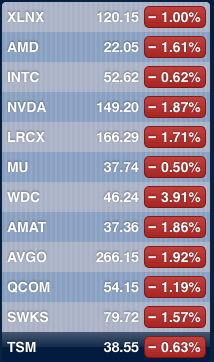

My wash period is over so I looked at NVDA’s chart. It looks pretty weak to me still. Will wait for it to break out from the multiple tops around 165 or so.

Triggered my stop. Sold all. Will look for an entry point to get back in.

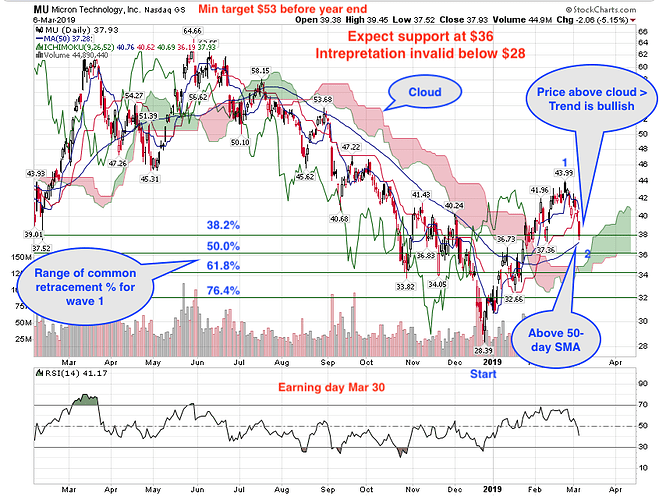

Technically I noted that it might decline to $36 when it was trading around $42s, so I sold all shares and short term calls, left with L20 calls. Waiting for it to drop to $36 to short puts, if lower rebuild shares position ![]() my plan is purely technical driven. Do you see any fundamental reason not to buy now?

my plan is purely technical driven. Do you see any fundamental reason not to buy now?

Expectation is that chip prices will firm up in 2H. People were trying to front run it.

MU: Earning announcement Mar 20. Unless the unexpected (Trump walk away from China to negotiate for a better deal exploiting the fast deceleration of China economy and deterioration of Xi reputation) occurred, believe MU should roar to a new ATH before year end. Meanwhile hopefully no surprise on Mar 20.

Aggressive investors always frontrun ![]() and get slaughtered.

and get slaughtered.

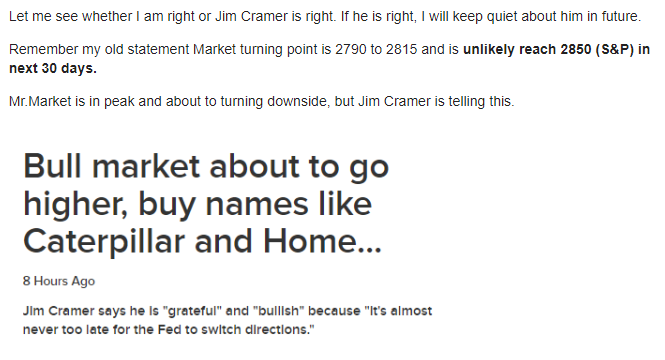

I had some intuition that market likely dip, but never knew that it is so much perfect from the day I posted Jim Cramer challenge !

I may not be right always, but lucky to be right on 12/24 and 9 days before when I said “Remember my old statement Market turning point is 2790 to 2815 and is unlikely reach 2850 (S&P) in next 30 days”

So far, I shorted the market buying PUTs on the day challenged Jim Cramer and that is why I did not buy TSLA even though price is attractive.

I did not like to post about my puts or any purchases as I do not want to people to follow me as I may not be right always

9 days before, I posted the challenge here only.

I ignore that post because it is off topic, should have posted in s&p and nasdaq thread.

The challenge was against Jim Cramer , but not about S&P.

While talking to @Jil MU bounced up strongly without touching $36  My GTC BTO calls didn’t get triggered, obviously

My GTC BTO calls didn’t get triggered, obviously  purchase price is too low. Hopefully better luck Monday. I don’t share @jil bearish view, MU price behavior is bullish, refer to chart posted 1 days ago.

purchase price is too low. Hopefully better luck Monday. I don’t share @jil bearish view, MU price behavior is bullish, refer to chart posted 1 days ago.

• Nvidia (NASDAQ:NVDA) is nearing a deal to acquire Mellanox (NASDAQ:MLNX) for more than $7B, according to Bloomberg and CNBC sources.

• The sale could be announced as soon as tomorrow and Nvidia is the leading bidder of a pack that also includes Intel (NASDAQ:INTC).

• Mellanox has a market value of about $5.9B.

• Why Nvidia? Mellanox chips power high-speed networks connecting servers and would help Nvidia boost its chipmaking for data centers at a financially vulnerable time thanks to China weakness and the cryptocurrency mining bubble burst.

• Also benefitting: Activist investor Starboard Value, which is a Mellanox shareholder and last year reached a board member agreement with the company.

Trade options ![]()

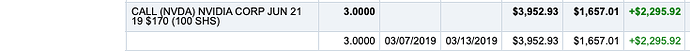

In 6 calendar days (4 trading days), $1657 became $3953. Gain 139%. Easily afford an iPhone XSmax ![]()

For the same period, option trading portfolio +12% ![]() About 600% a year. Wasn’t even aggressive.

About 600% a year. Wasn’t even aggressive.

Bought?

Yup. Bought. Back into amd as well. WS is still badmouthing micron. The latest is Wells Fargo.

NVDA broke above the cloud >> in up trend. However, I don’t like the decreasing volume so I STC the calls as they can quickly become worthless ![]()