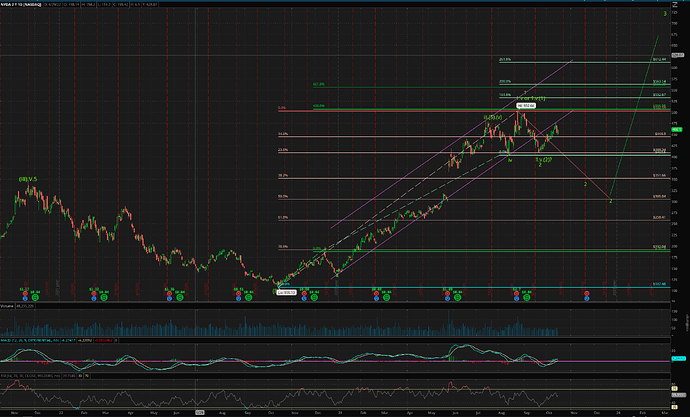

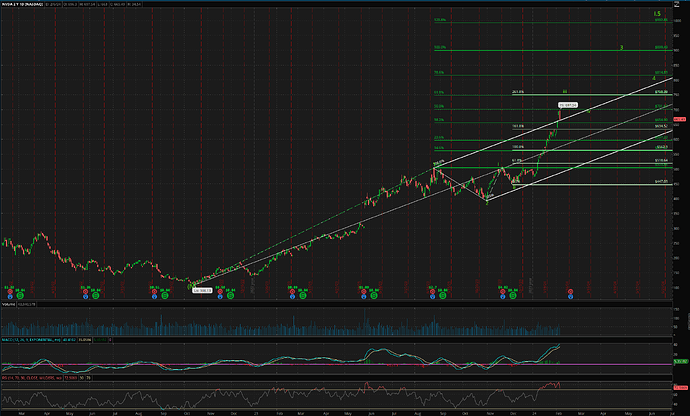

Updated EW count for NVDA. No change in count, just update progress in price vs time.

