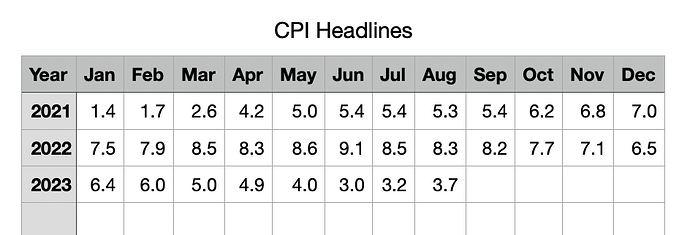

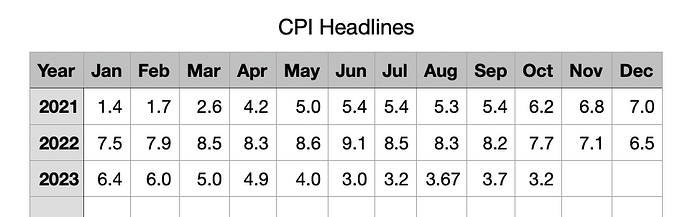

Sep 13, 2023

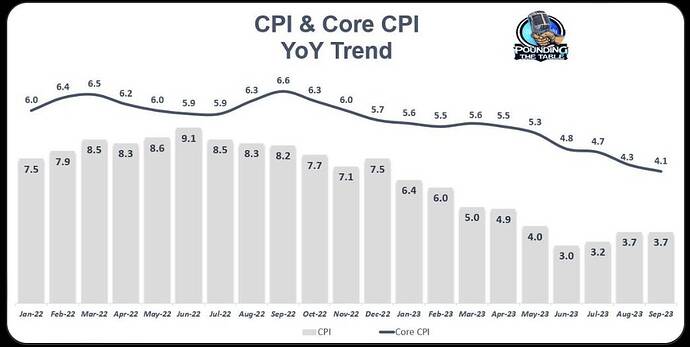

CPI YoY 3.7%, expected 3.6%

CPI MoM: 0.6%, expected 0.6%

CPI core YoY 4.3%, expected 4.3%

CPI core MoM 0.3%, expected 0.3%

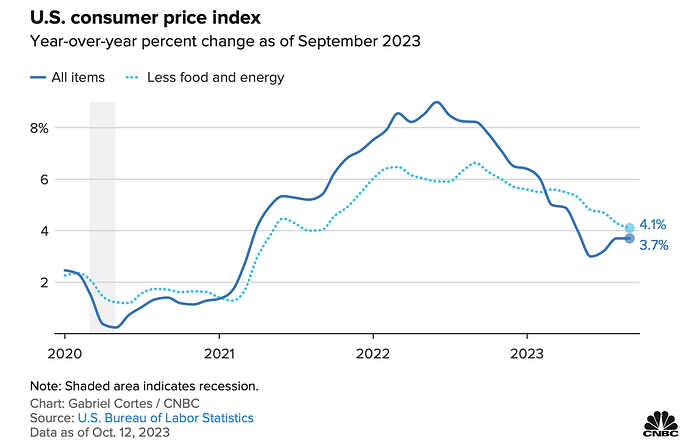

Oct 12, 2023

CPI YoY 3.7%, expected 3.6%

CPI MoM: 0.4%, expected 0.3%

CPI core YoY 4.1%, expected 4.1%

CPI core MoM 0.3%, expected 0.3%

That variance is tiny.

Oil should help.

If EV’s are part of the index that should help even more ![]()

