Don’t know. But nvidia’s PE is only 20. Not expensive given the potential growth ahead.

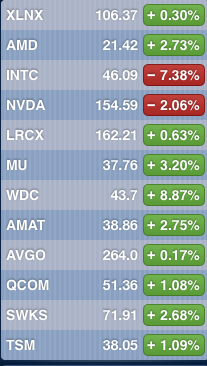

XLNX and LRCX led the recovery of semi ![]()

@manch is jumping in joy, PGA is the way to go… manch getting his mojo back.

Btw, why @manch is not interested in tool makers like LRCX and AMAT?

Dont want to make portfolio too diluted. Lam makes equipments for memory manufacturers and AMAT mostly does solar panels? Not sure about AMAT. But Lam and Micron have strong correlation.

Semis have bottomed. BTFD.

Good news keep rolling in for semis. WDC helps MU ![]()

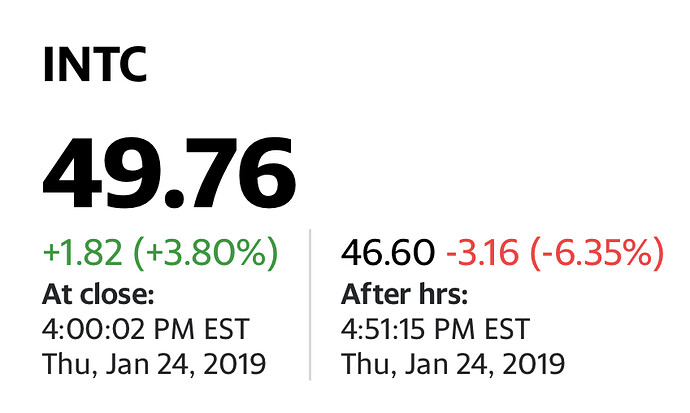

Question now is should we buy INTC? Is result really bad or just overly negative reaction?

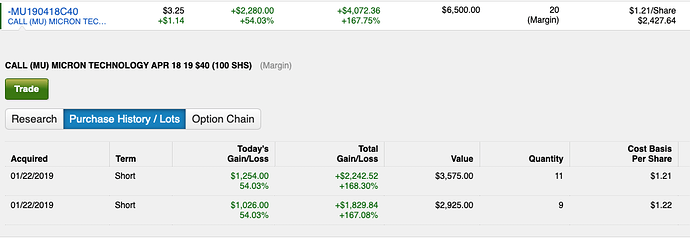

Don’t be so sure. My 20 MU calls is appreciating pretty fast. Might be able to sanjay your TSLA gain ![]()

Bought in Jan 22, today is Jan 25, up more than 100%!!!

Give me a break. As if your little nibbles here and there will amount to anything. Your only asset here is your Aapl holdings otherwise you are nothing!

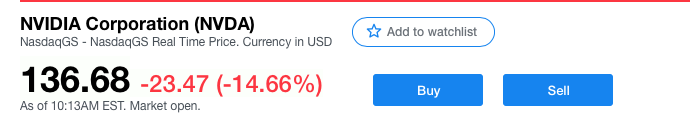

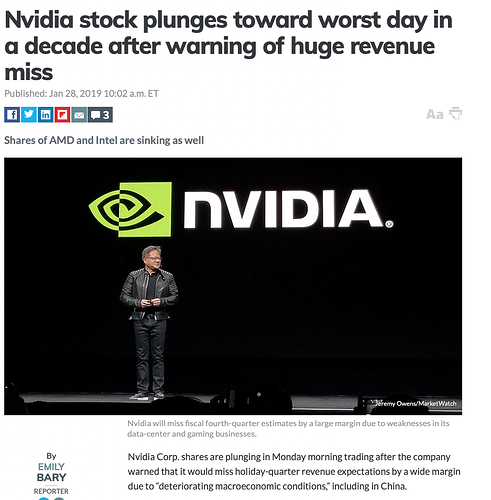

Forgot what you said is the criteria to long INTC. Buy now? Every semis are roaring… my only bet is MU and a small amount of NVDA. I think I miss XLNX and don’t like AMD. Is INTC any good at this price? Or should I bite the bullet and long NVDA big time?

Intel will announce new CEO next month according to CNBC. I will only buy if I like the new head. It better be johny.

The new head is Meg Whitman

Short like hell. ![]()

Good choice too. If she comes, I will buy INTC, hold for few years. She make sure, shed all the FATs and make further profitable!

OK, apparently Johny is not biting. TC must be paying him tons. ![]()

Don’t buy INTC. It’s beyond savage.

Just realized all four companies are headed by Asians. XLNX, NVDA and AMD have Taiwanese CEO’s and MU’s CEO is Indian.

Are hardware companies more likely to have Asian CEO’s?

Don’t scare Trump!

The next CEO at Intel is likely to be an Indian too. That Murthy guy is so fat he should count as two Asians.

Should Nvidia be on your buy list? It’s on ours…

2 Tech Bargain Stocks You Can Buy Right Away Buy NVDA and MU.

Investors, however, should note that these stocks could witness near-term pressure because of the headwinds outlined earlier. But the long-term opportunity seems too good to pass up, especially considering the valuation levels of Micron and NVIDIA. Value investors looking for fast-growing tech stocks might consider buying these two chipmakers, because they can get back on track once the headwinds subside.

Plenty of time to accumulate ![]() BTFD. Don’t hope for Dec 24’s low, not likely to hit there again.

BTFD. Don’t hope for Dec 24’s low, not likely to hit there again.