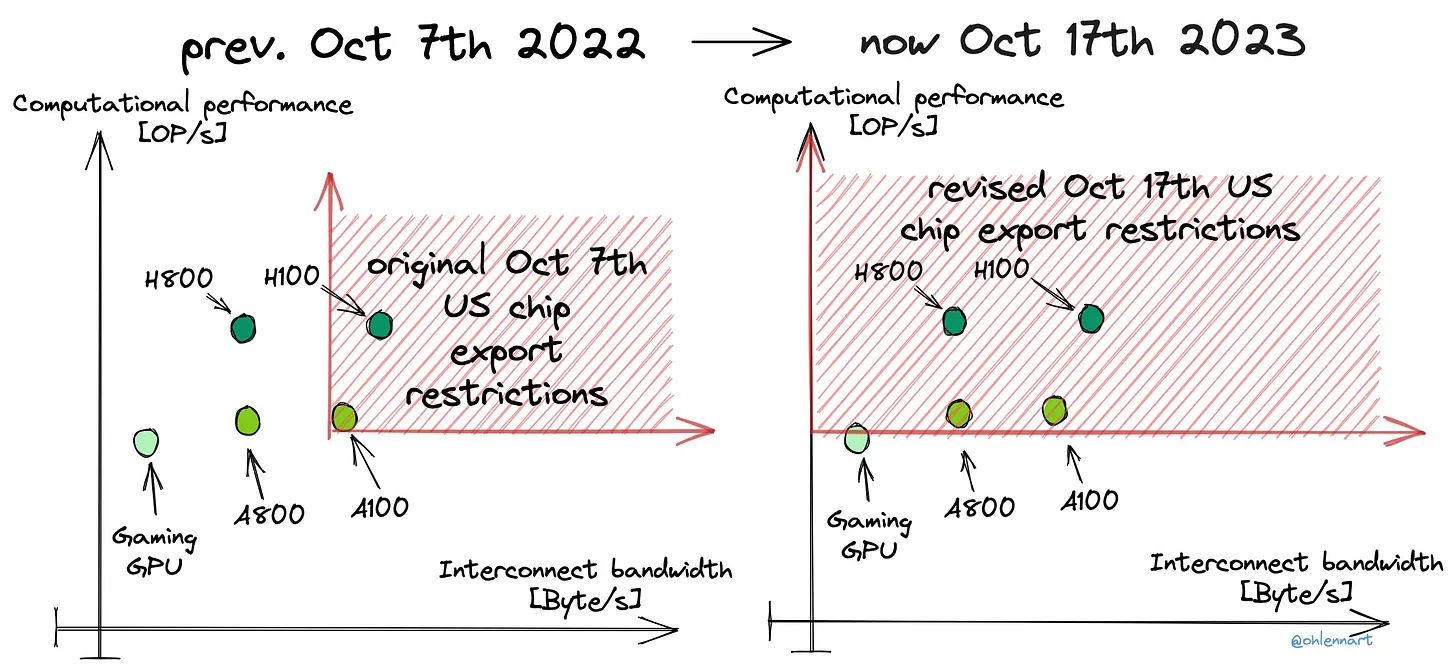

The new China chip export ban in easy to understand graphics:

The US just published its revised export controls on AI chips, moving away from the ‘chip-to-chip’ interconnect bandwidth threshold to a threshold on computational performance (OP/s), including its derived performance density (OP/s per mm²).

There were loopholes in the initial controls. At first glance, these new measures seem to address those. The prior ‘escape/scaling path’ allowed continued scaling computational performance while bounding the interconnect.

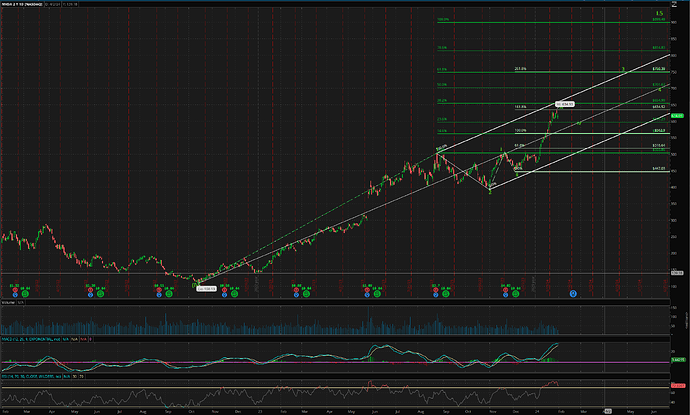

A certain Elliottician’s view…

Well, if wave 3 is at $600, wave 5 can be at $750-$800.

…

Old Chart.

Likely wave 1.v which can be extended ![]() If didn’t extend, would end not higher than $525. If extended, can be very high ($800

If didn’t extend, would end not higher than $525. If extended, can be very high ($800 ![]() ). If not extended, would wait to add upon completion of wave 2. If extended, just enjoy the ride.

). If not extended, would wait to add upon completion of wave 2. If extended, just enjoy the ride.

How about TSLA is doing what USG wants to achieve?

The TSLA community could be started by USG.

A few characteristics of EV:

a. You can imprison by your car.

b. Your car can be bricked OTA.

c. Your car can be summoned (drive itself to somewhere),

I’ve been wanting to ask this question for a while. These 3 characteristics aren’t necessarily tied to EV. It should be possible to put the same kind of smartness on a gas car and subject you to these characteristics too. It’s just that it seems nobody is trying to do it.

If scientists find a way to capture CO2 from air and store it somehow that we no longer need to worry about the green house effect, I don’t see why you can’t have a self-driving gas car too.

.

Self driving car is ok. Just don’t like it if it can be controlled OTA by another party.

That can happen once some1 developed a great edge AI software… AAPL? Apple has many edge AI hardware e.g. iPhone, watch, MBP, MBA. I sense that SV startups are rushing to make great edge AI platform, do you know any promising ones? I mean other than the publicized ones (can’t remember their names, I think is by OpenAI and started by ex-Apple employees), and big boys (Apple, Google, Meta and Tesla).

