet. That, along with fresh electric-car competition from rivals, means increasing urgency to actually deliver on these promises.

The stock has sold off nearly 20% from September’s recent high. Tesla needs to keep its share price high, since it uses the capital markets to fund its operations. More debt doesn’t seem like a practical solution—Tesla issued $1.8 billion in bonds due in 2025 over the summer; those bonds now trade below par. And the lower the stock price, the more any new equity raise would dilute existing shareholders.

Don’t underestimate the challenges Tesla faces. The company has never produced a fraction of the cars it needs to deliver, and it has never made a profit while selling far more expensive vehicles. Producing more cars won’t solve the problem without quantum leaps in production efficiency.

Mr. Musk has taken this company farther than almost anyone expected. In the coming year, he will be judged on operations, not hype.

Write to Charley Grant at charles.grant@wsj.com

Never made a profit… and never will… Biggest con job in American history… the most valuable car company based on stock value in America can barely make any cars and takes huge losses.

Shows you how little investors think of Ford and GM…

Musky should sell to the Chinese and concentrate on rockets

GM has recovered by competing with Tesla.

TSLA will make it as they are selling expensive cars and the front runner in technology.

Waiting fro TSLA to touch $300 within next 15 days.

What’s to stop it from going to 190?

Curious if you watch 175 stocks, why bother with this one?

TSLA is for Quality, people are ready to pay premium, and demand is there. Even though I bought GM Bolt, I am waiting for one more Model 3, not canceling the model 3 deposit.

There is some management issue in delivering, but soon will go away. My friend is working there and the whole company operations are working round the clock to make this happen. Almost 18 months they are struggling to make it work.

Keeping the demand, Musk is dispatching high end model S and X, lowering the model 3 priority, as he gets lot of profit on high end cars.

Demand is there, in spite real competition from GM Bolt, revenue if increasing qtr by qtr. With this, Tesla will soon hit the profitable range and meeting the demand.

The current price trend is going down cyclically and turn back at $300 level. IMO, Unless economy gets corrected, TSLA won’t come to $190 level.

Well it won’t pay a dividend so you are picking a trading range… 300-360?

Out of the 7000 stocks, I applied filter to reduce the scope to 150 stocks. My filter did not pick up TSLA, AMZN, NFLX, but I manually added them.

I will be monitoring these 150 for this year 2018, but this is too high for me. l further reduced to 50 stocks keeping TSLA, AMZN, NFLX.

Reseaching/Reading those stocks one by one. Most of them are well known stocks like AAPL, GOOGL, BA, FB…etc.

why bother with this one? IMO, Tesla is still in early stage with 50B. This has potential to reach 500 B in next 10 years. Unless there is a downturn, TSLA is good to hold for long.

Out of the 7000 stocks, I applied filter to reduce the scope to 150 stocks. My filter did not pick up TSLA, AMZN, NFLX, but I manually added them.

I will be monitoring these 150 for this year 2018, but this is too high for me. l further reduced to 50 stocks keeping TSLA, AMZN, NFLX.

Reseaching/Reading those stocks one by one. Most of them are well known stocks like AAPL, GOOGL, BA, FB…etc.

I have 28 dividend paying stocks and 22 non-dividend paying stocks out of 50 selected. Still trying to reduce the list.

why bother with this one? IMO, Tesla is still in early stage with 50B. This has potential to reach 500 B in next 10 years. Unless there is a downturn, TSLA is good to hold for long.

TSLA I am looking for growth, not for dividend.

$500b is more than all car companies combined worldwide. I just don’t see it . Electric cars will soon just be a commodity like refrigerators… in fact if self driving actually happens the demand for cars will drop 90%

Musky is smarter to sell and let someone else produce for the masses

This is not now, but in 10 years. Worst case scenario, this may cross 200B easily.

The jump will be steep when it makes profit and catering the demand and then flat thereafter. Once it becomes flat, I will come out (unless there is a recession in between).

If you really look at dividend returns, TSLA is not the correct one.

For dividend side, you are too good with your BP stock

Presently, GSK (GlaxoSmithKline plc) is at its low end with good dividend 5.67% return as of now. It is like your BP stock at this stage.

GSK payout ratio is more than 160%, but they reached 10 years low, almost 2010 price level.

I like TOYOTA… 10 million cars a year almost 480b in profits . Value of $188b

They can build electric cars easily… And when it’s profitable they will…

But the issue is technology/innovation. Honda, Toyota, BMW, Benz and Nissan are struggling to meet TESLA level. GM is the only company so far able to meet TSLA range. Chinese BYD is also trying to make battery technology, but no match to TSLA so far.

The key is Gigafactory, largest infrastructure he created. TSLA has lot of chargers across USA and they support 100 KWH speed while other commercially available is around 50 KWH range.

Most likely, Tesla will get out of this production mess this year 2018.

With GM bolt, 200+ range. I am able to reach easily SFO and come back with a single charge. Tesla range is even 300 miles now for model 3.

The Prius is the best of breed. Toyota can buy batteries or make them in China. They will lead the electric car field

Musk knows he will never produce 10m cars a year

That’s fine. It will be acquired by Apple and together they will produce 100 million cars a year.

Are you the Author?

Great minds think alike…

However, I think the companies will probably merge when one of them Is in trouble. If both companies are doing great on their own, then no merge will happen. So 2018 is probably not the year this will happen.

They have one thing in common… don’t know how to mass produce cars