.

Guess this is the type of free speech you like. A non-expert with no data and no staff commenting on an expert with lots of data and staff.

Weird market. Even the gun stocks are down. Usually contrarian. Smith and Wesson is down 50% at $9. Likewise gold oil and commodities all down… inflation will end soon.

Market down before FOMC announcement is good. We don’t want JPow to talk hawkish. Every time market reacts positively, JPow talks down the market.

Dow up 200 points. Debating selling my dogs for tax harvesting now or waiting

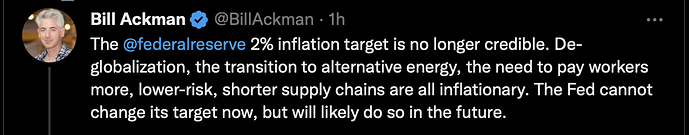

All I understand is Bill Ackmann too feeling the pain of FED!

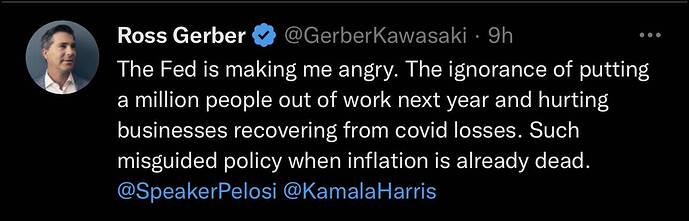

Recessions are directly affecting fund managers income by multi-millions! They want FED to stop raising rates by accepting 3% inflation.

However, 3% inflation will affect the common people living by paycheck to paycheck.

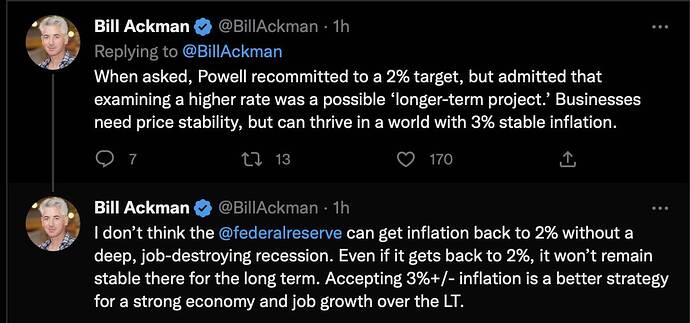

Bill Ackman is day dreaming or may be he is cornered. Below is the exact words from Papa Powell.

“Changing our inflation goal is something we’re not thinking about. It’s not something we’re going to think about. We have a 2% inflation goal, and we’ll use our tools to get inflation back to 2%,” Powell said. “The committee – we’re not considering that, and are not going to consider that under any circumstances. We’re going to keep our inflation target at 2% and use our tools to get inflation back to 2%.”

Welcome to 7.5-8% mortgage. Only Stevie Wonder would think that this + layoffs + remote work + recession would not kill Bay Area RE price bubble.

Consumers are exhausted and tapping out. This isn’t surprising given the drop in savings and increase in CC debt that’s been happening. This should help unwind inflation at an accelerated pace now.

Anger is step 2 after denial. This jackass investor needs to go back to elementary school.

I thought if we use current market rents then there is deflation already? Prices of everything seem to be down quite a bit from spring highs.

.

Seasonally, rent declines from Nov till Jan.

That’s what I thought too. Inflation is only a cover for increasing rates to achieve other goals.

I think imploding crypto was one of them. I wonder when they’ll consider that war won.

Giving Fed a hard time… hike rate more!

The fed could do nothing and we’re on a glide path to lower inflation.

Higher interest rates CRUSH certain industries. Most people finance a car purchases, so it’s going to hit the auto industry first.

What is this phenomenon? Not anchoring, right? Gaming?