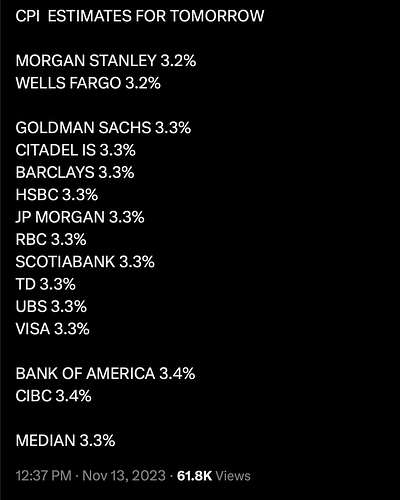

Nov 14, 2023

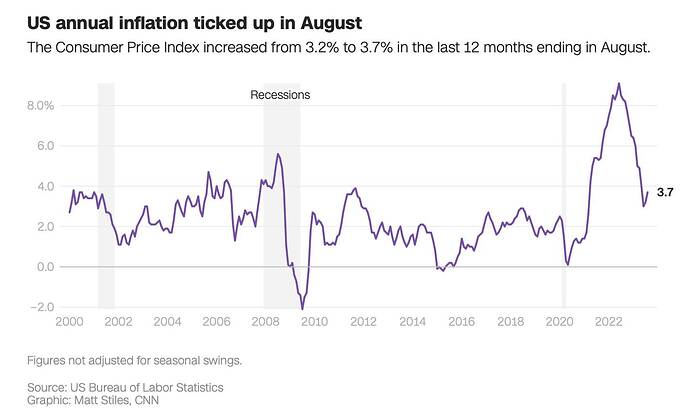

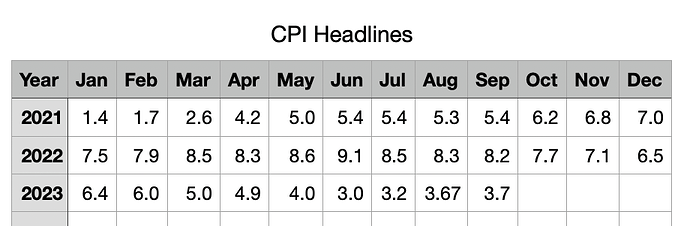

CPI YoY 3.2%, expected 3.3%

CPI MoM: 0.0%, expected 0.1%

CPI core YoY 4.0%, expected 4.1%

CPI core MoM 0.2%, expected 0.3%

Fed has no excuse to hike anymore. I think that’s it. No more hikes.

We can now have our face ripper rally.

Depends on oil prices. Could be fickle.

Core is ex food and energy. That’s all Fed is targeting.

.

Fed can’t cut rates unless democrats are serious in cutting expenditures and stop giving free monies.

![]()

Since when it became a criteria? Go back to all the past episodes when the Fed cut rates. Did the deficit increase or decrease in the year prior?

Read between the lines.

Nah. It was never a requirement, or else the Fed will never cut rates.

Also I don’t know where this idea that Democrats increased deficits while Republicans decreased it came from. In modern times Reagan, Bush and Trump increased deficits, while Clinton, Obama and Biden decreased it.

