It has been like this since noon. Looks like Too many hits…

You have set up some type of custodian account. The treasury direct site has instructions or maybe Google somewhere with step by step instructions.

I don’t have kids so never did it myself.

I found the link or at least a discussion on gifting at bogleheads.

I didn’t know you could gift I bonds - hope you all go to sleep soon and the site comes back.

The monthly numbers aren’t cooling yet. The YoY numbers are better, because it’s a comparison to higher inflation last year. I pointed out months ago that YoY numbers would decrease late in the year even if inflation didn’t actually improve.

Cannot catch a break

The govt system is probably on Windows 95.

Widows? Have a Mac ![]()

I was able to finally get in and buy some I bond gifts last night. Took me 2 hours of trying.

yay!

small ka-ching ![]()

Still costs way too much and takes way too long.

Are you kidding? It’s probably a 1980’s era IBM mainframe.

![]() you’re likely right.

you’re likely right.

I used as400 at my old work. It wasn’t pretty but that thing was lightening fast. Couple years later we “upgraded” to some slick software with fancy interface. It was buggy and laggy as hell.

But the Fed only cares about data that’s a year old.

![]()

Asking rents down sequentially two months in a row after seasonal adjustment.

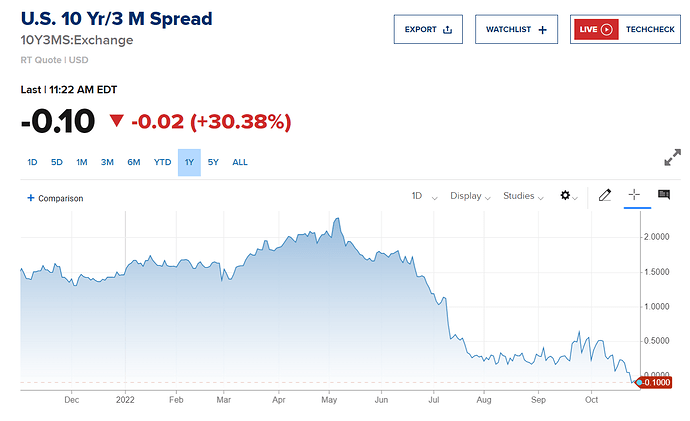

Inflation getting controlled as I-Bonds rate is reduced, but market may go trash as final leg when Yield curve inverted clearly.

FED will stop all rate hike by Dec 2022!

.

So confident?

The consensus is Nov 0.75 Dec 0.5 Jan 0.25 Feb 0.25. Even GS bows to this consensus.

Inflation - Market tumbles

Recession - Market tumbles

When will market rally?

Even GS bows to this consensus => Many times I said, do not believe free service. Why GS analysts needs to provide free service to you or me? They do it for his own publicity.

So confident? => Okay, you have inference very easy one.

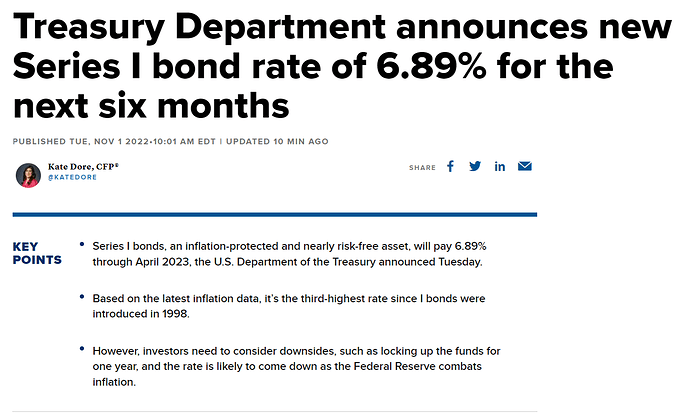

The I-Bonds are called “INFLATION(Protected)-bonds”. Until oct 2022, the rates are 9.62%, now treasury department changed the I-bonds rate 6.89% for next 6 months.

What does it mean? The treasury department confirms 2.73% inflation will be down next 6 months.

However, bond market rushed heavy with demand for 10Y-30Y bonds until now, that has inverted Yield curve.

Yield curve inverted in Dec 2019, market bottomed by Mar 2020. Can we expect similar or same now?

JC may be right here…Future is unpredictable, wait and see…

.

Future is unpredictable, wait and see…

Status quo to deal with all changes ![]()

No action is better than take uninformed actions