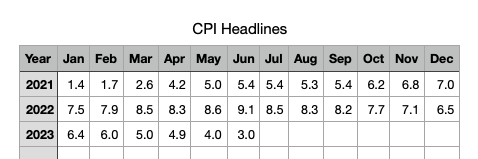

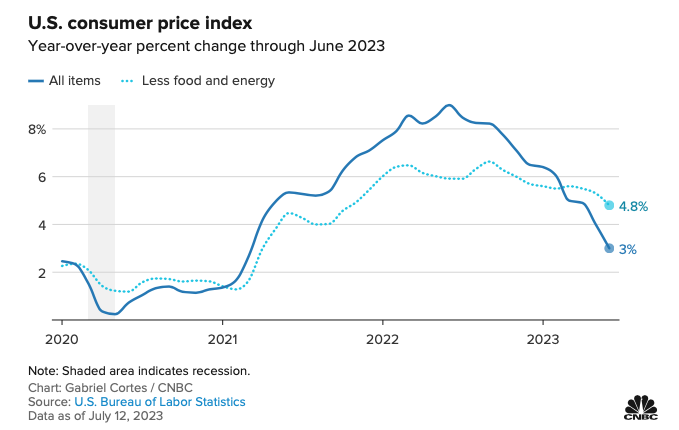

CPI YoY 3.0%, expected 3.1%

CPI MoM: 0.2%, expected 0.3%

CPI core YoY 4.8%, expected 5.0%

CPI core MoM 0.2%, expected 0.3%

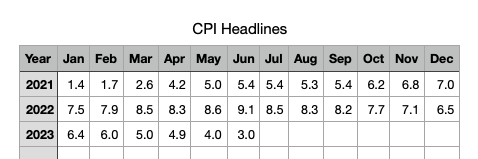

CPI YoY 3.0%, expected 3.1%

CPI MoM: 0.2%, expected 0.3%

CPI core YoY 4.8%, expected 5.0%

CPI core MoM 0.2%, expected 0.3%

Haters

Up or down? Many debates.

Obviously inflation wasn’t transitionary… has been coming down because of Fed rate hikes.

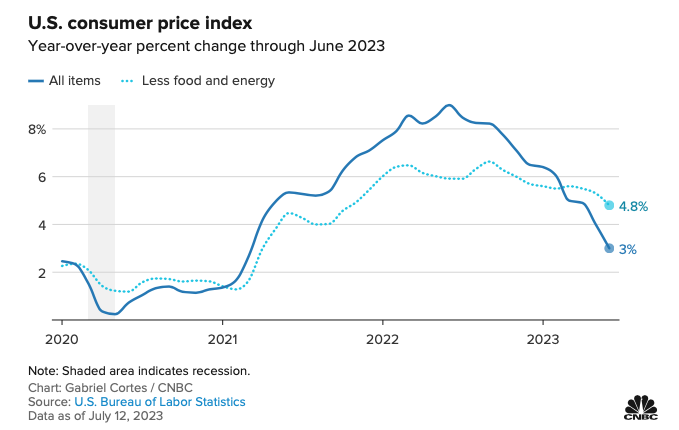

CPI YoY 3.2%, expected 3.3%

CPI MoM: 0.2%, expected 0.2%

CPI core YoY 4.7%, expected 4.8%

CPI core MoM 0.2%, expected 0.2%

Alternatively, rent remains steady (has been weakening in certain zip codes in Austin MSA) while RE prices resume downward trend after a few months (Feb to now) of re-acceleration.

Retail companies are starting to off load their excess inventory to discount retailers. Also, consumers are pulling back on spending or at least shifting it. At some point, consumers will hit their debt limit, and they aren’t the federal government. They can’t just increase the cap. They’ll have to spend less and servicing their debt will take up a bigger share of their spending.

.

In recent 1-2 months, I notice restaurants are getting less crowded. Could be seasonal. Or inflation is biting.

Oil needs refined. How much refining capacity have we added? I can’t find anyone that’s done a recent analysis including this year. I suspect we are getting a bigger and bigger deviation between oil and gas prices. We definitely have a huge deviation in gas price by state. The west coast is paying far more than everyone else.

Not only that but as long as demand slowly increases there will always be a need for “record” amounts of oil. Until the population actually starts to decline we will also need a “record” amount of housing. All nonsense numbers. Oil is back over $80 a barrel.

Well US refinery capacity is also increasing, and Republicans also don’t care.

Labor market is slowing in terms of pay:

Aug 31, 2023

PCE, yoy: 3.3%, expected 3.3%

PCE, mom: 0.2%

Core PCE, yoy: 4.2%, expected 4.2%

Core PCE, mom: 0.2%

Personal Income and Outlays, July 2023

Now the market is expecting now rate hike in September. Mortgage rates are down about 0.5% from the peak.

“Professionally managed” places are so expensive…