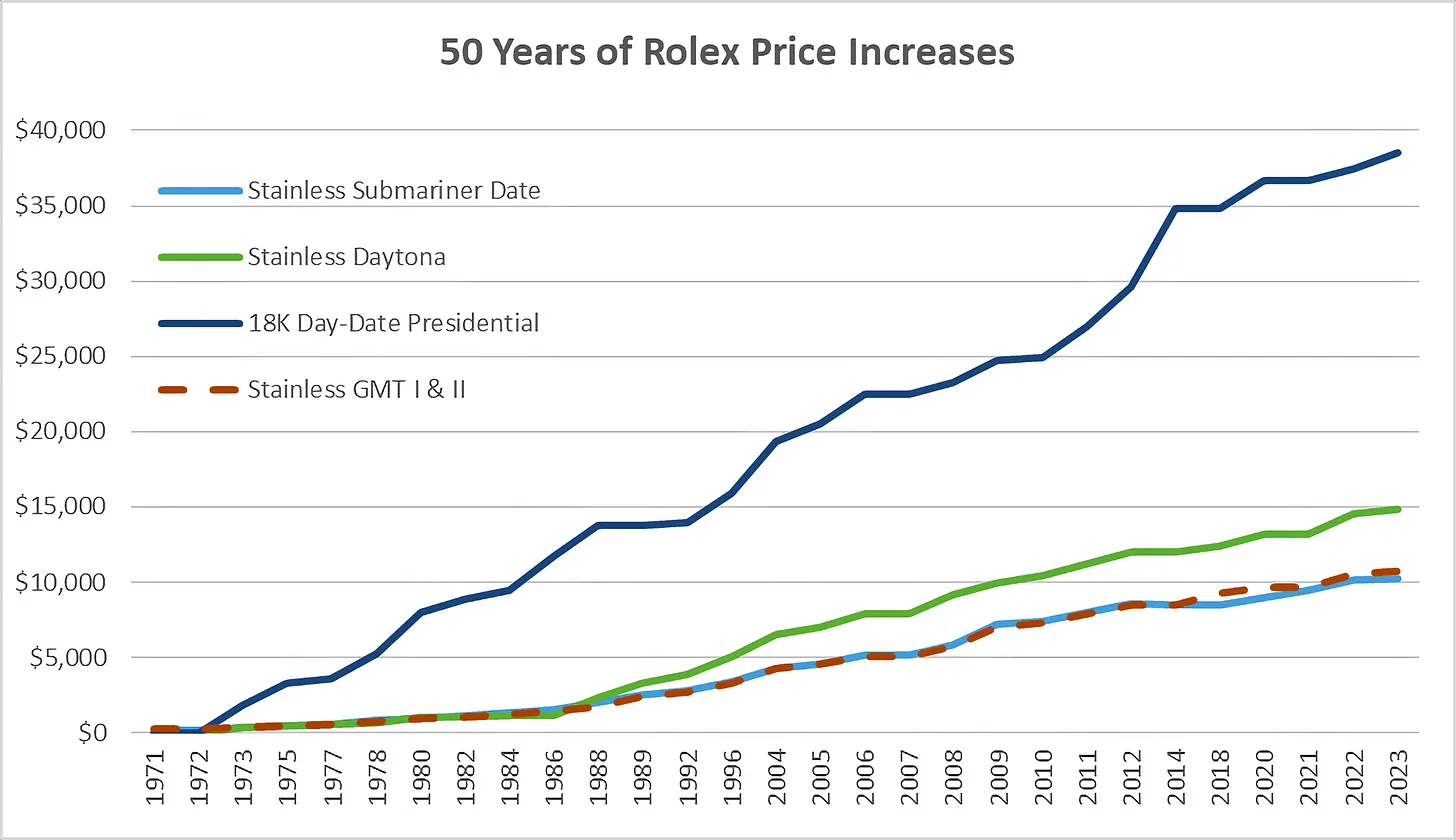

Forget about gold. Get a few dozen Rolexes as inflation hedge.

Average yearly price increases of 6-8%. This is what pricing power looks like.

These are retail prices at Authorized Dealers, not what they trade for in secondary market (eg Daytona goes for 2x retail)

Submariner saw the highest price increases at 8% CAGR, Day-Date the lowest at 6%. Difference mainly being low starting base

A Submariner cost only $180 in 1971, while a Presidential Day-Date (18K Gold) cost $1850 in 1973.

Over the next 10 years, Rolex Gold watches rose significantly in price (5X or 17% p/yr), mainly to position as a luxury brand given the Quartz crisis (competition from Japan)

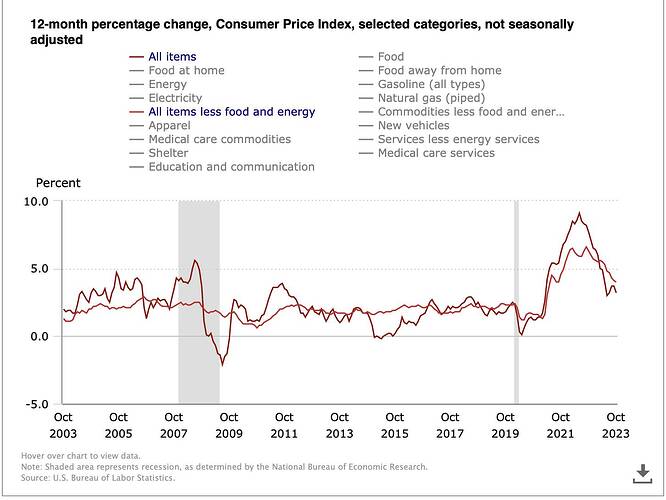

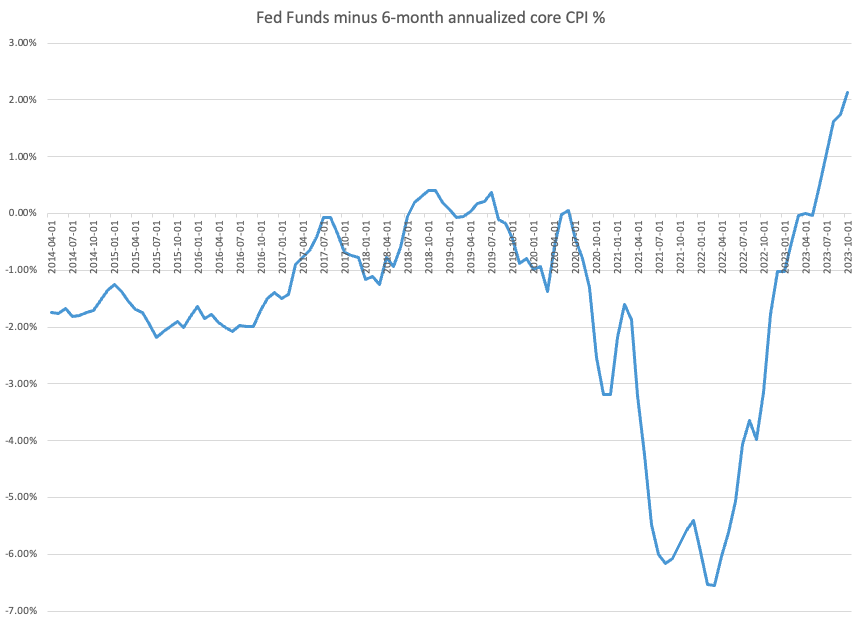

Fed fund rate history chart. Note that after the Fed stopped raising rate it soon started cutting. The longest period they maintained high rate was between Jul 2006 and Jul 2007, a whole year. But then GFC happened and the Fed can’t cut fast enough. All the way to zero + QE infinity. I think there is enough institutional memory at the Fed to never let that happen again.

I think Fed is likely done hiking this cycle. Recent Fed officials speeches look pretty dovish to me. The last hike happened in Aug 2023, so we may actually see a rate cut sometime in H1 2024.

If true stock and RE will

![]()