There are already startups working on it. Someone will solve it.

https://twitter.com/The_AI_Investor/status/1746220865774391396

Jensen Huang on digital biology: ‘It’s the next revolution. It’s going to be flat-out one of the biggest ones ever. And Nvidia is at the center of it.’ $NVDA

![]()

In Oct 2017,

The response is…

SMH. Lack of vision.

Manufacturing advanced-node semiconductors is one of the most challenging business to be in. If it were that easy to just throw money at it and expect to solve the problem, Apple would have done it ages ago. There was a reason AMD sold off its foundry business and became fabless. It just couldn’t compete.

Granted, Apple bought PA Semi and started designing its own silicon and has become quite successful at it, but still, making these chips are far more difficult than designing them. Just look at Samsung’s foundry business. Catching up to TSMC has proven to be extremely difficult and costly, even with its leadership expertise in the memory business.

The only possible success story as a newcomer is from the endeavors in China. And that is way more than just a money thing.

Sam’s goal is to push for more semiconductor manufacturing capacity, not to get into the business directly. He might as well invest in these major foundry companies to advocate for his goal.

Actually China is going to bring a lot of semi manufacturing capacities online in the next few years. They are not the more advanced nodes but maybe Sam doesn’t have to use the most advanced ones.

.

Didn’t know that ![]()

Also 8 to 10B doesn’t cut it. A modern fab costs 20B each.

If Intel sticks to its foundry plan and doesn’t make big mistakes again (big if), I think it has a decent chance of bouncing back. It can become a solid Number 3 fab but key point is it will be the only entirely American and Western advanced fab. Intel will get boatloads of government money to make sure it stays afloat.

Chinese fabs are cut off from EUV machines. That makes advanced nodes all but impossible. Intel tried to get cute with their 14nm node without EUV but got burned badly. Saw rumors SMIC’s 14nm yield is very bad.

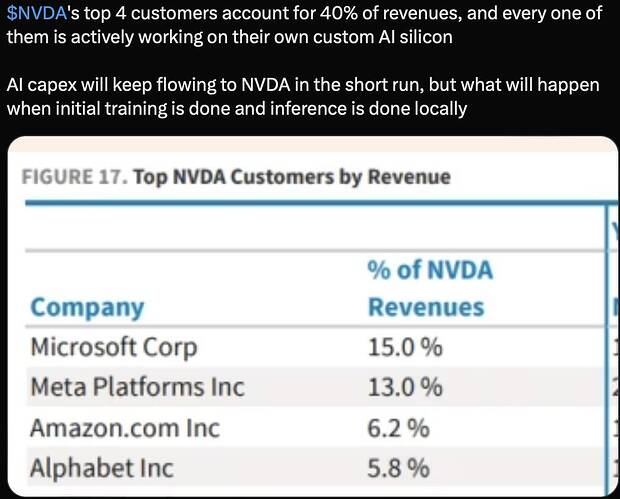

What happen when initial training by the top four is done?

The next four are still in the midst of training… then next next four… and so on.

Please note that while META and MSFT got 150k H100s each, TSLA only got 15k.

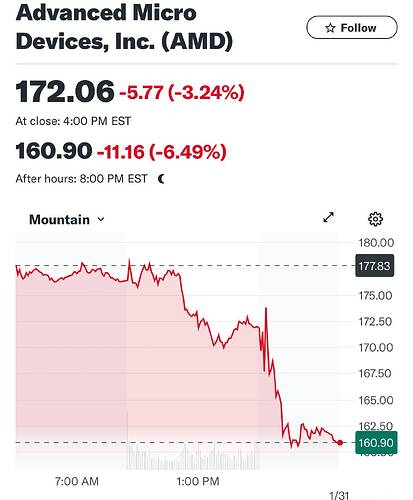

Aunties who have followed below advice and bought NVDA yesterday are likely to panic sell today.

Ofc, investors like you and me won’t sell at ST weakness (RSI shows extreme overbought)… we know the AI story has legs…

Huawei’s HiSilicon chip development arm will be SMIC’s alpha customer for its 5nm node and is expected to make AI and smartphone processors.